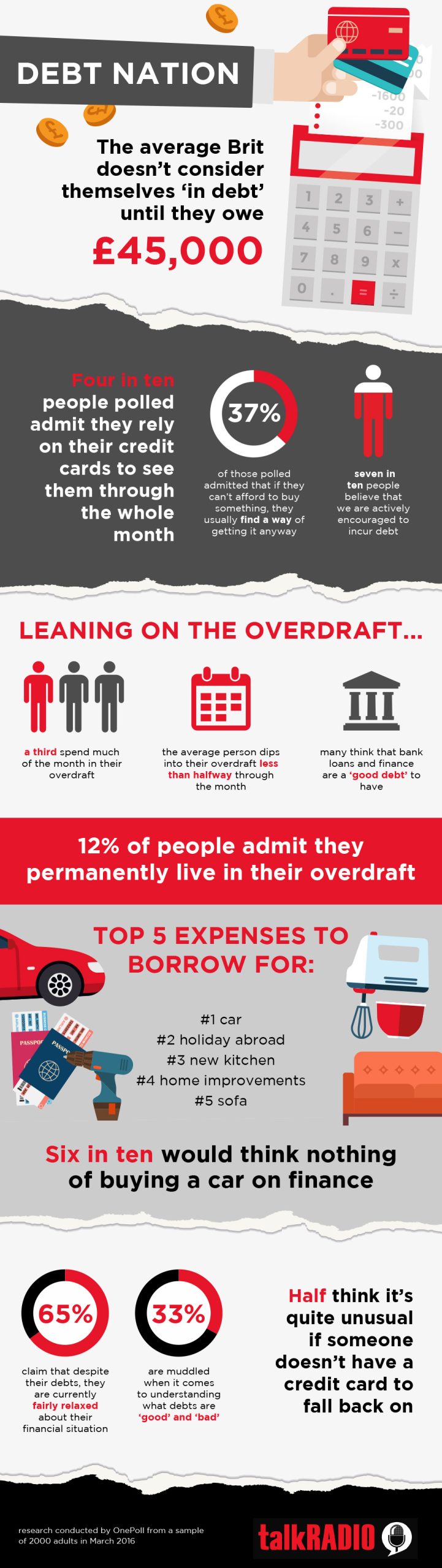

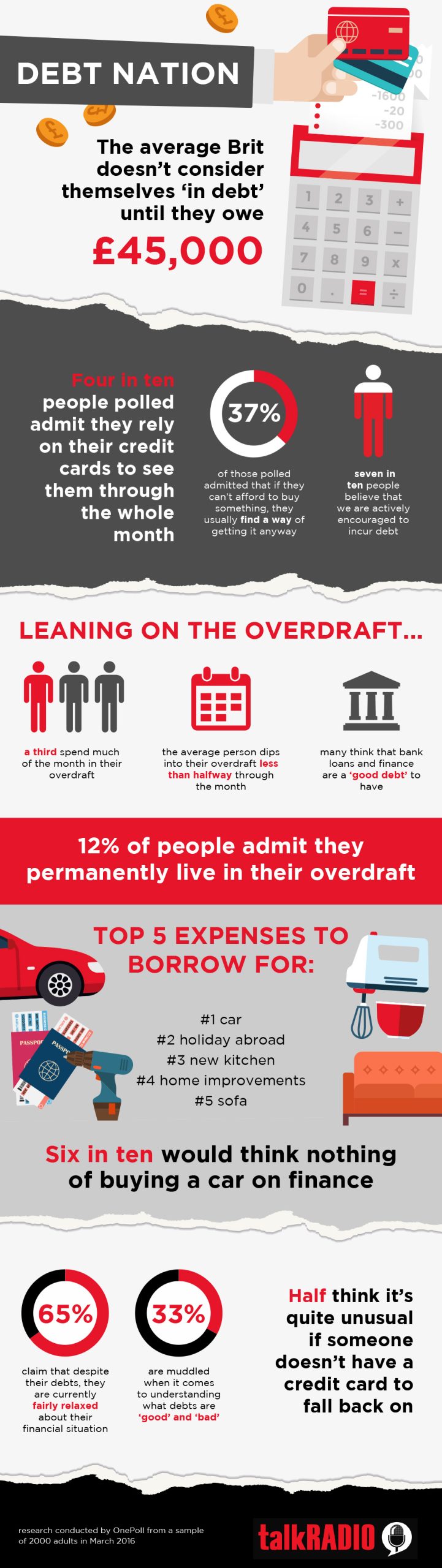

Four in ten Brits rely on credit cards to see them through the month, according to new research.

The study into the financial behaviour of 2,000 adults found 37 per cent of those polled admitted that if they can’t afford to buy something, they usually find a way of getting it anyway, either by sticking the balance on a credit card, taking out a loan or dipping into the overdraft.

Most Brits have a balance of at least £3,000 debt to pay, while a further third spend much of the month in their overdraft. But most worryingly, it is only when the mountain of debt reaches a peak of £45,454.26 that people suddenly start to panic, and realise that they need to take action to remedy their financial situation.

Dennie Morris, Managing Editor of talkRADIO, a personality-driven station which launches today and tackles all the hot topics of the day, said: “It is hugely concerning that it takes so many people until they owe more than £45,000 to really feel the pinch, and to try and tackle their debt.

“talkRADIO’s research highlights that the days are long gone when an overdraft was for emergency borrowing only and a credit card was something we pulled out when there was no other option.

These days it’s perfectly acceptable to rely on finance or loans to purchase bigger items, and to lean on overdrafts and credit cards to get through a normal month of spending.”

There is a concern that debt has become ‘normalised’, with 65 per cent of Brits feeling relaxed about their financial situation despite mounting debts. Two thirds of people think the days are gone when people would save up for a long time for something they wanted, and more than half of those think it’s quite unusual if someone doesn’t have a credit card to fall back on when times are hard.

In fact, seven in 10 people polled believe that, these days, we are actively encouraged to take out credit cards, store cards and personal loans, as this helps to create a credit profile, which is useful for getting on the housing ladder and taking out further loans.

Morris added: “The Chancellor has just announced his budget for 2016, so debt is high on the agenda and a key issue for the British public, making for interesting timing of these findings.

“The public’s attitude towards debt means that some people are happy never to climb out of the red and also divulge active encouragement to borrow more from lenders, which are worrying facts to quote.

“The level of confusion that talkRADIO’s research highlights between ‘good debt’ and bad is also pretty appalling, with so many of those questioned thinking of bank loans and finance as a good thing, a point that surely needs to be addressed in the future.

“talkRADIO launches today and these are the kind of topics that we won’t be shying away from.”

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin