Since the financial crisis of 2008, the markets had continued to drive higher for over 11 years…

That is until February 2020, when markets started dropping at an unprecedented rate. Usually, a drop in the Dow Jones Industrial Average of 300 points would be considered a bad day, but 3000 points?

The bull market had come to an end, and investors instantly found themselves dealing with the fastest market drop in history once COVID-19 hit.

The bear market lasted just 33-days, and since then, the markets have roared back to new all-time highs.

So What are Investors Supposed to do Now?

It can be tough to invest when markets are overvalued but still trending higher…

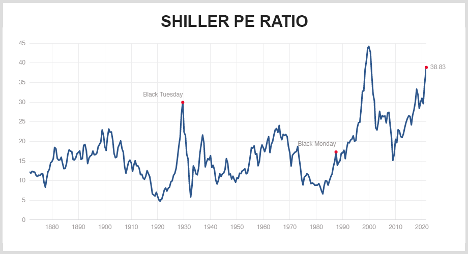

To help us evaluate what to do we can look at the Shiller P/E ratio, which measures the average price-to-earnings ratio of S&P 500 stocks. Today the Shiller P/E ratio sits at 38.8. Not as high as it was during the .com bubble, but it far exceeds the financial crisis, Black Monday, and Black Tuesday.

With inflation rising and the Federal Reserve likely to raise interest rates, what are traders supposed to do about their investments?

We can compare this to the Buffett Indicator, which is a ratio of the total stock market valuation versus US gross domestic product (GDP).

As it sits today, the Buffett Indicator shows us that the market value of all stocks is at 235% of GDP. That is 90% higher than the long-term trend line. This suggests that the market is highly overvalued right now.

These are just two of the warning signs that the stock market may be overvalued. With that said, the markets have been overvalued for some time, and they continue to grind higher. This is why it can be such a frustrating trading environment.

We know there’s a pullback coming, but timing when it comes can be easier said than done.

So, what should investors do?

Limit Margin Trading

It’s always nice to have margin on the way up, but once you’ve made your money and validations get inflated, it’s wise to slash those margins. Margin trading is a way for investors to borrow money from their investment bank and then invest that borrowed money. They can enjoy accelerated gains within their portfolio, but they also experience accelerated losses when the markets drop.

The losses are often a lot worse than the gains are good…

For example, if you have $100,000 within your investment bank and borrow another $100,000 for a total investment of $200,000. If the market pulls back 50%, you will lose $100,000, meaning the bank will take back their $100,000, leaving you with zero.

This is why you need to be careful with a margin account.

Understand the Difference Between Hype and Reality

The media has no shortage of so-called experts who try to persuade the average population to take action. However, I always warn against knowing the difference between what people are saying and what they’re doing.

This is why it’s essential to pay close attention to regulatory filings and what the corporate insiders buy and sell. Company CEOs and other C-level managers have the most knowledge about how a company is positioned. If you see a corporate insider selling, that’s a good indication that they feel the stock may take a downturn.

Keeping an eye on what corporate insiders are doing is an excellent indication of the financial stability of a company.

Hedge Your Positions with Options

Most intelligent investors have a long-term investment strategy. However, it doesn’t mean you can’t experience short-term losses along the way. This is why it’s vital to hedge long-term bull positions with short-term options.

The most popular strategy is executing a covered call option strategy, whereby the investors sell a short-term call against the stock they already own. If the stock experience a pullback, some or all of the losses will be absorbed by the call option.

A protective put option strategy could fit the bill for investors who want to take an even more dramatic approach to protecting their positions. This is where an investor buys a downside put option guaranteeing the investor the ability to sell that stock at a specific price if the stock continues to fall.

If the investor doesn’t like the idea of paying for their protective put, another options strategy could be executing a collar. The collar option strategy involves selling a covered call while simultaneously buying a protective put. This allows the investor to have a protective put but finance the cost of that put through the sale of the covered call.

Hopefully, these strategies will allow you to protect your portfolio against a bear market for investors who are getting skittish about stock evaluations today. To learn about all of the strategies in great detail, sign up for the free options trading class at OptionStrategiesInsider.com today and learn how to boost your portfolio returns in any time of market.

This way, you’ll be prepared no matter what the market has in store…

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin