The highly contentious Brexit decision was one that Britons embraced with a slim majority on June 23, 2016. According to the official polls, 46,501,241 UK citizens turned out to vote on the Brexit issue (accounting for 72.2% of the electorate). Of those, 17,410,742 (51.9%) votes were in favour of a Brexit and 16,141,241 (48.1%) votes were in favour of a Bremain. Approximately 1.3 million votes pushed Britain over the line for independence from the European Union. This affected multiple aspects of the UK economy, notably immigration and borders, laws and regulations, unemployment and welfare etc.

The majority of voters in England wanted to leave the EU (53.4%), with just 44.2% for Northern Ireland, 38% for Scotland and 52.5% for Wales. Fast-forward to April 2017, and we are seeing some interesting trends developing in Scotland with a push for a second independence referendum. Clearly, the Scots do not want to lose their EU benefits vis-à-vis trade, migration and special rights and privileges. What happens in Scotland remains to be seen, given that the first independence referendum was a dismal failure. Whatever decisions are made by the political elite, the more pertinent reality is the one facing the people on Main Street.

UK Economic Realities to Contend With

Brexiteers cautioned about the risks of remaining in the EU, while Bremainers like the former Counselor of the Exchequer, IMF head Christina Lagarde, and ex-PM David Cameron warned of a housing market crash and plunging GBP if Britain was no longer part of the EU. Most of those fears have been vanquished, but concerns remain about how UK traders will do if passporting rights are lost by UK banks and financial institutions to Europe. A few points are worthy of mention:

- GDP is up 0.7% according to the ONS (final quarter of 2016).

- The Bank of England reduced interest rates from 0.50% to 0.25%, weakening the GBP, but boosting overall economic activity to prevent deflation.

- UK service sector growth dropped to a 5-month low in February 2017.

- The services PMI figure dropped from 54.5 in January to 53.3 in February (any figure above 50 represents an expansionary economic climate).

- Retail Sales Index figures are falling in 2017 (-1%) versus the 3months ending on September 30, 2016.

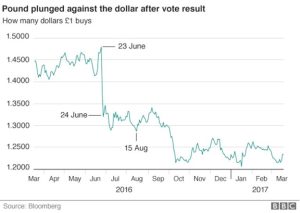

- the GBP has fallen hard against the USD, and is currently trading approximately 50% less versus the USD, and 12% less versus the EUR.

- Importers are paying more for goods coming into the UK, while exporters are enjoying booming trade. UK retailers typically rely heavily on imports of raw materials from Europe and abroad and these costs are now being passed on to consumers in the form of higher prices.

- The FTSE 100 index is enjoying a golden period, now that the GBP has weakened considerably against the greenback, the EUR and other major currencies. Recall that 70% + of all revenues derived on FTSE 100 index companies are overseas. When these funds are repatriated back to the UK, they are worth more in GBP, hence the strong performance of the all share index.

Analysts from SaxonTrade have opined in a bullish way for UK traders. It appears that the honeymoon period for the Brexit is still in play. Since Theresa May triggered Article 50 of the Lisbon Treaty in March 2017, there is still a period of 2 years (March 2019) until the UK is no longer officially part of the EU. This means that all trading activity (passporting rights and regulations) between UK banks and financial institutions and the rest of Europe will remain in effect for several years. It is also likely that the UK financial sector will work hard to hammer out a deal with European countries to prevent a loss of trade and confidence that a Brexit brings. Of all the geopolitical events taking place in the world, Brexit uncertainty appears to have been factored into the GBP/USD, and the more concerning elements are the rise of nationalist parties in Europe, uncertainty in Syria and North Korea, and US/China relations.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin