Mazagon Dock Shipbuilders Share Price

Mazagon Dock Shipbuilders Limited is an elite Indian shipyard that has established its reputation in the defense and maritime sectors. The company, based in Mumbai, is involved in constructing warships and submarines, which has prompted investors to be interested in its securities.

Historical Performance: 2020–2022

Share price of Mazagon Dock. Let me pick on the year 2020, when they had a share price of around 150 rupees. It shot up to 250 by 2021 on defense contracts. In 2022, the rise resumed, and the shares closed at 400 on the back of high order books and government backing.

Breakout Year: 2023–2025

In 2023, it was a matter of turning point as the shares rose to 1200 at a go, backed by robust financials. In 2024, the share skyrocketed to 2500 (in Indian rupees), on the back of the rise in export orders. Current estimates predict a 100 percent share of 3500 rupees by 2025, driven by continued demand for naval vessels.

Short-term Projection: 2026-2028

With the new submarine contracts, analysts estimate its share price to be 4,200 by 2026. In 2027, shares might rise to 5,000 since stable growth is possible. With a larger production capacity, it could be predicted that, in 2028, the stock could be up to 200 times the current level with stable market conditions 2028, reaching 6 thousand rupees.

Mid-Term Growth: 2029–2031

With technology upgrading, the shares of Mazagon Dock will reach 7,200 in 2029. Prices by the year 2030 may range up to 8,500 Rs, and joint international efforts are likely to increase the received income. Consistent inflows of orders with respect to shares can reach 10,000 per share by 2031.

Long Term Prospect: 2032-2035

In the long run, Deutsche Bank believes that shares could also reach a level of 12,000 rupees by 2032, driven by defense modernization in India. The prices may rise to 14,500 in 2033, powered by exports. Within the next ten years, i.e, by 2034, shares can reach 17,000 and in 2035, analysts believe they will reach 20,000 were it to continue the current run.

Drivers of the Growth in Share Price

The expansion of Mazagon Dock is linked to India’s military expenditure, which focuses on local production. Technological advantage is given a projection with strategic tie-ups with international companies. Also, the government policies such as Make in India extend its order pipeline, which aids a long-term increase in the stock price.

Competitive Advantage and Competitive Positioning

Mazagon Dock is a monopoly-controlled enterprise in some navy contracts since it is a company of the public sector. It boasts of skill in constructing destroyers and frigates. Innovation and promptness in delivering products within the company make it powerful in the market, which draws investor interest.

Economic and Policy Effects

The Indian government’s drive to self-sufficiency in defense production is a plus to Mazagon Dock. The increment in the geopolitical tensions also creates demand for naval resources, which improves the orders. Stability in government policies on its side and a rise in defense expenditures are some of the significant magnets of the company’s share price trend until 2035.

Risks and Challenges

Mazagon Dock has potential, but it is under pressure from risks such as delays and cost overruns. Production may be affected by global network effects of supply chains. Additionally, competition between private players and market volatility can squeeze margins, which may impact rising share prices.

Market Trend and Investor Sentiment

Mazagon Dock is a good company to invest in. The stock has all the fundamental support needed to keep investors interested in it. The performance of this stock is stable, which makes it appealing to retail and institutional investors. The bullish trend in the defense companies is also company-specific, as recently revealed by market trends, which further justifies the bullish stock market sentiment on Mazagon Dock.

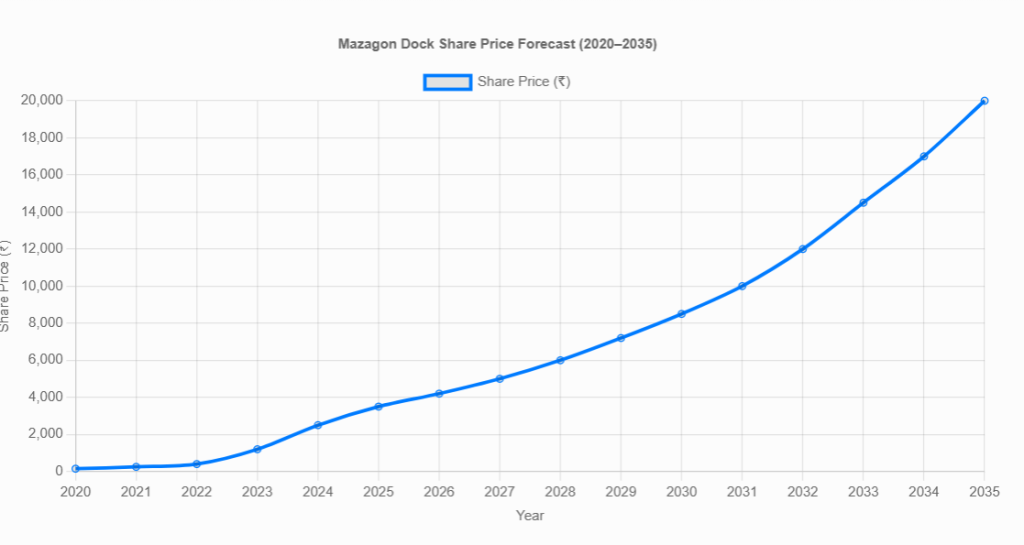

Graph: Share Price Forecast (2020–2035)

The following graph illustrates Mazagon Dock’s projected share price trajectory:

The Forecast Graph interpretation

The graph indicates a constant increasing trend in the share price of Mazagon Dock. The stock is also expected to grow to 20,000 from 150 in the year 2020 to 2035. The sharp increase after 2023 indicates increased confidence among investors and good business basics.

Growth Initiatives Using Strategies

Mazagon Dock’s investment in the latest shipbuilding technologies increases efficiency. Joint ventures with foreign defense companies increase their capacities. The company is centered on green technologies, which are popular all over the world, so this tendency may increase its demand for stocks.

International Opportunities and Internationalization

The potential of export orders from friendly countries is high. The experience that Mazagon Dock has in the building of cost-effective ships has given it an edge in the global market. By diversifying to cover commercial vessels, the company has the potential to increase its share price by 2035.

Financial Health and Profitability

The progress in the profitability of Mazagon Dock is a sign of efficient operation. The increasing revenues of the defense contract guarantee the stability of the financial resources. Due to the low debt levels and regular dividends, the company is an attractive investment that allows for an increase in the share price in the long term.

The Place of Governmental Assistance

Government projects such as Atmanirbhar Bharat focus on the domestic production of defense products to the advantage of Mazagon Dock. Greater budgets for the naval forces and future contracts create a picture of revenue. This policy support is essential to the maintenance of the forecasted growth of the share price out to 2035.

Technological Advancements

The automation and AI in shipbuilding at Mazagon Dock increase the productivity. Advanced warships’ investments in R&D give it a leading position. Such developments will spur cost initiatives, which will have a positive influence on share prices in the forecast period.

Market Volatility and Prevention

Although the market fluctuation is risky, there is reduced volatility due to the varied order book of Mazagon Dock. Contracts with a long run protect revenues. Superior cost management and governmental support ensure that even in moments of economic decline, the company can be sheltered, contributing to the share price growth.

Mazagon Dock Investor Strategies

The long-term perspective is the consideration of Mazagon Dock, which investors should look at as it presents growth potential. Periodic revisions of the defense budgets and national contract observance are important. Other stocks in the defense sector could be included in portfolios to balance risks, but take advantage of the growth of the industry.

Conclusion: A Good Investment

Mazagon Dock Shipbuilders is a good investment. With such robust fundamentals and market backing, the company’s share price is expected to rise to $ 20,000 to $ 150 in the year 2035. With the strategic moves and government support, the stock can grow even further.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin