The growing need for lithium in a wide range of industries, most notably for the production of electric vehicle batteries, has positioned the mineral as a key player in the world’s future energy mix. As demand continues to grow, lithium mining companies like Albemarle, Livent Corporation, US Critical Metals and a number of other players are expected to benefit.

Leading financial institutions and analysts, such as UBS, have begun to recognize the potential of some of the bigger lithium stocks, specifically Albemarle. At the same time, analysts and wealth advisors are moving quickly to assess smaller players in the lithium industry.

Unseen Powerhouses: The Emerging Potential of Small Lithium Producers

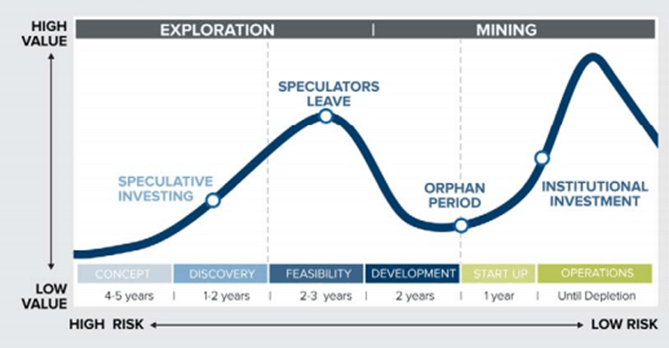

Notwithstanding interest from bulge bracket investment banks in the largest companies within the lithium industry, the potential for emerging exploration companies focused on the discovery of new lithium resources have considerable potential as well. Legendary investor Pierre Lassonde demonstrated this risk reward relationship in the form of the chart below, which is known as the Lassonde Curve.

The chart suggests not only do the largest producers have great potential but small companies like Century Lithium, US Critical Metals, American Lithium, and Norma Lithium should be further investigated as well. Although more speculative in nature, these smaller companies have the potential to outperform their larger peers in the near term as the lithium cycle develops.

Albemarle – An Alluring Proposition

Albemarle Corporation (NYSE: ALB), a leading lithium miner, has recently been identified by UBS as an attractive entry point for investors interested in capitalizing on the surge in lithium demand propelled by the electric vehicle (EV) revolution. This promising outlook on Albemarle is echoed by a diverse list of analyst firms, including BMO Capital Markets, Citigroup, Deutsche Bank Securities, Jefferies & Co., JP Morgan Securities, Morgan Stanley, Piper Sandler, UBS, and Wells Fargo Securities among others.

These firms base their forecasts on multiple factors, ranging from the company’s robust financial performance, its strategic positioning in the lithium market, to the overall macroeconomic trends favoring lithium demand. Over the last three months, the average 12-month price target for ALB has been set at $262.61, with the highest estimate reaching $403 and the lowest at $155. Such figures imply a strong consensus among analysts about Albemarle’s strong potential.

The driving factor behind Albemarle’s optimistic outlook is the company’s impressive ability to position itself advantageously in the lithium market. As EV production ramps up across the globe, automakers are hunting for secure and sustainable lithium supplies, making Albemarle’s lithium mining and refining capabilities increasingly indispensable.

Furthermore, Albemarle’s ongoing efforts to expand its lithium production capabilities show the company’s commitment to staying ahead of demand. By investing in new technology and exploration projects, Albemarle is not just ensuring its own growth, but is also contributing to the overall stability of the lithium supply chain..

Livent Corporation – A Pure-Play Lithium Leader

On the other hand, analysts are also paying attention to Livent Corporation (NYSE: LTHM), which is considered one of the best pure-play lithium stocks on the market. Livent specializes in the production and manufacturing of lithium and its derivatives. The company has undergone a series of changes and its earnings in 2022 outpaced even the most bullish analyst expectations.

Lithium mining is a complex process that is still not fully understood by many investors.

However, understanding how and where lithium is mined is crucial to grasping the industry’s unique risks. Livent is well-positioned in this regard, demonstrating its capabilities in both lithium carbonate and lithium hydroxide operations, two key lithium compounds used in various applications including batteries.

While Livent’s stock price return has been stagnant due to the short-term concern of lithium oversupply and falling prices, analysts and investors believe the company is well-positioned for future growth. This is mainly due to the anticipated increase in demand for batteries as electric vehicle production capacity continues to increase. Livent’s strategy of organic growth through reinvestment in portfolio companies and current operations will allow it to support increased production, thereby positioning it for long-term success.

US Critical Metals – Moving Early on Lithium Clay

The ongoing lithium supply crunch has directed attention towards US Critical Metals Corp. (TSXV: USCM) (OTCQB: USCMF) (FSE: 0IU0), a company focused on mining projects that secure the US supply of critical metals and rare earth elements. An IBTimes feature on Lithium recently tipped USCM as a contender among Lithium stocks. One of the reasons is its participation in Lithium Clay exploration. As the EV industry expands, automakers require a secure and stable supply of lithium, making companies like USCM potentially crucial to their growth and existence within the U.S.

Robert Cannon, a wealth manager who consults with affluent investors and hedge funds across the United States weighed in and said: “…given the prominence of activist investors and the heightened vigilance of hedge funds, they appear to increasingly appreciate the link between lithium, a critical element in our modern technology-driven society, and US national security. While caution is always warranted in investment decisions, a company like US Critical Metals, exhibiting considerable initiative in important spheres such as lithium clay exploration, may capture their attention..”

USCM’s recent announcement of the Bureau of Land Management’s (BLM) approval of the Phase 1 drill program at the Clayton Ridge Lithium Property points towards significant potential for lithium discovery in the US. USCM aims to acquire a 100% interest in Clayton Ridge upon fulfilling certain conditions in 2023. Given the current macroeconomic scenario and its robust strategic planning, USCM is well-positioned to take advantage of the growing lithium demand

Lithium clay deposits could represent a major breakthrough for America and U.S. automakers for several reasons.

According to Darren Collins, CEO at US Critical Metals, lithium clay may hold the key to America’s quest for resource independence and potential dominance in this market.

Reducing Dependence on Foreign Lithium Supplies

A significant proportion of lithium used in the U.S., especially in the production of electric vehicle (EV) batteries, is sourced from other countries (primarily Australia and Chile) and processed and imported from China. This situation exposes the U.S. and its automakers to supply chain risks, including potential disruptions due to geopolitical conflicts, shipping issues, or sudden changes in foreign government regulations. Furthermore, the prices of lithium can also be influenced by these external factors, introducing volatility in the operational costs of U.S. automakers.

Collins also explained that: “…by exploring and developing lithium clay deposits within the U.S., the country could potentially reduce its dependence on foreign lithium supplies. This will not only help to secure a more stable supply of lithium, but it could also lead to a decrease in lithium prices within the U.S., thereby lowering the production costs for U.S. automakers and boosting their competitiveness…”

Speed and Environmental Impact

Compared to traditional methods of lithium extraction, like evaporating lithium from salt brines, extracting lithium from clay deposits could potentially be faster and more environmentally friendly. The conventional evaporation process can take up to 18 months and requires a significant amount of water – a scarce resource in many lithium-rich areas.

On the other hand, extraction from clay deposits involves using a process known as acid leaching. If companies can manage the environmental risks associated with this process, such as the disposal of the acid leachate, this could represent a more sustainable and efficient method of lithium extraction.

Potential for High Lithium Concentrations

Another advantage of lithium clay deposits is that they have the potential to contain very high concentrations of lithium compared to brine operations. For instance, Nevada’s Thacker Pass, one of the largest known lithium clay deposits in the U.S., is estimated to contain millions of tons of lithium. The development of these deposits could provide a vast amount of domestically produced lithium, which could meet the U.S.’s lithium demand for years to come.

Overall, the development of lithium clay deposits could be a significant step towards the U.S. achieving energy independence. It could provide a stable, domestic source of lithium that could fuel the country’s transition to renewable energy and electric vehicles. In addition, it could also give U.S. automakers a competitive edge by providing them with a more reliable and potentially cheaper supply of lithium.

Conclusion

In light of the expanding lithium demand, driven by its crucial role in the EV industry and other diverse sectors, lithium stocks present a significant investment opportunity. Among these, larger players like Albemarle and Livent stand out due to their proven track records, robust strategic planning, and established position in the market. Their ability to scale and commitment to meet the growing lithium demand, positions them as potential key beneficiaries of the lithium boom.

On the other hand, smaller contenders such as US Critical Metals, Century Lithium, American Lithium, and Norma Lithium are also garnering attention. These companies, although more speculative, bring to the table unique extraction methods, strategic reserves, and a nimble structure that allows them to potentially outperform their larger peers in the near term as the lithium market evolves.

As such, distinguished financial institutions, analysts and funds are finding value in both these segments. Could they align their bets with the larger players for their stability and the smaller ones for their high growth potential? If so, that will reinforce the broad-based potential of the lithium industry.

Disclaimer:

This article is intended purely for informational purposes and should not be interpreted as financial advice. The content does not factor in the individual financial circumstances, situations, or needs of readers. Before making any financial decisions, readers are advised to assess their own personal circumstances and, if required, consult with a professional advisor.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin