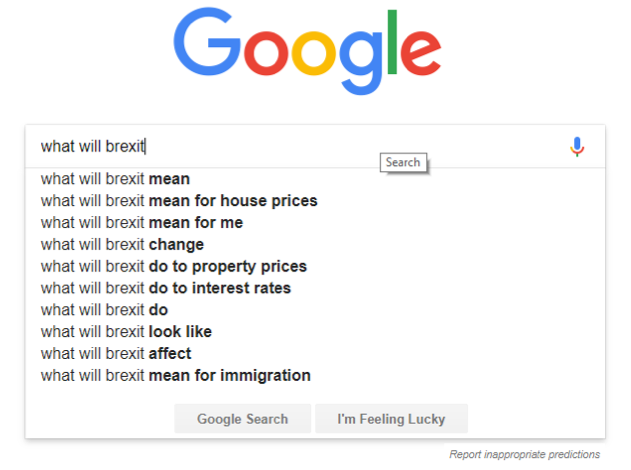

It’s now over two years since the UK voted to leave the European Union and ‘Brexit’ became probably the most used word across the country. With it now even closer to happening in March 2019, a lot of people have been wondering, questioning and worrying about the impact it’s going to have on a lot of things. So much so that the term ‘what will Brexit do to interest rates’ is one of the top Google suggestions.

The short answer is that nobody knows for certain. But to try and make it clearer, this is what we currently know and can assume may happen.

What’s Happened Already?

Immediately after the Brexit vote, savings rates fell to record lows. Part of this was down to the Bank of England’s decision to halve the Bank Rate in August 2016, while the rest was mostly down to the uncertainty that the Brexit decision introduced. Another factor was that many investors sought out government bonds due to the instability, which pushed up their prices and reduced their yield. This is often used as a benchmark for other rates, which had an impact.

The Bank of England’s Role

The Bank of England (BoE) sets the UK interest rate and can increase or lower it as and when it sees fit, so it is pivotal in reacting to Brexit. After the vote the BoE did lower interest rates in an attempt to encourage spending and make debts cheaper. However, in November 2017 they raised the interest rate again, more to keep it in line with inflation.

BoE governor Mark Carney has said that Brexit negotiations will influence monetary policy and therefore interest rates. This isn’t surprising, and it’s expected that they will keep increasing the rate over the coming years. What remains to be seen is by exactly how much it will grow.

Impact on Mortgages and Loans

A great example of how hard it is to predict what effect Brexit will have on interest rates is with what happened to mortgages. Many expected mortgages to rise after the Brexit vote but in fact they fell. Since then they have started to creep up though, so in some ways these predictions were right.

Interest rates increasing is also going to affect loans. It will likely make them more expensive to access and could make borrowing a lot harder and riskier for many people in the coming years. A lot still depends on the Brexit negotiations outcome, but anyone who might need a loan in the near future could be better off applying now before the rates increase.

Future Changes

For the time being there’s not much we can do other than wait and see the Brexit outcome and prepare for interest rates to rise. Anyone with a mortgage could avoid risk by re-mortgaging onto a fixed rate one, as rates are unlikely to fall. Plus, it’s important to remember that wider economic factors both in the UK and abroad will continue to affect interest rates, it’s not all about Brexit.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin