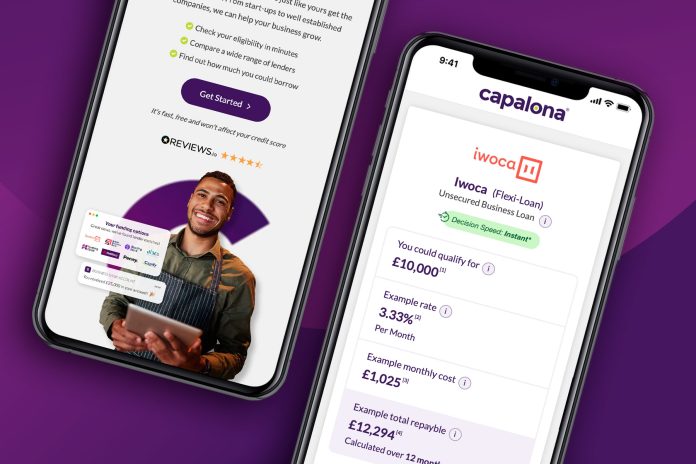

Capalona.co.uk is thrilled to unveil its enhanced business loan comparison service, now featuring example costs of lender products, rates, monthly loan cost, and total repayable amounts. Additionally, an expandable panel titled “more details” provides borrowers with additional product information.

These updates make it even simpler for business owners to make well-informed decisions about their funding options. The fintech brand has eliminated the need for business owners to engage with brokers by offering a self-serve tool that presents business finance options within seconds.

Customers can now effortlessly view and compare rates from each lender and product they are matched with, enhancing their experience when searching for and applying for business funding online.

The business loan comparison service is completely free to use, and there is no obligation to accept any loan offers.

Based in North Wales, Capalona collaborates with a range of trusted UK lenders, utilising Open Banking to assess borrower eligibility and provide real-time lending options. They integrate with both bank and non-bank lenders, offering a wide range of financing solutions such as business loans, revolving credit facilities, invoice finance, merchant cash advance, and more.

The online business finance marketplace is open to all business owners, from startups to established SMEs, allowing them to access funding options and example rates from multiple lenders through Capalona.

“Navigating the business finance landscape can be challenging—I’ve been there myself,” says Rich Wilcock, Co-Founder at Capalona. “Searching for business finance typically overwhelms business owners, which is why we created Capalona. We wanted a solution that simplifies the process of finding and comparing business finance. Our platform guides business owners to suitable lenders in minutes.”

“We are continuously evolving our comparison platform, and our next step is to leverage real-time data through Open Banking and Open Accounting. By harnessing this technology, we can not only provide our customers with real-time offers but also benefit our lenders,” says Simon Moorcroft, Co-Founder at Capalona.

“By combining indicative rates from lenders with our user-friendly interface, we empower business owners to make informed financial decisions with ease,” adds Jamie Moorcroft, Co-Founder at Capalona.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin