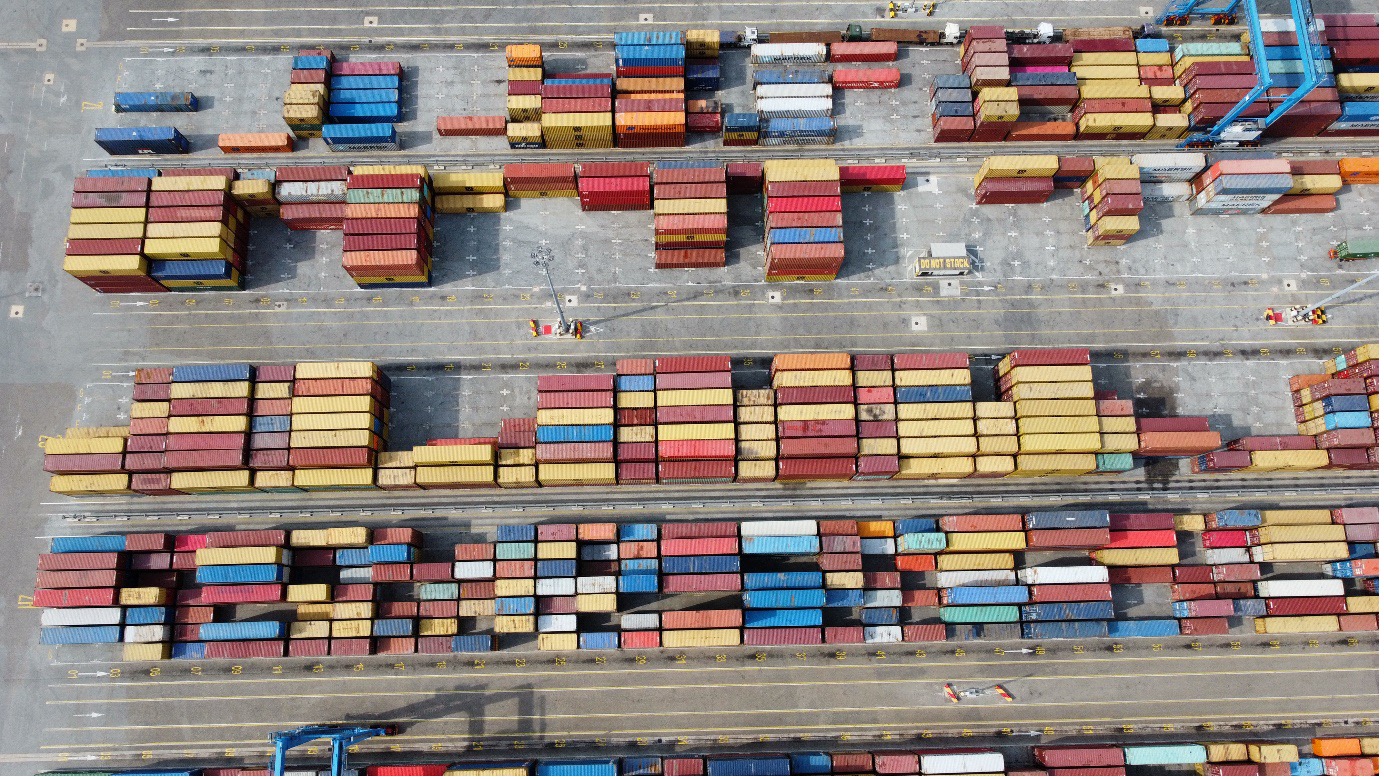

The Port of Tema in southeastern Ghana hums with activity. Multicoloured container ships, stacked like Lego blocks, stretch as far as the eye can see, while cranes ferrying goods from across the globe hug the coast, the most visible sign of a global trade hub. Look closer, and the port reveals more than meets the eye, with the harbour exposing the long reach of vulture investors.

In early October 2012, an Argentinian naval training vessel was impounded here after a Ghanaian court ruled in favour of a US vulture fund with a claim on Argentinian debt. The fund in question was a subsidiary of Elliott Management Corporation, a US$20 billion hedge fund.

Seeking an opportunity to make astonishing profits during Argentina’s 2001 financial meltdown, the fund bought up vast swathes of Argentina’s sovereign debt at a steep discount so that when the crisis passed, they could sue in international courts for repayment of the bonds in full. As part of these efforts to tie up Argentina’s dwindling assets, the vulture fund persuaded a judge to allow the seizure of the country’s prized naval vessel in Ghana.

Unfortunately, the fund did not stop there. Indeed, it would go on to sue Argentina in New York, with the US court ruling in 2012 that Argentina had to pay back the fund in full, to the tune of US$4.65 billion. The ruling came at a time when unemployment rates in Argentina were skyrocketing to above 20 per cent, and 57.5 per cent of the population lived beneath the poverty line.

This dispute was easily one of the longest, most contentious battles over sovereign debt in modern memory. But the incident is far from isolated, with vulture funds increasingly targeting developing countries in turmoil.

Operating in a topsy-turvy world where bad times are good and national or corporate wreckage yields rich rewards, vulture funds work by buying distressed debt at rock-bottom rates in an attempt to profit from an eventual restructuring. They achieve this by ‘holding out’ against any form of write-down on the debt, including international debt relief initiatives, so that eventually they will be paid out in full.

The practice is widely condemned, with former British Prime Minister Gordon Brown describing vulture funds as ‘morally outrageous.’ The reasoning is simple – the lawsuits leave debtor countries in tatters. For example, in 2007, as Zambia’s healthcare system teetered on the brink of collapse, the country was forced to pay US$15.4 million to settle a US$55 million case brought by vulture fund Donegal. The debt Zambia originally owed to Romania was bought for just US$3.2 million, giving Donegal a profit of over US$12 million.

Hoping that feast will follow famine, vulture funds are now circling what they hope will be their next prize. Looking to profit off the Nigerian people, Process & Industrial Developments (P&ID) – a shell company owned by the vulture fund VR Capital and an opaque Cayman Islands-based entity Lismore Capital – are currently pursuing the Federal Republic of Nigeria (FRN) for the sum of US$10 billion.

This eyewatering figure is equivalent to roughly one-fifth of Nigeria’s foreign reserves and almost 2.5 per cent of its annual gross domestic product. Paying such a large sum would be disastrous for any country. Yet, for a developing nation such as Nigeria, which has an annual health budget of just US$1 billion and a security budget of US$2.6 billion, the result is potentially cataclysmic. Despite these consequences, the owners of P&ID continue to pursue the FRN aggressively, putting profit over the Nigerian people.

VR Capital, which describes itself as ‘an alternative asset manager focused on distressed securities’, has a long history of profiting from countries in financial crisis, having most recently taken a punt on distressed sovereign debt in Argentina. The vulture fund has also purchased distressed sovereign debt in Ukraine and Greece, accruing outrageous sums as the nations restructured their debts to avoid default.

Now turning its attention to Nigeria, VR Capital acquired its 25 per cent stake in P&ID in 2017, just months after the company won a US$6.6 billion arbitration award. The award concerned a dispute over a 2010 deal for P&ID to carry out a gas project in the country.

However, it appears VR Capital’s luck may be finally running out. In 2020, a London Court granted the FRN permission to challenge the arbitration award, finding a strong prima facie case that the underlying contract for the gas project was pursued through bribery. With P&ID now on shaky ground, it appears VR Capital may have backed the wrong horse.

It is clear the tactics of vulture funds can leave countries with crippling debt repayments that only exacerbate existing economic turmoil. Yet, with political leaders becoming more attuned to these practices, we may witness an increased clampdown on vulture funds to put a stop to so-called ‘investors’ profiting from national or corporate wreckage.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin