If you are interested in cryptocurrencies in the world of decentralized finance, then you will undoubtedly want to know the difference between DeFi and traditional financial systems. Generally speaking, the most basic question that the Defi system poses in terms of traditional finance is whether or not intermediaries are necessary for finance. Traditional financiers will insist that yes, while DeFi supporters assert that intermediaries only bring errors, bureaucratic hurdles, and unnecessary fees and regulations to one’s finances. In this way, DeFi has worked to restructure the world of traditional financial systems by overturning these qualities one at a time, mainly by leveraging the many advantages of blockchain technology — the technology on which DeFi systems are built.

First off, we address how data is stored in each of these systems. A blockchain-based concept, decentralized finance stores data in a way that enhances the development of an open financial system. DeFi challenges the existing financial sector by providing an alternative to centrally government institutions such as banks or even ministries. Traditional financial systems, on the other hand, are largely reliant on both centralized storage and centralized rule. This means that your investments, money, and even data are all stored in one place and are subject to political, economic, and regulatory changes. This means that events such as war, general mobilization policies, or even the bankruptcy of financial institutions can have a deep bearing on your money — something that has proven to be detrimental to investors and savers in the past.

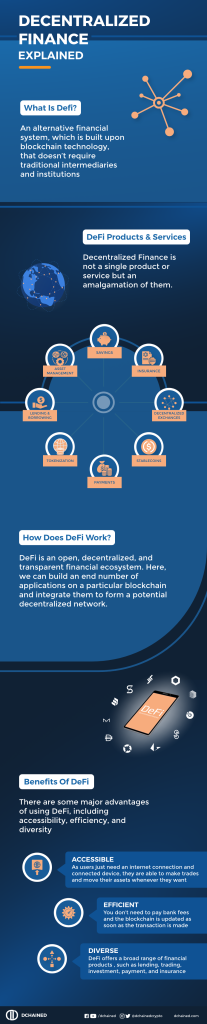

On the other hand, in DeFi, a public blockchain operates as the trusted source, governing all operations within. It offers a more open, transparent, and accessible system by greatly lowering the barrier to entry. In DeFi banking, people are given full control over their assets and personal financial data. This is unlike the heavily bureaucratic traditional financial system wherein you are handing over control of your data and finances to the bank.

DeFi began turning heads back in 2008 during the world financial crisis during which many people lost fortunes as the result of banks going bankrupt. This had many searching for a way to store and safely keep both their savings and investments in places that would not suddenly be under threat. DeFi stepped in as a reliable method to guard against hyperinflation or currency devaluation. Through the use of cryptocurrencies, many found new ways to hedge against inflation. DeFi and cryptocurrencies also offered people a reliable way to ensure that their privacy is restored, thus circumventing instances of censorship and restrictions. This is ultimately one of the biggest selling points to DeFi: the fact that it gives people back control over their assets and finances, and strips third parties of any such control.

Another major advantage point that DeFi scores over traditional finance are that the integration of blockchain technology into financial products has made it possible for people to send and receive money without having to worry about hefty fees and lengthy wait times. Unlike banks where each transaction can take hours or even days to complete, transactions in the DeFi sphere are instantaneous. By giving a cheaper, quicker, and more transparent alternative, DeFi has laid out systems that are far more desirable to use than those of traditional financial systems.

Since its inception, DeFi has grown extremely fast all around the world. This points to the fact that many find the traditional financial systems to be either rigged or somehow imperfect. Monetary policies and financial crises have greatly thwarted interest rates on earnings, while they have skyrocketed on money that is lent. This, exacerbated by hidden fees and tonnes of hurdles, has led people into the arms of DeFi. Moreover, DeFi eliminates one of the largest elements of the traditional financial systems: human error and input. Whether it is through a faulty keystroke or a bank committee that has not approved you for a loan, human error is rampant and works to put certain people at a disadvantage. And unlike human discriminatory practices that may bring nepotism, racism, and classism into play, technology is neutral.

Ultimately, we find that the core differences between decentralized finance and traditional financial systems lie within their inherent structures and their modes of operation. Unlike traditional financial systems and as their name suggests, DeFi is decentralized in nature meaning no centralized authority regulates its operations (such as a bank, state, or government). Moreover, they are inherently more transparent in their operations given the fact that they are built on open, transparent, and immutable infrastructure.

All in all, this innovative new sphere has revolutionized the world of finance and brought forth a financial structure that many of us never thought was possible. Promising greater efficiency increased transparency, and egalitarianism, DeFi has upended the traditional financial systems.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin