For a travel industry that’s spent the past two years hampered by the onset of the Covid-19 pandemic, the rise of geopolitical tensions in Eastern Europe has brought with it even more challenges for a sector that was eagerly hoping for a summer full of tourist activity. Many travel stocks around the world tumbled upon Russia’s invasion of Ukraine, but signs of a market recovery have brought the hope that the industry will enjoy a strong summer season.

Despite 2022 starting on an optimistic note as Covid-19’s omicron variant was identified as a significantly weaker strain of the virus and thus opening the door for more tourism in the summer, travel stocks have struggled significantly as the threat of conflict in Europe has put off holidaymakers.

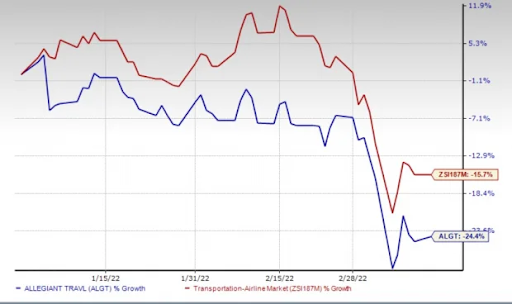

As the chart above shows, shares of leading travel firm Allegiant (NASDAQ: ALGT), and the wider industry have fallen heavily upon Russia’s invasion of Ukraine. However, a recent uptick in performance points to a recovery for the industry and a possible resumption of growth trends ahead of a busy summer.

Remaining on Course for a 2022 Rebound

Since the emergence of the pandemic, the travel sector has been one of the most sensitive areas of the stock market. This is unsurprising – even without the presence of Covid, when the economic outlook becomes uncertain, most consumers cut back on their travel as a reaction.

However, there is widespread optimism that a rebound is set to take place in 2022, even despite the flare up of geopolitical conflict in Europe and the lingering presence of an albeit weakening Covid-19 pandemic.

“As COVID-related restrictions continue to ease, travel stocks will be free from the impact these had on both their business and their stock prices,” explained Julie Gillespie, head of TipRanks TV. “There is renewed optimism for future travel, with plenty of pent-up travel demand in store.”

Although prices have tumbled in recent weeks, it’s worth noting that the stock market typically takes a six-to-nine month outlook when it comes to pricing its assets. This means that low stock prices at the moment may turn bullish depending on just a handful of favourable conditions emerging.

“Travel demand, in general, is expected to be high in 2022, but one important factor is the course of the pandemic, omicron and other variants,” noted Maxim Manturov, head of investment advice at Freedom Finance Europe. “The pace of vaccination in 2021 has contributed to a modest recovery in domestic travel in the US, with the CDC reducing requirements for isolation. As a result of these developments, travel stocks are trending upwards.”

“The underlying theme is that people are tired of sitting at home. They don’t want to sit at home and want to travel the world again. Data from Google shows that travellers are keen to travel after Covid-19. Analysis of the search engine shows an increase in search queries related to booking flights and travel packages. These are all great signs for the travel industry,” Manturov added.

Beware the Impact of Fuel Price Rises

For investors looking to invest in the potential recovery of the travel industry, it may be worth taking a more cautious approach in the short term due to the confounding impact of the conflict in Eastern Europe on global oil prices.

Russia’s invasion of Ukraine has pushed global oil prices higher, as sanctions from around the world have limited the use of oil throughout neighboring countries. This can carry a significant impact on travel stocks due to the high volumes of fuel consumption used by airlines and cruise liners.

“The price of oil is by far the biggest factor for the airlines globally and in the U.S.,” said Morningstar analyst Burkett Huey. “Higher oil prices means that ticket prices should go up because oil is effectively passed through to the customer. I would expect to see less travel relative to what would have happened with lower oil prices.”

With this in mind, it may be worth investors looking more to the hospitality industry as a place to invest in the short term. As companies like Airbnb and hotel chains are less impacted by fossil fuels, the prospect of profiting from a return to summer holidaying on a similar scale as before the pandemic may be more likely.

However, it’s important for investors to continue to monitor the situation in Ukraine. Further escalations in the conflict can lead to holiday cancellations for tourists fearful of visiting Europe. Likewise, indicators of an end to the invasion will incontrovertibly lead to a stock market rebound for firms impacted by the crisis.

Sadly, for a travel industry that’s been severely hindered by the events of the past two years, it appears that testing times are still ahead for tourism in 2022. But with signs of a rebound already taking place, investors and holiday makers alike may yet have an enjoyable summer this year.

(Image: Nasdaq)

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin