The average rental price has fallen in Spain by 3.52% in one year, comparing last April 2021 with April 2020, in full confinement due to the coronavirus pandemic.

The significant decrease has been produced, mainly, by the collapse of the rental price in the large capitals, such as Madrid and Barcelona. In the capital of Spain, for example, the fall was 14.9%, according to the report by the real estate portal apartments.com. In the Catalan capital the fall was even greater: 17.3%.

Average monthly rent of 960 euros in a 104 m2 house

According to this study, the housing for rent in Spain in April 2021 had an average area of 104 square meters and an average monthly rent of 960 euros. This figure marked an increase of 0.21% compared to March of this year 2021, but compared to April 2020, just a year ago, the cut was -3.52%.

Cádiz, Barcelona, Palma and Seville, the biggest falls

Despite the decline, in Spain as a whole, two capitals posted increases of over 10% compared to April 2020: the Aragonese Huesca (13.56%) and Teruel (11%). The largest adjustment, on the other hand, took place in Cádiz (-18%).

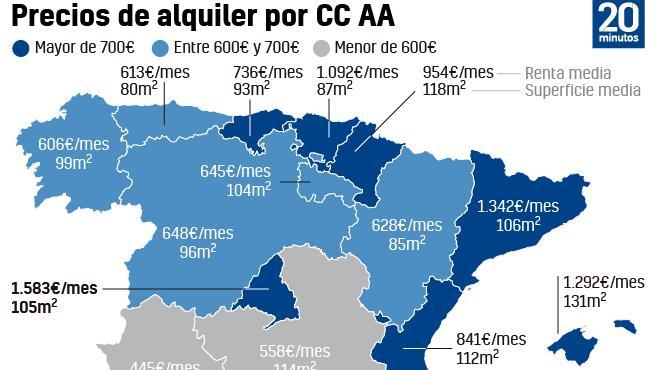

Rental price in Spain by CCAARental price in Spain by CCAACarlos Gamez

They are followed by Barcelona (-17.30%), Palma de Mallorca (-16.44%), Seville (-16.28%) and Malaga (-16.12%).

Madrid, the most expensive capital, followed by Barcelona and San Sebastián

Regarding provincial capitals, Madrid was the most expensive for tenants, with an average income of 1,642 euros per month. They were followed by Barcelona (€ 1,551 / month) and Donostia-San Sebastián (€ 1,224 / month). For its part, Ciudad Real was the cheapest, with 436 euros of monthly rent.

People walk down the Ramblas of Barcelona on Sant Jordi’s day, April 23, 2021, in Barcelona.People walk down the Ramblas of Barcelona, April 23, 2021, in Barcelona.Europa Press

Other economic capitals were Teruel (€ 473 / month) and Zamora (€ 480 / month). Guadalajara (3%) led the largest monthly increase, while the setbacks were led by Pamplona (-2.99%). Year-on-year, Huesca topped the ranking of increases (13.56%), with Cádiz (-18%) at the other end of the table.

The communities with the most expensive rents were Madrid (€ 1,583 / month), Catalonia (€ 1,342 / month) and the Balearic Islands (€ 1,292 / month). For their part, Extremadura (€ 445 / month), Castilla-La Mancha (€ 558 / month) and Galicia (€ 606 / month) registered the cheapest rents.

Madrid (2.11%) was the autonomy that grew the most compared to March, followed by Galicia (1.87%). In contrast, Andalusia (-2.07%) was the one that adjusted the most followed by Navarra (-1.61%).

On the other hand, in the annual comparison, Navarra (5.72%), Catalonia (4.46%), Andalusia (4.30%) and La Rioja (2.22%) showed the only increases. In this period, the most intense adjustments were registered by Madrid (-13.42%), the Balearic Islands (-12.48%) and the Canary Islands (-10.21%). These last two regions have suffered a collapse in tourism this year, their main source of income.

Malaga, the third most expensive province behind Madrid and Barcelona

In the classification of provinces by income, the first position was for Madrid, with 1,583 euros per month. Behind were Barcelona (€ 1,422 / month) and Malaga (€ 1,302 / month).

Ports.-The Port of Malaga, the first Andalusian to join the European Network of Excellence for innovative venuesThe Port of Malaga.Rocio Villegas

On the opposite side, Teruel closed the classification with 408 euros per month. Other economic provinces were Córdoba (€ 416 / month) and Cáceres (€ 416 / month).

The province that became more expensive compared to last month was Jaén (3%), while the one that became cheaper was Santa Cruz de Tenerife (-2.98%). From one year to the next, the one that increased the most was Soria (9.99%), and the income that adjusted the most was that of Madrid (-13.42%).

The rent, in line with the adjustment of the real economy due to the difficulties

The rental price confirms its trend towards correction. Ferran Font, director of Estudios de piso.com, affirms that “as it is more closely linked to the real economy, movements in the rental market are always more immediate and take less time to consolidate.”

For the spokesperson of the real estate portal, “the adjustment in the monthly payments is a reflection of the economic difficulties that the population is going through due to the impact that the pandemic has had on employment.”

In this sense, Font indicates that “access to housing through this formula continues to be a challenge for Spain, where the demand from tenants grows at the same time as the solvency requirements imposed by the owners of rental properties do.”

Administrations must redouble their efforts to present an affordable rental offer to the citizen, but without falling into interventionism

The expert indicates that “administrations must redouble their efforts in order to present an affordable rental offer to the citizen, but without falling into interventionism”, adding that they have a “golden opportunity” thanks to European funds.

Likewise, Font points out that “the private sector is the best ally to achieve this goal. In fact, many promoters have already placed rent among their priorities, betting on a business model on the rise such as build to rent ”.

Tenants are confident that the Housing Law will lower the price

On the other hand, tenants are more optimistic than owners that the entry into force of the future Housing Law will generate more affordable prices in the rental market. All in all, this is a moderate optimism and one that decreases as awareness of future regulations increases. This is the main conclusion of the latest analysis carried out by the Fotocasa real estate portal based on 5,000 surveys carried out on Spanish active in the real estate market in the last 12 months.

It is important that both tenants and owners know how it could impact them, because in the first instance it could avoid exorbitant price increases

“There is still much ignorance among the population about the consequences that this future law would have on the market, in part because there is still no definitive draft by the Government.

It is important that both tenants and owners know how it could impact them, because probably in the first instance it could avoid exorbitant price increases but it will not solve the great problem of the lack of rental housing, and it could even be aggravated by causing supply contraction, which in the long term would cause increases in rental prices ”explains María Matos, Director of Studies and Spokesperson for Fotocasa.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin