Bitcoin Price Prediction 2025: Impact of BlackRock’s $350M Investment

BlackRock’s recent $350 million Bitcoin (BTC) purchase through its iShares Bitcoin Trust ETF (IBIT) has sent shockwaves through the cryptocurrency market, cementing Bitcoin’s status as a mainstream investment asset. As the world’s largest asset manager, overseeing $11.6 trillion in assets, BlackRock’s move underscores the growing institutional appetite for digital currencies.

With Bitcoin trading around $94,000 as of May 2, 2025, investors are eager to understand how this investment could shape its price trajectory. The impact of BlackRock’s investment, expert price predictions, market trends, and key factors driving Bitcoin’s future, offering actionable insights for investors.

Understanding BlackRock’s $350 Million Bitcoin Investment

BlackRock’s $350 million Bitcoin acquisition is part of its ongoing strategy to dominate the cryptocurrency market through its IBIT ETF, launched in January 2024. The ETF has amassed over $54 billion in assets under management, holding more than 567,000 BTC, valued at $47.8 billion as of March 2025, according to Arkham Intelligence.

While specific details of the $350 million purchase are not explicitly outlined, posts on X from late 2024 highlight similar transactions, including a $337.8 million buy of 3,515 BTC on December 3, 2024, and a $359 million purchase on December 19, 2024. At current prices of approximately $94,000 per BTC, the $350 million investment likely equates to around 3,700 BTC.

The IBIT ETF has seen consistent inflows, with a record $970.9 million on April 28, 2025, marking its second-largest single-day inflow, per Farside Investors. BlackRock’s aggressive accumulation, led by CEO Larry Fink, reflects a strategic pivot toward digital assets. Fink, once a Bitcoin skeptic, now champions it as “digital gold” and a hedge against currency debasement, a view he reiterated at the World Economic Forum in January 2025. This investment not only bolsters BlackRock’s crypto portfolio but also signals to other institutions that Bitcoin is a viable long-term asset.

Immediate Market Impact of BlackRock’s Investment

BlackRock’s $350 million purchase has provided immediate support to Bitcoin’s price, which has stabilized around $94,000–$95,000 in April 2025. The $970.9 million IBIT inflow on April 28, 2025, helped Bitcoin recover from a dip to $80,000 earlier in the year, driven by over $3 billion in cumulative ETF inflows, according to Cointelegraph. The $350 million buy likely played a role in counteracting outflows from competing ETFs, such as Fidelity’s FBTC ($87 million) and ARK Invest’s ARKB ($226 million), in late April 2025.

The investment has also reduced market volatility by injecting liquidity. BlackRock’s IBIT ETF, with 51% of the $100 billion spot Bitcoin ETF market, has outpaced traditional safe-haven assets like the iShares Gold Trust ETF ($5 billion AUM). Posts on X, such as @AlvaApp’s April 29, 2025, comment, emphasize BlackRock’s “massive accumulation” and a “bullish narrative,” noting that ETF inflows and a 2.77% supply hold signal strong institutional conviction. This stability could pave the way for Bitcoin to test higher resistance levels, such as $95,441, in the near term.

Bitcoin Price Predictions for 2025

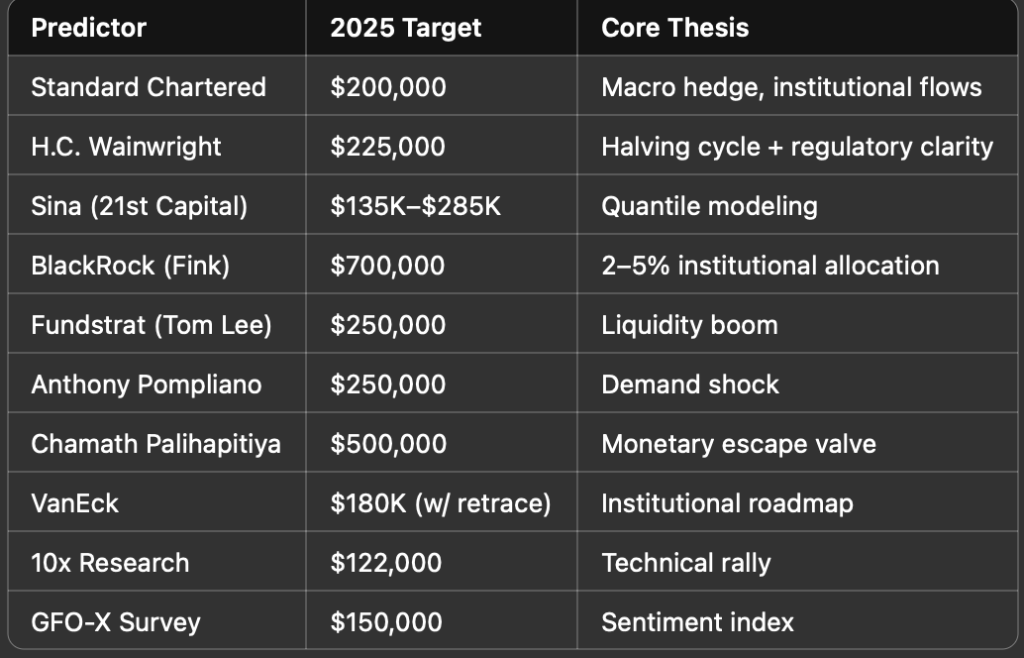

Analysts and industry leaders offer diverse Bitcoin price predictions for 2025, shaped by BlackRock’s investment and broader market dynamics. Below are key forecasts:

- Bullish Scenarios:

- Larry Fink (BlackRock): Predicts Bitcoin could reach $700,000 if sovereign wealth funds allocate 2–5% of their portfolios, citing its role as a hedge against geopolitical risks and inflation (World Economic Forum, January 2025).

- Tom Lee (Fundstrat): Forecasts $250,000, driven by ETF inflows and post-halving supply constraints.

- Coinpedia: Projects a high of $168,000, fueled by institutional adoption and bullish sentiment.

- Matthew Sigel (VanEck): Expects $180,000, emphasizing reduced volatility and institutional demand.

- Robert Kiyosaki: Predicts $350,000, alleging BlackRock suppresses prices to allow large investors to buy below $100,000.

- Bearish Scenarios:

- Peter Berezin (BCA Research): Warns of a drop to $45,000 if a global recession impacts risk assets.

- Peter Brandt: Suggests a potential decline to $78,000 based on technical patterns, though he notes uncertainty.

- James Butterfill (CoinShares): Envisions stagnation at $80,000 if regulatory reforms falter.

- Long-Term Projections:

- Cathie Wood (ARK Invest): Forecasts $3.8 million by 2030 with 5% institutional allocation, implying a $75 trillion market cap.

- Michael Saylor (MicroStrategy): Predicts $13 million by 2045, with a bull case of $49 million.

- Changelly: Estimates an average of $574,902 by 2030, with highs of $2.65 million by 2040.

BlackRock’s investment tilts the balance toward bullish scenarios by attracting more institutional capital, though macroeconomic and regulatory risks could temper gains.

Key Drivers of Bitcoin’s Price in 2025

Several factors will influence Bitcoin’s price in 2025, amplified by BlackRock’s $350 million investment:

- Institutional Adoption:

- BlackRock’s IBIT ETF has drawn significant interest from hedge funds, with Citadel Advisors increasing its stake by 5,196% in Q4 2024 and Millennium Management boosting its holdings. Public companies like MicroStrategy (252,000 BTC) and Tesla ($500 million buy in Q1 2025) are also allocating to Bitcoin, driving demand.

- Dominari Holdings, linked to Donald Trump’s sons, invested $2 million in IBIT shares in March 2025, reflecting wealth management firms’ growing interest.

- Post-Halving Supply Dynamics:

- The 2024 Bitcoin halving reduced miner rewards to 3.125 BTC per block, tightening supply. Historical halving cycles (2017, 2021) triggered bull runs, with 2025 expected to follow suit.

- The network’s hash rate reached 818 EH/s in March 2025, signaling miner confidence despite lower rewards.

- Macroeconomic Environment:

- Federal Reserve Chair Jerome Powell’s recession warnings and BlackRock’s Larry Fink’s concerns about Trump’s trade policies fueling inflation enhance Bitcoin’s appeal as a hedge. Robbie Mitchnick, BlackRock’s head of digital assets, notes that recessions often drive Bitcoin rallies due to stimulus and lower rates.

- The Fed’s 4.25% rate policy and cooling inflation (2.8% CPI in February 2025) support risk assets.

- Regulatory Clarity:

- The SEC’s approval of spot Bitcoin ETFs in January 2024 and options trading in September 2024 has reduced barriers for investors. BlackRock’s April 2025 meetings with the SEC’s crypto task force suggest a stable regulatory framework, encouraging further institutional investment.

- Technical Analysis:

- Bitcoin is forming an ascending triangle on the 2-hour chart, with resistance at $95,441 and support at $94,400. A breakout could target $97,500, while a failure may test $94,400.

- Bullish MACD and an RSI of 83 indicate strong momentum, though overbought conditions pose risks.

Risks to Bitcoin’s Price Outlook

Despite the optimistic outlook, several risks could impact Bitcoin’s price in 2025:

- Volatility: Bitcoin’s 12% drop in Q1 2025, its worst since Q2 2024, highlights ongoing price swings.

- Regulatory Uncertainty: While ETFs enjoy regulatory approval, broader crypto regulations remain unclear, potentially affecting investor sentiment.

- Macroeconomic Challenges: Trump’s trade policies could stoke inflation, limiting Fed rate cuts and pressuring risk assets.

- Technical Resistance: Bitcoin faces a sell-wall at $95,000–$100,000, with traders likely to take profits, as noted in technical analyses.

Strategic Implications for Investors

BlackRock’s $350 million investment offers actionable insights for investors:

- Leverage ETFs: IBIT provides a regulated, low-friction way to gain Bitcoin exposure, ideal for institutional and retail investors.

- Monitor Inflows: Track ETF inflows via platforms like Farside Investors to gauge institutional sentiment.

- Technical Signals: Watch for a breakout above $95,441 or a drop to $94,400 to time entries and exits.

- Hedge Against Uncertainty: Bitcoin’s appeal as a hedge grows amid recession fears and trade policy risks, as noted by BlackRock’s Jay Jacobs.

The Future of Bitcoin in 2025 and Beyond

BlackRock’s $350 million investment marks a turning point for Bitcoin, reinforcing its role as a mainstream asset. If bullish predictions materialize, Bitcoin could reach $168,000–$700,000 in 2025, driven by ETF inflows, post-halving dynamics, and macroeconomic uncertainty. However, bearish scenarios suggest a potential drop to $45,000–$80,000 if recession fears or regulatory setbacks intensify.

Long-term, Bitcoin’s trajectory looks promising, with projections of $3.8 million by 2030 (Cathie Wood) and $13 million by 2045 (Michael Saylor). BlackRock’s dominance in the ETF market and growing institutional adoption will likely sustain upward momentum. For now, investors should stay vigilant, leveraging regulated vehicles like IBIT and monitoring market signals to capitalize on Bitcoin’s transformative potential.

Conclusion

BlackRock’s $350 million Bitcoin investment through its IBIT ETF is a pivotal moment, bolstering Bitcoin’s price stability around $94,000 and fueling optimism for 2025. Expert predictions range from $45,000 to $700,000, with institutional adoption, post-halving supply constraints, and macroeconomic trends as key drivers. While risks like volatility and regulation persist, BlackRock’s influence could propel Bitcoin to new highs. Investors should leverage ETFs, track inflows, and monitor technical indicators to navigate this dynamic market, positioning themselves for success in the evolving world of digital finance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin