Despite the title of Satoshi Nakamoto’s whitepaper, Bitcoin has always been more than just a peer-to-peer electronic cash system.” This year, amid near-infinite monetary expansion to combat Covid-19, Bitcoin’s digital gold narrative finally hit the front pages.

For centuries, gold has been used as a reliable store of value, hedge against inflation and other macroeconomic risks. Gold’s investment appeal comes from its limited supply. Asteroid mining aside, there’s simply not that much gold around. Its scarcity is further reinforced by how expensive and slow the process of gold mining is. For instance, it takes between ten and twenty years, on average, for a gold mine to become fully operational and start producing material that can be refined. This scarcity is increasingly appealing in the world where fiat currencies are being printed at will by global central banks.

However, according to the United States Geological Survey, gold reserves are estimated at 57,000 metric tons, relative to be the 187,000 metric tons of gold that have been produced. Roughly 3,300 tons are mined every year, adding to the global supply. While gold inflation has averaged 1.2% between 2016 and 2019, according to Fitch Solutions, it’s expected to accelerate to 2.5% between 2020 and 2029.

Bitcoin exhibits some of the more attractive characteristics of gold while improving on its drawbacks. Like gold, Bitcoin is a scarce asset. Its maximum supply is 21 million coins, and roughly 18.5 million have already been mined. Unlike gold, Bitcoin’s supply is embedded in its source code and therefore not dependent on any external variable, like price or demand. New coins are generated approximately every 10 minutes and awarded to Bitcoin miners in the form of a block reward. Every four years, in what is known as halving, the size of a block reward is reduced by 50%. The most recent halving occurred on May 11, reducing block reward form from 12.5 BTC to 6.25 BTC per block. This puts the current inflation rate of the Bitcoin network at approximately 1.8%, which is programmed to decline over time.

In addition to the preferential new supply and inflation dynamics, the maximum supply of Bitcoin could be 20% less than the hardcoded 21 million. This is an outcome of lost private keys, burnt coins, and other user mistakes associated storing and sending Bitcoin. Analysis by Coin Metrics shows that the current free float is around 14.4 million, relative to the 18.5 million current supply. Bitcoin also improves on several other functions, essential for a store of value asset. It’s easier to transport, easier to store, highly portable and is divisible down to 8 decimal places.

While Bitcoin could be a better version of gold than gold itself, it is still a relatively small asset. Its market cap of under $350 billion is a fraction of gold’s estimated market cap of around $9 trillion. However, there are signs of meaningful institutional capital flows into Bitcoin with investors increasingly choosing Bitcoin over gold to hedge inflation, currency, and macroeconomic risks. Joel Zamel, start-up investor and founder of Wikistrat, a crowdsourced consulting firm, agrees. The Australian-born political powerbroker believes that Bitcoin and gold can protect against downward forces, such as a weakening US dollar and stock volatility, as the pandemic continues down its destructive path. Yet Zamel’s shift into crypto currency may have more to do with global politics than simple finances. His crypto-focused investments are geared towards North American bitcoin mining operations that help distribute and pivot operations away from China.

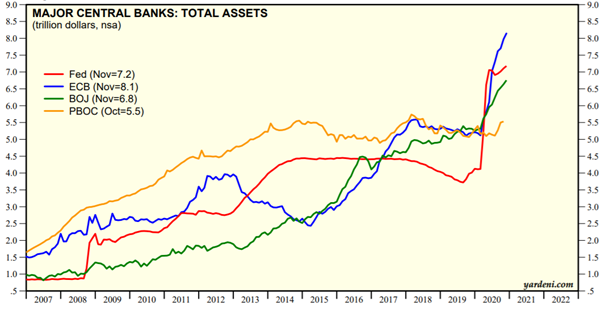

The macro economic trends of 2020 will likely continue in 2021, driven by further global monetary stimulus and fears of fiat currency devaluation. During 2020, global central banks added a record amount of assets to their balance sheets, effectively monetizing sovereign debt of their governments. The incoming Biden Administration is likely to push for further stimulus, hoping to pass a relief package of between $2 trillion and $3 trillion.

Many professional investors are beginning to recognize the potential of Bitcoin in this environment. Stan Druckenmiller, for instance, told CNBC that “if the gold bet works, the Bitcoin bet will probably work better.” A November report by JP Morgan notes that “some investors that previously invested in gold ETFs such as family offices, may be looking at Bitcoin as an alternative to gold.” And BlackRock’s CIO of fixed income Rick Rieder, recently remarked that Bitcoin could “replace gold to a large extent.”

Growth of the Grayscale Bitcoin Trust, often used as a barometer of institutional sentiment, is another signal that the narrative is changing in favor of Bitcoin. The latest update from Grayscale shows total asset under management (AUM) for the Grayscale Bitcoin Trust of $10.4 billion, up from around $0.8 billion at the end of 2019.

Company treasuries are relatively new to Bitcoin investing, but there’s a growing trend of treasury allocation to Bitcoin. MicroStrategy and Square are two of the more notable examples. After initially investing $425 million in Bitcoin, MicroStrategy recently announced a $400 million convertible bond offering, with net proceeds going into Bitcoin purchases. Due to overwhelming demand, the offering was upsized to $550 million a few days later.

For corporate treasuries, Bitcoin might be one of the very few good investment ideas. Government and corporate bonds are yielding next to nothing, with negatively yielding debt at an all-time high. Cash is consistently losing purchasing power due to inflation. At the same time, Bitcoin volatility, often cited as an impediment to corporate adoption, has been coming down and recently hit an all-time low relative to gold.

Over the next several years, Bitcoin will likely continue to take market share from gold as the go-to safe haven and store of wealth asset. Its scarcity is mathematically defined and verifiable. Its network metrics, from hashing power to number of active accounts, are flashing green. Considering Bitcoin’s relatively small market cap, accelerating institutional and retail adoption could mean attractive risk-reward for investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin