The Capital One Bank settlement of 2024 represents a significant development in consumer protection and financial services accountability. This settlement stems from multiple legal actions against Capital One, addressing issues ranging from data breaches to unfair fee practices.

Data Breach Settlement

| Details | Information |

| Settlement Amount | $190 million |

| Eligible Individuals | Approximately 98 million |

| Per Individual Settlement | Up to $25,000 |

| Claim Submission Deadline | November 27, 2023 |

| Initial Payment Date | September 28, 2023 |

| Second Payment Date | September 4, 2024 |

| Eligibility Criteria | U.S. residents affected by the breach in 2019 |

Representment Fees Settlement

| Details | Information |

| Settlement Amount | $16 million |

| Estimated Final Payout | Approximately $10.3 million after legal fees |

| Eligibility Period | September 1, 2015 – January 12, 2022 |

| Claim Submission Deadline for Opt-Out | June 17, 2024 |

| Final Approval Date | July 15, 2024 |

| Eligibility Criteria | Account holders charged representment fees during the eligibility period |

Key Points

- The data breach settlement addresses the exposure of personal information of approximately 98 million customers, resulting from a significant cyberattack in 2019.

- The representment fees settlement involves claims of improper charges on transactions that were initially returned due to insufficient funds but later cleared.

- Payments for both settlements began in late September 2023 and will continue into 2024, with specific deadlines for claims and opt-outs.

This settlement not only aims to provide financial compensation but also highlights the importance of consumer protection and accountability within financial institutions.

Background of the Capital One Bank Settlement

Capital One, one of the largest banks in the United States, faced legal challenges related to two primary issues:

Data Breach Settlement In 2019, Capital One experienced a massive data breach that exposed the personal information of approximately 98 million customers and credit card applicants. This breach led to a class action lawsuit, resulting in a $190 million settlement agreed upon in 2021.

Representment Fees Lawsuit A separate legal action addressed Capital One’s practice of charging representment fees on transactions that initially failed due to insufficient funds but later cleared when funds became available. This lawsuit culminated in a $16 million settlement in 2024.

Settlement Details and Payout Structure

Data Breach Settlement

The $190 million settlement for the data breach provides affected individuals with:

- Up to $25,000 in cash payments for out-of-pocket losses and lost time

- Free identity protection services

- Credit monitoring for a specified period

Representment Fees Settlement

The $16 million settlement covers representment fees charged between September 1, 2015, and January 12, 2022. Eligible account holders will receive compensation based on the fees they incurred during this period.

Capital one bank settlement 2024 how much will i get?

Eligibility Criteria

Data Breach Settlement Eligibility

- U.S. residents whose information was compromised in the 2019 breach

- Individuals who received notice of potential eligibility

- Those who submitted valid claims by the November 27, 2023 deadline

Representment Fees Settlement Eligibility

- Capital One account holders charged representment fees between September 1, 2015, and January 12, 2022

- Both current and former account holders may be eligible

Payout Date and Distribution Process

The exact payout date for the Capital One Bank settlement in 2024 varies depending on the specific settlement and claim process:Data Breach Settlement

- Initial payments began on September 28, 2023

- A second round of payments was distributed on September 4, 2024

- Claimants who accepted their initial payment were automatically considered for the second payment

Representment Fees Settlement

- The final approval hearing is scheduled for July 15, 2024

- Payments are expected to be distributed within 60 days of the final approval, likely in September or October 2024

Claim Verification and Compensation Amounts

The settlement administrators employ a rigorous process to verify claims and determine compensation amounts:Data Breach Settlement

- Claims are reviewed for validity and completeness

- Compensation is based on documented out-of-pocket expenses and time spent addressing issues related to the breach

- Maximum individual payout is capped at $25,000

Representment Fees Settlement

- Eligible account holders do not need to submit a claim

- Compensation is calculated based on the number and amount of representment fees charged during the covered period

- Payments will be automatically credited to current account holders or sent via check to former customers

Impact on Consumers and Financial Industry

The Capital One Bank settlement of 2024 has far-reaching implications:Consumer Protection

- Heightened awareness of data security and privacy issues

- Increased scrutiny of banking fee practices

- Potential for improved transparency in financial services

Industry Standards

- Pressure on other financial institutions to review and revise their data security measures

- Possible industry-wide changes in fee structures and policies

- Enhanced regulatory focus on consumer protection in digital banking

Steps for Affected Consumers

If you believe you may be eligible for either settlement, consider the following actions:

- Verify Eligibility: Check official settlement websites or contact Capital One directly to confirm your eligibility.

- Review Documentation: Gather any relevant documents, such as account statements or correspondence related to the data breach or representment fees.

- Monitor Communications: Keep an eye on your email and mail for official notices regarding the settlements and payment distribution.

- Update Contact Information: Ensure Capital One has your current mailing address to receive any physical checks or important communications.

- Be Patient: The distribution process can take time, especially with large-scale settlements involving millions of claimants.

Future Implications and Consumer Protections

The Capital One Bank settlement of 2024 may lead to several long-term changes in the financial industry:

Enhanced Data Security Measures Banks and financial institutions are likely to invest more heavily in cybersecurity infrastructure and protocols to prevent future breaches.

Fee Structure Reforms The scrutiny on representment fees may prompt banks to reevaluate and potentially reform their fee structures to avoid similar legal challenges.

Increased Transparency Financial institutions may adopt more transparent practices regarding fees, data usage, and security measures to rebuild consumer trust.

Regulatory Changes Lawmakers and regulatory bodies might introduce new legislation or guidelines to prevent similar issues in the future and protect consumer interests.

Here are the latest updates on the Capital One Bank Settlement 2024 payout date:

Second Round of Payments

Capital One has initiated a second round of payments to eligible claimants in the data breach settlement, which began on September 4, 2024. Those who accepted their initial payment were automatically considered for this subsequent distribution.

Representment Fees Settlement Timeline

The final approval hearing for the $16 million representment fees settlement is set for July 15, 2024. Payments from this settlement are anticipated to be distributed within 60 days following the final approval, likely occurring in September or October 2024.

Claim Verification Process

Settlement administrators are currently verifying claims and determining compensation amounts for both the data breach and representment fees settlements. This involves checking claims for validity and completeness, as well as calculating payments based on the number and amount of fees charged during the specified periods.

Guidance for Affected Consumers

Affected consumers are encouraged to remain patient as the payout process continues. Given the large number of claimants involved, it may take time to complete the distributions. Individuals should keep an eye out for communications from Capital One and the settlement administrators regarding their payments.

Anticipated Industry Changes

The Capital One Bank settlement is expected to prompt improvements in data security measures across the financial sector, along with potential reforms to fee structures. Financial institutions may invest more in cybersecurity and reassess their fee policies to prevent similar legal issues in the future.

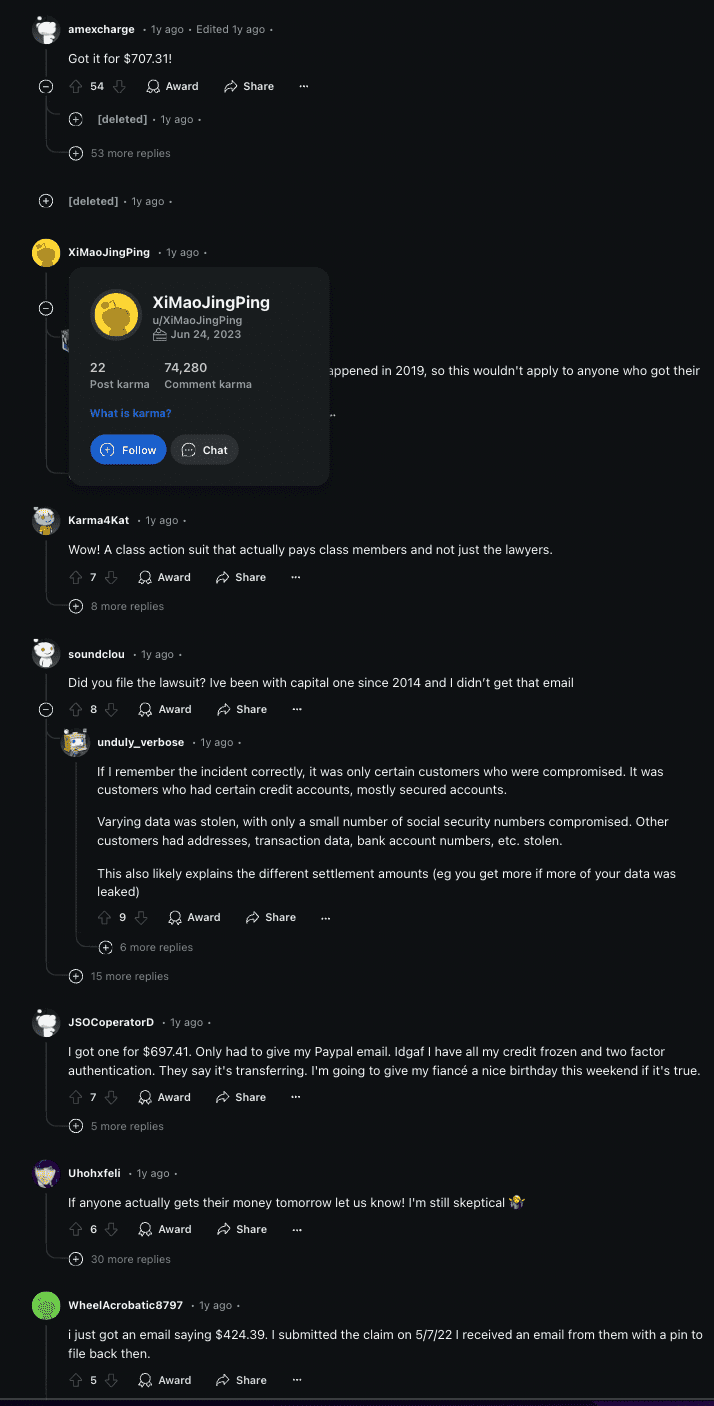

Capital One Bank Settlement 2024 Reddit

Many Redditors discuss the complexities of the claims process, emphasizing the importance of submitting valid claims by the November 27, 2023 deadline to qualify for cash payments that began on September 28, 2023. Additionally, users highlight the provision of free identity protection services for affected individuals.

CapitalOne Data Breach lawsuit – did anyone else get this?

byu/Asleep_Onion inCreditCards

As discussions unfold, participants express concerns about data security and the implications of the breach on consumer trust in financial institutions. Overall, Reddit serves as a platform for individuals to seek advice and share updates on their claims related to this significant settlement.

Conclusion

The Capital One Bank settlement of 2024 marks a significant moment in consumer protection within the financial services industry. By addressing both data security concerns and unfair fee practices, this settlement sets a precedent for accountability and consumer rights. As the payout process unfolds throughout 2024, affected individuals should stay informed about their eligibility and the steps required to receive compensation.

This settlement also serves as a reminder of the importance of vigilance in personal financial management. Consumers are encouraged to regularly review their bank statements, monitor their credit reports, and stay informed about their rights and protections in the digital banking era.

As we move forward, the implications of this settlement will likely resonate throughout the financial industry, potentially leading to improved practices, enhanced security measures, and a renewed focus on consumer trust. While the immediate focus is on the payout dates and distribution process, the long-term impact of this settlement may be even more significant, shaping the future of banking and financial services for years to come.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin