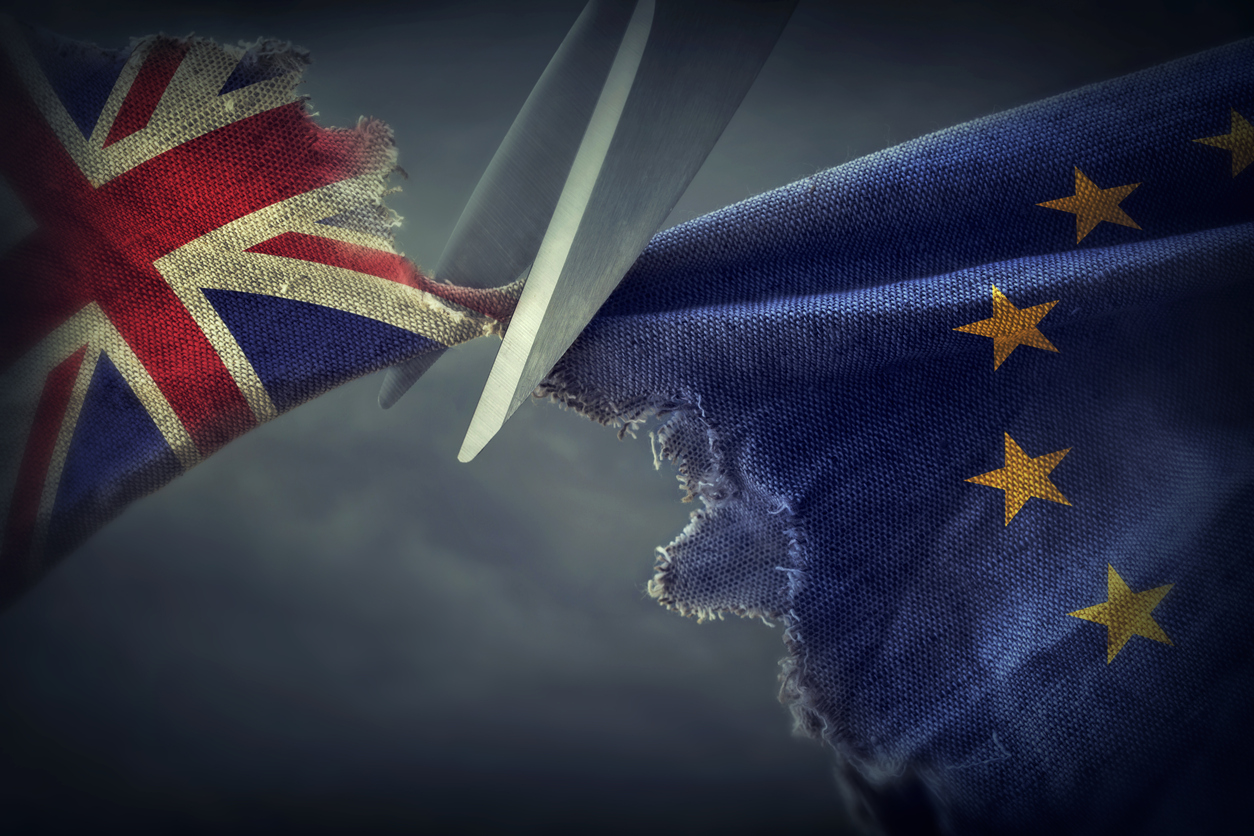

In terms of politics, it appears as if we have entered into a brave new world. The events which have taken place during the past 12 months solidify the fact that business as usual is no longer an applicable term. Two shining (and somewhat disconcerting) examples include the actions of the Trump administration and the inevitable Brexit from the European Union.

What have we learned so far in regards to how these situations have impacted the global foreign exchange market? This is an important question, for the actions of today will have an undeniable impact upon the investor sentiment of tomorrow.

The Brexit Conundrum: For Better or for Worse?

Although investors have been aware of the Brexit for some time, the activation of Article 50 cemented the fact that there is now no turning back. Politics within the United Kingdom have become strained and the calling for a snap election by Prime Minister May has certainly not helped to placate speculation.

The main issue here is that the markets are still concerned about the value of the pound in relation to other benchmark currencies such as the euro and the dollar. Indeed, this is no surprise and major institutions such as Deutsche Bank are predicting that a parity will eventually be reached. Although this may seem damning from a domestic point of view, we need to look at such a movement from a broader perspective.

Should the pound continue to fall, exports will naturally rise and this could actually benefit the United Kingdom. From a Forex perspective, many investors will be looking to take advantage of short-term movements that may be generated by this approach towards parity. Either way, it is a foregone conclusion that the pound will remain in the doldrums for some time.

The Trump Effect

Many have referred to Trump as the “elephant in the room” in regards to currency trading, and for good reason. Very few analysts are willing to speculate on what his next move may be and as he has already negated some of his campaign promises, we are beginning to wonder how far he is willing to take his “America First” slogan.

Still, it is critical to point out that Trump alone cannot decide upon fiscal policy and the United States Federal Reserve is well aware of this fact. The main takeaway point here is that uncertainty continues to dominate the global foreign exchange markets. This has caused many investors (particularly those who are politically opposed to Trump) to take a back seat for the time being. On the contrary, many international Forex traders are looking at the bigger picture and realising that there are plenty of opportunities to capitalise upon the movements of the dollar in relation to the pound.

This is particularly relevant due to the fact that the gap between these two currencies is narrowing to a nearly unprecedented level.

Different Trading Strategies

If there is one observation that analysts can agree upon, it is that traders are taking a much more risk-averse approach. They are now looking to supplicate one-off positions for more conservative stances. Investors are learning about spread betting and similar strategies in order to minimise potential losses while still remaining active within a liquid marketplace.

We can see that there are a number of variables that Forex investors are watching closely. What is arguably the most interesting takeaway point is that we have entered into entirely new territory and we are simply unsure of what may be looming around the next corner. It is likely that the global foreign exchange markets will reflect this fact for some time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin