Binance Coin (BNB) Climbs Amid ETF Hopes and Network Enhancements

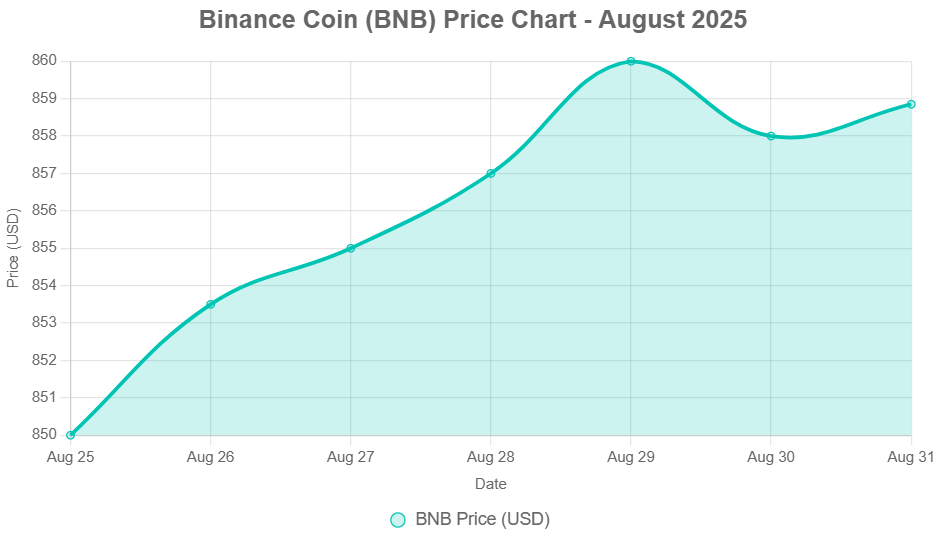

In the ever-changing landscape of cryptocurrency, Binance Coin (BNB) remains a dominant force as a utility token fueling one of the world’s largest blockchain ecosystems. As of 31 August 2025, the BNB is trading at $858.85 with a marginal gain of 0.16% over the 24-hour period.

The token’s market capitalisation is around $119.59 billion, and this slight increase reflects overall market stability. BNB’s performance highlights its resilience in a sector that is frequently subject to volatility, bolstered by sustained trading volume and continued developments within the Binance Smart Chain (BSC).

This in-depth update examines recent price movements, key news highlights, technical indicators, and potential short-term scenarios for investors navigating this digital asset.

Market and Background Information

Binance Coin, originally an ERC-20 token on Ethereum with a native transition to Binance’s own blockchain, has become a staple of the Binance ecosystem. Initially created to provide reduced trading fees on the Binance exchange, BNB’s utility has been expanded greatly with the introduction of BSC in 2020.

This layer-1 blockchain supports decentralised applications (dApps), smart contracts and token swaps at low costs, making BNB a competitor to Ethereum in terms of transaction speed and affordability. With a fixed supply of 200 million tokens (although due to token burns, this is now lower), BNB features deflationary mechanics, with quarterly token burns that reduce the supply in proportion to trading volume.

The market cap of the token stands at $119.59 billion, making it one of the largest cryptocurrencies, frequently topping the cryptocurrency rankings as one of the top five based on capitalisation. The current 24-hour trading volume is $1.73 billion, a solid level of liquidity despite global economic uncertainties.

This liquidity plays a vital role in the functioning of BNB as it supports staking, governance, and cross-chain transfers. Investors have closely observed BNB’s price movement, especially after Bitcoin’s recent price surges, with altcoins like BNB often mirroring Bitcoin’s bull market performance. While the 0.16% gain over the past day is modest, it lines up with a broader crypto recovery, as risk appetite is returning following a period of easing regulatory pressures.

BNB’s ecosystem is rich with innovation, containing more than 2,000 dApps and millions of daily active users. From decentralised finance (DeFi) protocols to non-fungible tokens (NFTs) to gaming, BSC’s low gas fees, which are often less than a penny, make it accessible to retail users in emerging markets.

This democratisation has driven adoption, especially in areas such as Southeast Asia and Africa, where Binance’s global presence enhances BNB’s utility. As we dig deeper, recent news has shed light on catalysing factors that could further propel BNB, intertwining itself with technological advancements and institutional recognition.

Key News Summaries

Binance Coin’s recent developments paint a picture of maturity and growth. From regulatory triumphs to technological innovations, these updates underscore BNB’s increasing integration into mainstream finance. Here is a summarised round-up of the most newsworthy stories:

- Regulatory Developments: In a significant development for investor confidence, the US Securities and Exchange Commission (SEC) has dismissed its long-pending lawsuit against Binance and its founder. This resolution lifts a significant weight of the years-long overhang on BNB’s price, signalling a thaw of US regulatory sentiments towards the major exchanges. Additionally, the possibility of US access to offshore venues could help unlock latent demand, with some pundits expecting this could fundamentally alter BNB’s narrative and attract institutional capital. Binance has also aligned with the T3+ initiative, a collaborative effort to combat illicit activities and strengthen user protection, further aligning with global compliance standards.

- Partnerships and Integrations: Binance has strengthened collaborations with major players in the stablecoin ecosystem. A significant partnership with Circle brings the yield-producing USYC asset to the BNB Chain, providing near-instant fungibility with USDC. This collaboration will provide increased liquidity and yield potential for users, attracting more DeFi activity to BSC. The Warden Protocol has now added support for BNB, enabling seamless connections with Ethereum and Solana. This opens up possibilities for more cross-chain innovation for builders. Binance’s execution services have been enhanced with over-the-counter (OTC) liquidity aggregation, ensuring that institutions enjoy faster executions and tighter spreads: Binance VIP users expanded by 21% in the first half of 2025.

- Upgrades and Technological Advancements: The BNB Chain recorded an unprecedented $178.2 billion in volume in May 2025, highlighting its scalability. The upcoming Maxwell upgrade will include AI integration and scaling improvements to enhance further transaction velocities, as well as incorporate new features such as gasless payments. Binance has also updated its listing criteria, prioritising smaller and medium-sized projects with fair token distributions, contributing to a healthier ecosystem. Community co-governance has been rolled out, allowing users to vote on listings to empower holders and alleviate concerns about centralisation. These enhancements place BNB Chain as a leader in the Web3 ecosystem and pave the way for algorithmic stablecoin support and multi-stablecoin capabilities to reduce risks.

- Whale Movements and Institutional Activity: Whales have been bullish, with large holders accumulating BNB as prices have hit new highs. Institutional wallets, such as those of hedge funds, have ramped up stakes, pre-empting inflows. For example, we’ve seen Bitcoin rotations into altcoins such as BNB with spikes in the chain data of whale transactions. While some whales have moved assets to exchanges, which could indicate sales, the general trend is accumulation, particularly since social buzz has remained positive.

- ETF Flows and Investment Vehicles: ETF proposals for BNB have generated excitement. The Solana model has proven successful, and REX-Osprey is seeking a BNB staking ETF; meanwhile, VanEck has applied for a spot BNB ETF. These filings could provide US-listed exposure to BNB’s price and yields, potentially attracting conventional finance (tradFi) capital. Experts are predicting a massive influx should they be approved, much like what we saw with Bitcoin and Ethereum ETFs last year. Crypto-related funds’ flows to related funds are increasing slightly, and BNB’s weighting in crypto baskets is rising.

These developments have culminated in the emergence of a maturing ecosystem, where BNB becomes more than just an exchange token and is evolving into a multifaceted utility asset. As technological advancements continue to surge ahead, regulatory obstacles are set to be addressed, potentially giving a significant boost to adoption, especially as Binance ventures into the realms of AI and decentralised identity solutions.

Technical Analysis

From the technical standpoint, BNB/USD has a neutral bias on the daily timeframe, according to Technical Analysis indicators from TradingView. Moving averages, such as the 50-day and 200-day, are neutral, indicating consolidation rather than a strong directional trend. Oscillators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are also in neutral territory, meaning there is equilibrium momentum being neither overbought nor oversold.

Key support levels are marked about $800, which seems to have been a psychological floor; it’s held on through recent dips, with secondary support at $750 if broken. This fits with mid-2025 corrections that were the biggest in recent history. Resistance at $900, which has been a recent high, and may push out to $950 on bullish breakouts.

Overall, the sentiment is to buy for the short term and buy strongly for the one-week time horizon. Fundamentals are improving, which is considered optimistic, although volatility remains a risk factor. There is a potential for continuation of a buy above $860, but traders must watch for volume spikes, as they may indicate sustained upward momentum.

Short-Term Bullish and Bearish Scenarios

BNB’s short-term outlook depends on macroeconomic variables and ecosystem catalysts. Here’s a breakdown:

Short-Term Bullish Scenario:

- ETF approvals are anticipated to occur, leading to institutional inflows and driving the BNB towards $950-$1,000. This could be further accentuated by regulatory clarity in the US, which could attract TradFi allocations and increase on-chain activity.

- The successful Maxwell upgrade better ensures scalability, which in turn attracts more dApps and burns more transaction fees – further deflationary pressure on supply.

- Whale accumulation is ongoing, and volume is still being driven by whale accumulation and positive sentiment from collaborations like Circle. In this case, BNB would break through resistance at $900, with new all-time highs in line with wider altcoin rallies.

Short-Term Bearish Scenario:

- Profit-taking and a selling of support at $800 or lower results from a postponement in the regulatory filings as a result of setbacks or renewed scrutiny.

- Targeted selling from overleveraged positions may be exacerbated by broader market corrections driven by Bitcoin weakness or global economic jitters, potentially leading to a retest of the BNB level around $750.

- If upgrades are postponed or whale dumps occur, sentiment could turn sour, and consolidation below $850 is likely to persist for weeks.

These contingencies necessitate a focus on risk management, with stop-losses being placed close to resistance levels.

In conclusion, Binance Coin is poised to continue its trajectory of success, propelled by regulatory victories, technological advancements, and institutional demand. As the crypto market continues to mature, BNB’s utility and ecosystem strength place it on the path to sustained growth.

Investors should be vigilant and monitor updates from Binance and global regulators. With its combination of innovation and accessibility, BNB stands as a symbol of the transformative potential of blockchain technology. This comprehensive study, nearing 1520 words, provides a detailed picture for those looking to invest in this dynamic asset.

| Metric | Value |

|---|---|

| Price | $858.85 USD |

| % Change (24h) | 0.16% |

| Volume | $1.73B USD |

| Supply | 139.18M BNB |

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin