What Happens If Satoshi Nakamoto Bitcoin Wallet Becomes Active and Moves Funds?

Satoshi Nakamoto, the pseudonymous mastermind behind Bitcoin, remains an enduring enigma in the world of modern technology. In 2008, Nakamoto unveiled the Bitcoin whitepaper, laying the foundation for a decentralized digital currency powered by blockchain technology. By 2009, Bitcoin was born with Nakamoto mining the genesis block, igniting the cryptocurrency revolution.

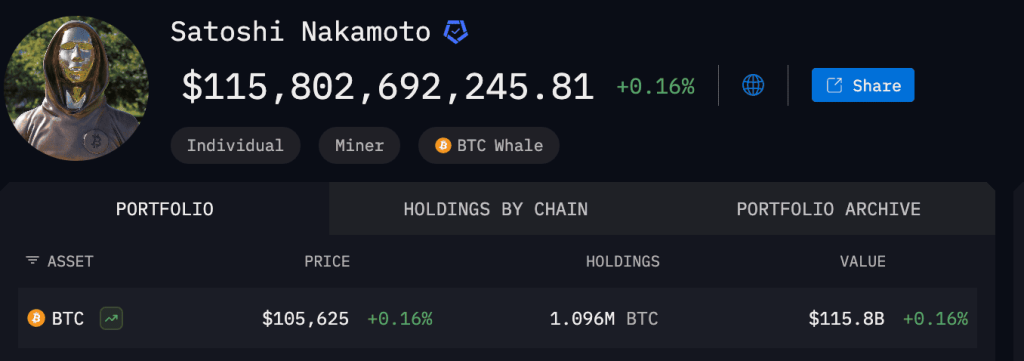

Nakamoto is believed to hold approximately 1 million BTC across multiple wallets, amassed during Bitcoin’s nascent years when mining was a low-competition endeavor. Known as “Satoshi’s stash,” these wallets have lain dormant for over a decade, sparking endless speculation about their potential to reshape the cryptocurrency landscape if activated.

What would happen if Satoshi Nakamoto wallet becomes active?

Understanding Satoshi Nakamoto’s Bitcoin Holdings

The Scale of Nakamoto’s Holdings

Estimates peg Nakamoto’s Bitcoin holdings at around 1 million BTC, a fortune valued between $60 billion and $100 billion as of June 2025, depending on Bitcoin’s fluctuating price. Mined in 2009 and 2010, these coins were acquired when Bitcoin’s value was negligible and mining difficulty minimal. Blockchain analysis links these wallets to early mining patterns and Nakamoto’s pivotal role in Bitcoin’s development and here is Satoshi Nakamoto Wallet Address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Dormancy and Speculation

Since Nakamoto vanished in 2011, these wallets have remained inactive, fueling theories about their fate. Did Nakamoto lose access to the private keys? Are they preserving Bitcoin’s decentralized ethos by staying silent? Or have they passed away? This dormancy has lent stability to Bitcoin’s ecosystem, but their activation could unleash significant market disruption.

Blockchain Transparency and Wallet Tracking

Bitcoin’s blockchain is an open ledger, enabling anyone to track wallet activity via tools like blockchain explorers (e.g., Blockchair, Blockchain.com) and analytics firms like Chainalysis. Nakamoto’s funds, if moved, would be instantly visible, amplifying market reactions due to this transparency.

Potential Scenarios If Nakamoto’s Wallet Becomes Active

Scenario 1: Small-Scale Movements

If Nakamoto shifts a modest sum—say, a few hundred BTC—it might signal a test or minor intent:

- Personal Use: Liquidity for personal needs.

- Charity: Donations to Bitcoin projects or causes.

- Maintenance: Securing funds in updated wallets.

Market Impact: A 5-10% price dip due to uncertainty, with quick recovery if the move seems harmless.

Scenario 2: Large-Scale Transfers to Exchanges

A transfer of tens of thousands of BTC to exchanges like Binance or Coinbase could hint at a sell-off, alarming investors.

Market Impact: A 20-50% price crash, fueled by oversupply and panic selling from retail investors and trading bots.

Scenario 3: Distribution to New Wallets

Distributing funds across multiple wallets without selling might suggest security upgrades or future planning.

Market Impact: Moderate 10-20% volatility, driven by speculation rather than immediate supply shifts.

Scenario 4: Symbolic Activation

If Nakamoto signs a message with a private key but moves no funds, it could affirm their presence without market upheaval.

Market Impact: A 10-30% price surge, reinforcing Bitcoin’s legacy and resilience.

How the Cryptocurrency Market Might Respond

Immediate Reactions

Price Volatility

Bitcoin’s price reacts sharply to news and large transactions. Nakamoto’s wallet activity could spike trading volume, echoing past events like the 2018 Mt. Gox sell-offs, which caused significant swings.

Fear, Uncertainty, and Doubt (FUD)

Speculation would explode on platforms like X and Reddit, driving FUD and potential panic selling—or bullish optimism if framed positively.

Exchange and Institutional Responses

Exchange Liquidity

Large sell orders could overwhelm exchange order books, causing slippage and trading halts, as seen in past flash crashes.

Institutional Investors

Firms like Grayscale and MicroStrategy might hedge via futures or diversification if Bitcoin’s stability falters.

Long-Term Market Implications

Regulatory Scrutiny

Governments, wary of crypto’s anonymity, might tighten rules if Nakamoto’s funds move. The SEC and FATF could enforce stricter KYC/AML measures, citing market manipulation risks.

Impact on Altcoins

A Bitcoin crash could drag down altcoins like Ethereum and Solana due to market correlation, though some might gain as alternatives.

Bitcoin’s Decentralization Narrative

If Nakamoto wields outsized influence, it could challenge Bitcoin’s decentralized image, impacting adoption.

Factors Influencing Market Reactions

- Nakamoto’s Intentions: Transparency (e.g., a signed message) could calm markets; ambiguity would fuel volatility.

- Market Conditions: Bull markets might absorb the shock; bear markets could amplify it.

- Media Influence: Narratives from influencers on X could sway sentiment.

Historical Precedents

- Mt. Gox and Silk Road: Large BTC movements in 2014 and 2013 caused 20-40% drops, dwarfed by Nakamoto’s potential impact.

- Whale Movements: A 2021 transfer of 10,000 BTC triggered a 5% dip, hinting at Nakamoto’s magnified effect.

Potential Positive Outcomes

- Renewed Interest: Media buzz could draw new investors.

- Strengthened Narrative: Responsible actions (e.g., donations) could bolster Bitcoin’s image.

- Tech Upgrades: Nakamoto’s involvement might fund scalability or privacy enhancements.

Mitigating Risks

- Investors: Diversify, set stop-losses, and track blockchain activity via CoinDesk or X.

- Exchanges: Boost liquidity and stress-test systems.

- Community: Counter FUD with Bitcoin’s resilience narrative.

Bitcoin Price Targets (June 2025)

Assuming a baseline of $80,000:

- Small-Scale: $72,000-$76,000 (5-10% drop).

- Large-Scale: $40,000-$64,000 (20-50% crash).

- Distribution: $64,000-$72,000 (10-20% dip).

- Symbolic: $88,000-$104,000 (10-30% surge).

Summary Table of Impacts

The following table summarizes the estimated impacts on Bitcoin’s price, major stock markets, and other cryptocurrencies if Satoshi Nakamoto’s wallet becomes active and moves funds:

| Asset/Index | Estimated % Drop | Price/Value Impact | Key Drivers |

| Bitcoin (BTC) | 20-50% | $110,000 → $88,000 (20%) or $55,000 (50%) | Panic selling, liquidity constraints, trust erosion |

| Ethereum (ETH) | 25-55% | $4,800 → $3,600 (25%) or $2,160 (55%) | Correlation with BTC, altcoin market contagion |

| S&P 500 (USA) | 3-7% | Index points drop of ~150-350* | Risk-off sentiment, crypto-related firm exposure |

| NASDAQ (USA) | 5-10% | Index points drop of ~1,000-2,000* | Tech and crypto ETF exposure, higher volatility |

| FTSE 100 (UK) | 2-5% | Index points drop of ~150-375* | Global risk sentiment, limited crypto exposure |

| Shanghai Stock Exchange (China) | 1-3% | Index points drop of ~40-120* | Indirect global economic ripples, low crypto exposure |

| Nikkei 225 (Japan) | 3-6% | Index points drop of ~1,200-2,400* | Crypto adoption, tech/finance sector sensitivity |

Note: Index point drops are approximate, based on current index levels (e.g., S&P 500 ~5,000, NASDAQ ~20,000, FTSE 100 ~7,500, Shanghai ~4,000, Nikkei ~40,000). Ethereum price assumes ~$4,800, reflecting June 2025 market conditions.

Long-Term Outlook

While the short-term impacts of Satoshi’s wallet activation would likely be disruptive, Bitcoin’s long-term fundamentals—decentralization, fixed supply, and global adoption—suggest resilience. Historical market shocks, such as the 2018 crash, demonstrate Bitcoin’s ability to recover as investor confidence returns. The event could also catalyze improvements, such as enhanced security protocols or broader institutional acceptance, reinforcing Bitcoin’s role in global finance.

For investors, the key is to stay informed and avoid emotional reactions. Long-term holders could view price dips as buying opportunities, while traders might capitalize on volatility. Monitoring credible sources and blockchain analytics platforms like Arkham Intelligence can provide real-time insights into wallet movements and market trends.

Conclusion

The activation of Satoshi Nakamoto’s wallet could spark short-term chaos but reaffirm Bitcoin’s long-term strength. By exploring these scenarios and preparing for volatility, readers can navigate this enigmatic event. Share your thoughts below or follow us for updates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin