Crashing at your friend’s place over the weekend? Sounds good! What happens when something else such as currency crashes? The minds of traders crash along with it! In the history of cryptocurrency, bitcoin has jumped way up nearly hitting the 5k mark before landing so hard that 40% of its value was lost. Here are 5 other times when bitcoin needed more than a simple plaster.

April 2013 meltdown, bitcoin down 71%

Why it happened?

The price of bitcoin fell 71% from $233 to $67 overnight. The initial boost in price was all due to media coverage and the hard fall was the correction in price. This took bitcoin 7 months to recover from this injury.

Bitcoin prices have not stopped moving so much since its release. In a blink of an eye, bitcoin prices can soar way up high or dive rock bottom. As a result, investors can turn filthy rich or lose great amounts of money super fast. If you are not ready to risk your own money to trade bitcoins, you can use The Trading Game ( for Android, iOS) to practice trading bitcoins. It is important to have a proper trading strategy for each financial instrument and especially bitcoin where prices can go crazy without warning. Know your trading limit and adopt the proper mindset before venturing into the trading world with your money!

Bitcoin get sliced in half in November 2013

Why it happened?

Bitcoin prices went up 10 times to a new high of $1150 in late November before crashing again to $500 in mid-December. This boost was due to amateur investors swooping in to get their hands on this new toy. This incident took bitcoin an even longer time to recover stretching to years.

850,000 bitcoins gone without a trace

Why it happened?

The hacking of Mt.Gox, Japan largest bitcoin exchange, left bitcoin bleeding from $867 to $439. February 7 was the day where hackers made away with 850,000 bitcoins and left investors doubtful of the security of bitcoins. Bitcoin started to recover from this in the late 2016.

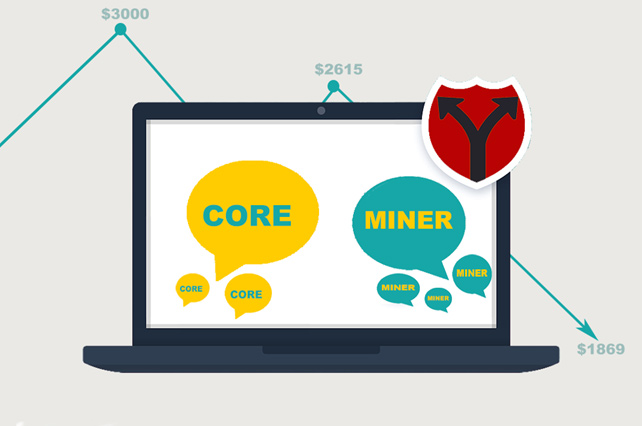

Why it happened?

In January 2017, bitcoin cross the 1k mark for the first time in years and did not stop. In June, prices soared close to $3000 before falling to $1869 in mid-July. The drastic fall was due to developers not able to come up with a proper update for the bitcoin software. Bitcoin was performing bad as compared to its brothers Litecoin and Ethereum. This gave prospect towards a “fork” and the market reacted badly towards this and started to lose confidence.

Cold shoulder China

Why it happened?

Bitcoin had nearly touched the 5k point before hurting itself by 37% in September 15,2017. $30 bilion from bitcoin’s total market cap was lost suddenly. The world’s biggest market, China, had announced that they are going to ban trading cryptocurrency and CTCChina will end trading at the end of September 2017. With one of the biggest players out of this game, this makes bitcoin less attractive already.

What can traders do during all the scenarios?

Bitcoin is highly volatile as seen by the many incidents it encountered. It can go up really quickly and dive really quickly as well. Historically, bitcoin has managed to recover from all the incidents and even managed to hit new highs each time. Traders can sell fast once signs of a crazy drop seems to be happening to take profit or cut losses. Traders can also buy when bitcoin is recovering from a crash and hold on to it for long term investment or quick profit.Due to the quick and big changes in bitcoin prices, traders are able to earn big profits in small amounts of time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin