As the UK tackles highest inflation rate in 40 years, HyperJar and Retail Economics release striking report revealing the implications for UK households

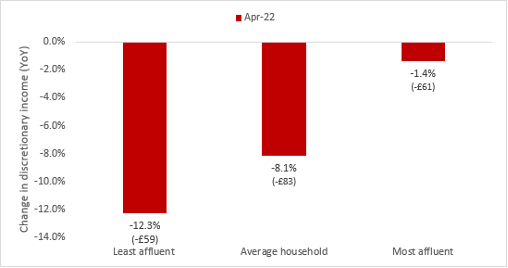

Least affluent families see disposable income plummet by 12.3% in April

The inflation gap between the rich and poor in the UK is now the widest it’s been since records began, according to new research from the Resolution Foundation think-tank. In light of this, HyperJar and Retail Economics have released their Cost of Living Tracker, showing how a fierce inflationary backdrop, including the energy price cap rise, has seen levels of discretionary income [1] among the least affluent UK households decline severely, plummeting by 12.3% in April. This is the equivalent of £59 per month less cash available to spend on non-essential items.

This is in comparison to the most affluent households, who’ve seen their spare cash fall by just 1.4% compared with the same month last year, leaving them with £61 less to spend on discretionary items in April. Across the economy, this is likely to have wiped out around £2.3bn worth of income for non-essentials throughout the month.

The new figures are in tandem with statistics unveiled in a national study from the UK’s most awarded personal finance startup, HyperJar, highlighting the cost of the financial burnout experienced by UK families. The data has revealed that 1-in-4 Brits admit their biggest mental health strain comes from the pressure of being responsible for their family’s finances, whilst 1-in-5 Brits state the responsibility of accounting for financial dependents means they’re unable to stretch their own budget for the things that make them happiest.

Figure 1: Comparison of changes in discretionary income by household income group, year-on-year.

Source: Retail Economics-HyperJar Cost of Living Tracker

[1] Discretionary income is a measure of how much income households are left with after paying for all essentials such as food, energy, and rent.

Essential costs such as energy and food are seeing some of the fastest price rises, which are hitting the least affluent households the hardest. They spend a disproportionate amount of their income on staples, which severely restricts the amount of spare cash they have to spend elsewhere.

Given the uneven impact of rising prices, it’s become critical to look beyond averages from official sources and split out inflation and earnings by household to understand the level of inequality across UK families. The Retail Economics/HyperJar research shows that the least affluent households are seeing inflation rates of 11.2% across their spending, compared with 8.3% for the most affluent families.

Figure 2: The least affluent already facing double-digit inflation

Source: Retail Economics-HyperJar Cost of Living Tracker

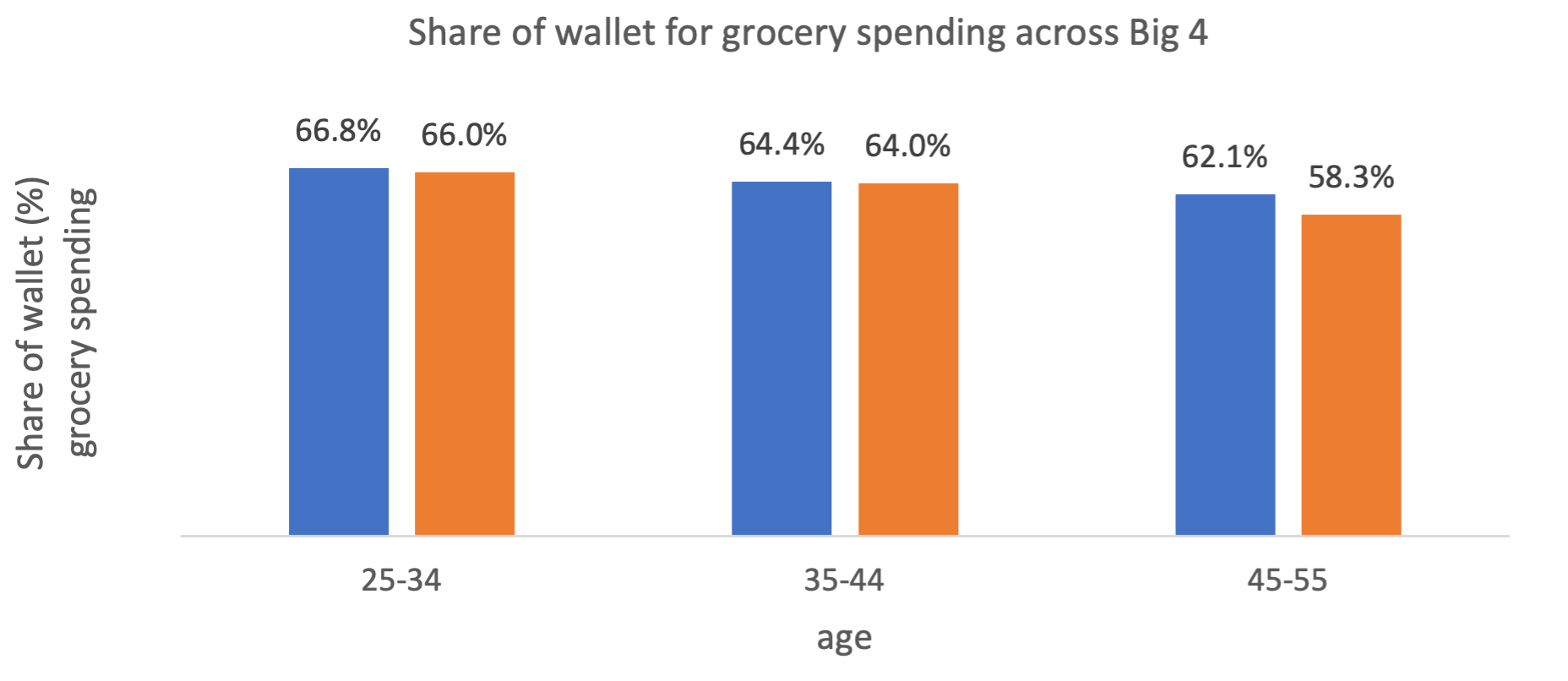

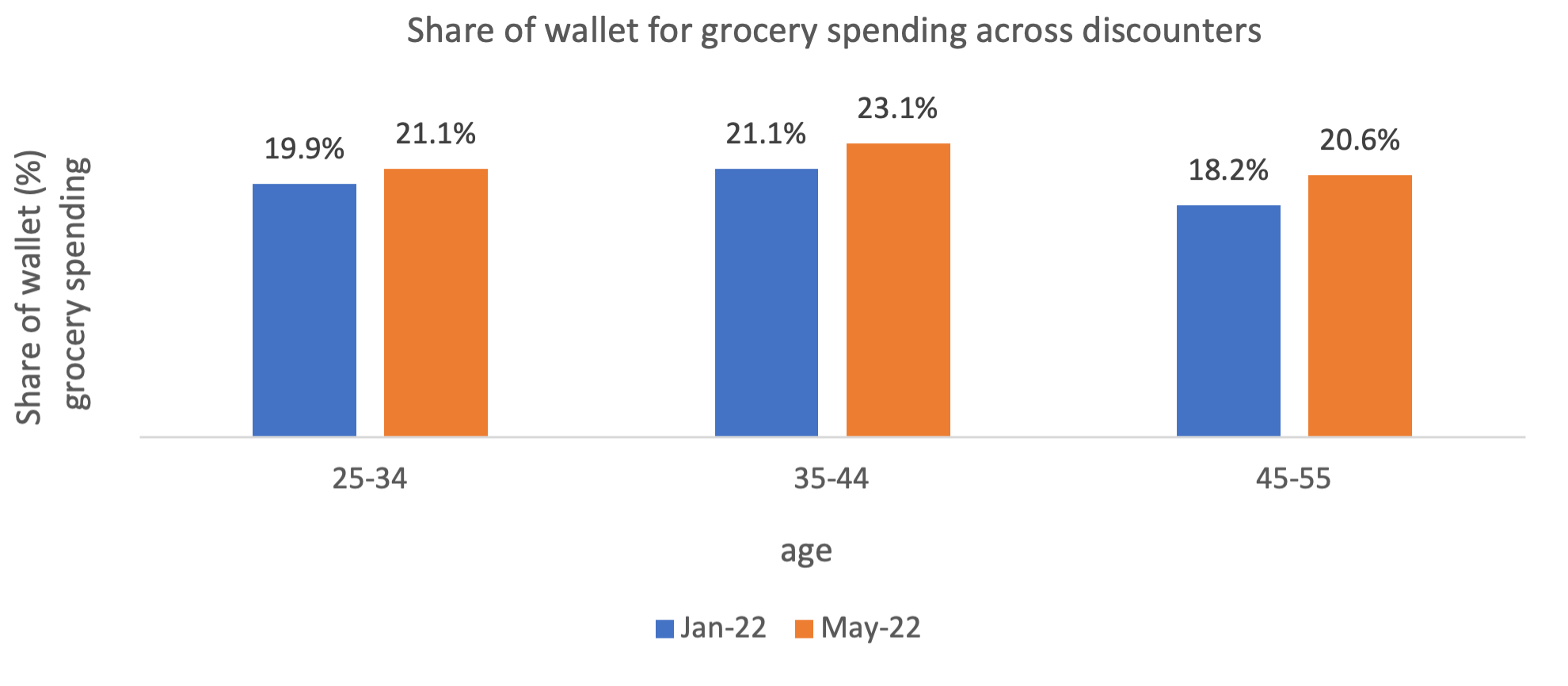

Consumers are already changing their shopping habits and adopting recessionary behaviours in the face of rising inflation and squeezing incomes. One of the most prominent areas facing change is grocery shopping. Spending data from HyperJar shows that the share of grocery spend going to discounters Aldi and Lidl has grown by 1.8 percentage points since the start of the year, while the Big Four (Tesco, Asda, Sainsbury’s and Morrisons) have seen the share of spend decline by 1.2 percentage points between January and May.

Figure 3: Middle-aged consumers have shifted their spending towards the discounters the most since the start of the year.

Source: Retail Economics-HyperJar Cost of Living Tracker

Note – period covers 1-31 Jan 2022 compared with 1-17 May 2022, average share of wallet.

Big 4 = Tesco, Sainsbury’s, Morrisons and Asda. Discounters = Aldi and Lidl

This shift in spending towards the discounters was most prominent across middle-aged (45-55) consumers who increased their share of grocery spending.

Mat Megens, CEO of HyperJar, says: “Many of us have never lived through a period of high inflation and it shows. Experts from ministers and markets to the Bank of England are getting their cost-of-living predictions wrong, prices are rising, and salaries aren’t keeping up. Individuals can’t control this surround-sound of uncertainty, but we can control what we spend and where – and try to make the most of every penny.”

Richard Lim, CEO of Retail Economics, says: “The country is witnessing an enormous income shock with the least affluent families anchored at the epicentre. With inflation nearing double digits, life has turned extremely uncomfortable for many households.

“The most disadvantaged families are facing genuine trade-offs between what essentials to buy. There’s only so much cutting back and shopping around that can be done with inflation reaching these levels.”

The Cost of Living Tracker report is available to download here: Cost of Living Tracker | Retail Economics-HyperJar

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin