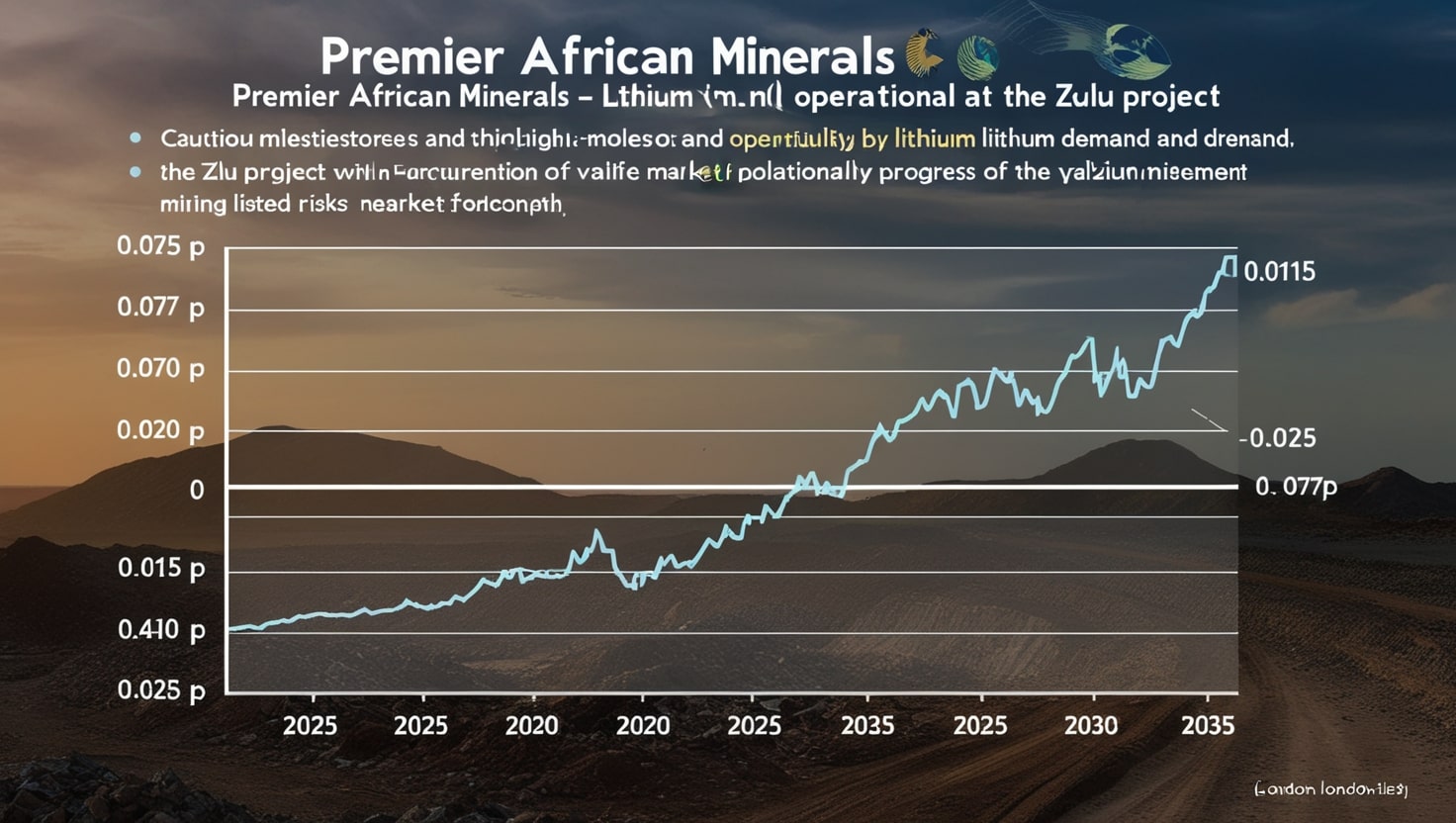

Premier African Minerals Share Price

Premier African Minerals is a London-listed African-centred mining firm operating in the fields of lithium and tantalum. Its Zulu mega project in Zimbabwe has attracted investors. Nevertheless, its share value is unstable in terms of the market and operations.

Market Position- The Company is currently in Third Place

The share price of Premier African Minerals as of June 2025 stands at 0.0125p, which is a considerable drop compared to a 52-week high of 0.114p. The market capitalization is approximately £ 6.45 million, and the volatility is high, indicating uncertainty among investors.

Aspects that affect Share Price

The global demand for lithium influences the share value, the development efforts of the Zulu project, and African geopolitics. There are also legal complexities in Ethiopia and unstable commodity prices. The atmosphere of investors and market trends is also of primary importance.

Forecasting Methodology

This prediction is based on technical analysis, past trends, and industry forecasts. The assumptions taken into account are the stable lithium demand, moderate operational success, and no significant geopolitical disruptions. The outdoors is a cautionary commentary with notes that penny stocks, such as Premier, are risky.

Share Price Projection Portfolio 2025

The share price of Premier might become stable in 2025 when the Zulu production is expected to increase significantly. Its expected price is 0.015p. Better drilling outcomes and possible collaborations with Glencore might promote confidence as well, but the effect might be limited by regulatory delays.

Price of Share in 2026 Estimation

The share price can be scaled up to 0.018p by 2026 because of the expected operational improvements. The need for lithium in the electric vehicle market is set to contribute to a trend, although volatility and financing requirements might restrict major positive changes.

Forecast of Share Price 2027

The share price can be expected to amount to 0.022p in 2027. Gains could be stimulated by successful Zulu project milestones, including a full-scale output. Still, the fluctuations in global prices of commodities and costs of operations are the primary risks to watch out for.

Prediction of Share Price 2028

By 2028, there is potential that the share price of Premier will soar to 0.027p. Constant output and the proposed new project can boost the confidence of investors. In the case of the lithium market becoming saturated, growth expectations can be dampened by external factors.

2029 Share Value Price

It is possible to predict that by 2029, the share price may increase to 0.032p. This might be driven by the expansion of operations in Africa and an increase in global demand for lithium. But there is a threat of sustained growth due to geopolitical risks and competition from bigger miners.

Forecast of Share Price in 2030

In 2030, 0.038p of share price is expected. Provided that Premier finds stable financing and passes regulatory requirements, the pool of investors may increase. The price momentum may, however, be marred by market corrections or oversupply of lithium.

The Share Price Outlook in 2031

The share price may even be 0.045p in 2031. Value may be catalysed by further Zulu progress and possible new acquisitions. Strategies of energy transition, as well as economic trends and investments, are going to impact performance in the long run.

Price Forecast of Share in 2032

In 2032, the price of shares in Premier may take off to 0.052p. Ramping up operations and technological evolution in the supported extraction of lithium would support growth. Investors should beware of external shocks like a fall in commodity prices or political turmoil.

Share Price Estimate of 2033

In 2033, the share price is projected to be 0.060p. Good project implementation and lithium market dynamics are likely to be favorable. Nevertheless, any pending operational inefficiency or an economic recession on a worldwide basis can present serious threats to this forecast.

Share Price Forecast 2034

The price of shares might go as high as 0.068p in the year 2034. The capacity of Premier to diversify risk and manage costs will be essential. The growth rate might be influenced by external factors such as competition and alterations in regulation.

Share Price Projections of 2035

The price of the shares can reach 0.077p as early as 2035. Sustained lithium demand and operational stability are important considerations for long-term success. Investors may be keen on how volatile the market may be and how well Premier can perform its long-term vision.

Share Price Forecast Table

|

Year |

Projected Share Price (GBX) |

|---|---|

| 2025 | 0.015 |

| 2026 | 0.018 |

| 2027 | 0.022 |

| 2028 | 0.027 |

| 2029 | 0.032 |

| 2030 | 0.038 |

| 2031 | 0.045 |

| 2032 | 0.052 |

| 2033 | 0.060 |

| 2034 | 0.068 |

| 2035 | 0.077 |

Threats and Hang-ups

There is a high level of risk challenging Premier African Minerals, expressed in terms of delays in operations, bureaucracy, and volatility in commodity prices. These risks are increased by the fact that it has a low market cap and no upcoming revenue. The performance might also be affected by geopolitical instability in the regions where the projects take place.

Growth Opportunities

The world is becoming electrified, offering great opportunities. Lithium demand also puts Premier in an advantageous position through the Zulu project. It may enhance its competitiveness in the industry by forming strategic alliances and utilizing advanced technological applications in mining.

Investor Considerations

Stock market investors are advised to exercise caution before venturing into Premier since it is a high-risk company. The portfolio diversification and observation of trends in the lithium market are necessary. Your risks are manageable, and short-term volatility may be practicable to long-term investors.

Conclusion

The forecast for the share price of Premier African Minerals highlights the low growth between 2025 and 2035, which is influenced by lithium demand and the implementation of projects. Nevertheless, the risks are high in terms of volatility and externality. Investors have to balance the potential of this penny stock and the uncertainties of this company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin