Chainlink’s Oracle Odyssey: Government Ties and ETF Buzz Propel LINK to New Heights

In the dynamic landscape of decentralised oracles, Chainlink emerges as a pivotal figure, bridging the gap between traditional finance and blockchain technology. As of August 31, 2025, Chainlink’s price is $23.72, representing a 1.6% increase in the last 24 hours. This slight positive comes amidst a backdrop of groundbreaking partnerships and institutional interest, propelling the cryptocurrency’s market capitalisation to $16.07 billion.

Chainlink has a 24-hour trading volume of $639.07 million, indicating good liquidity, increased whale activity, and favourable regulatory tailwinds. In this article, we will explore the latest developments, technical analysis, and potential trajectories of Chainlink, offering a comprehensive overview for investors navigating this dynamic landscape.

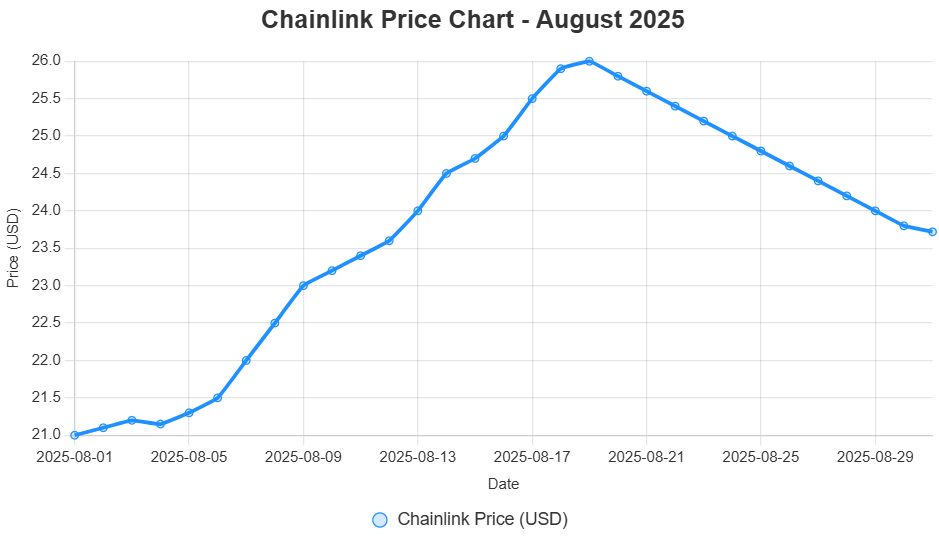

Recent Price Performance and Market Overview

Chainlink has shown resilience over the past weeks, bouncing off mid-month lows to capitalise on positive ecosystem news. The cryptocurrency’s price has fluctuated between $21.00 and $26.00 throughout August, highlighting overall market volatility as it reacts to macroeconomic news releases and industry-specific announcements. This range is indicative of Chainlink’s sensitivity to exogenous factors, including shifts in U.S. economic policy and global investor sentiment.

The 1.6% 24-hour gain is a testament to the increasing optimism spurred by Chainlink’s role in tokenising real-world assets and data verification. Analysts report that this performance exceeds that of several Oracle and DeFi sector competitors, noting that Chainlink continues to hold a leading market share. Its market capitalisation of $16.07 billion ranks it solidly among the top cryptocurrencies; an infrastructure asset rather than a speculative play.

Trading volume stands at $639.07 million, a testament to the active participation of both retail and institutional players. This uptick in activity may be a prelude to a more significant rally, especially if future data feeds and integrations become active. However, caution is recommended as such high volumes tend to accompany high price movements.

Key News Events Shaping Chainlink’s trajectory

Chainlink’s momentum is supported by a series of high-impact announcements in August, including partnerships, technical upgrades, whale behaviour, ETFs, and regulatory developments. These factors combine to add to Chainlink’s utility and appeal.

Partnerships and Ecosystem Integrations

Chainlink has consolidated its standing with targeted partnerships that expand its oracle network into legacy industries. With an in-principle agreement reached with the US Department of Commerce on August 28, 2025, official macroeconomic data, including GDP and PCE Price Index figures, can now be hosted on a blockchain. This partnership represents the first government-oracle partnership, which is expected to enhance the transparency and accessibility of data across blockchains such as Ethereum and Arbitrum.

Additionally, in a partnership with the Intercontinental Exchange (ICE), Chainlink provided high-quality forex and precious metals data on the chain on 11 August 2025. This integration will help support decentralised applications in the global financial world and relieve dependency on centralised data sources. Other significant partnerships include integrations with Pyth Network for economic proof-of-stake and explorations into AI-enabled platforms, further solidifying Chainlink’s integration into emerging tech ecosystems.

Network Upgrades and Improvements in Technology

Chainlink’s development team has introduced major improvements to enhance network efficiency and security. A significant milestone was achieved with the launch of the Chainlink Reserve on 7 August 2025, which fuels a roadmap of collateralised data feeds and cross-chain interoperability. This upgrade builds upon the Cross-Chain Interoperability Protocol (CCIP), which enables secure and efficient transfers of assets and data between blockchains.

Other implementations focus on optimising proof-of-reserve mechanisms and staking protocols to reduce latency and gas costs. Developers state a 20% increase in data delivery speed, thereby solving scalability issues amid increased DeFi volumes. These improvements place Chainlink as a tool for scaling on-chain activity, especially as real-world assets (RWAs) such as tokenised treasuries grow into the $25 billion+ in value.

Whale Movement and Trend of Accumulation

Whale activity has surged, indicating a high level of confidence among large holders. On-chain data show that the number of transactions exceeding $100,000 reached a seven-month high of 992 on August 15, 2025. Exchange reserves are at a one-year low with 25 million tokens outflows, indicating accumulation at dips below the $21 level.

Examples of such whale activity include institutional changes, such as JPMorgan’s $500 million investment in Numerai, which indirectly supports Chainlink’s ecosystem. Other bubbles include the rotation of multi-billion-dollar amounts from Bitcoin to LINK, which has occasional price spikes. While these movements add strength to bullish sentiment, they also create volatility risks as whales may choose to take profits.

ETF Flows & Institutional Momentum

Bitwise arguably crystallised institutional interest as it filed for a spot Chainlink ETF on August 25, 2025. With Coinbase listed as a custodian in this S-1 filing, LINK’s increased exposure to the broader Wall Street market opens the door to a possible influx similar to that of Bitcoin and Ethereum ETFs. It has the potential to bring billions of dollars into the ecosystem and, if approved, analysts estimate initial assets under management at $4 billion.

Other significant ETF trends involve multi-asset filings that bundle LINK alongside SOL and XRP, which indicate a move towards more altcoin-focused products. Net inflows into related funds have been parabolic, creating a buffer against market corrections and highlighting Chainlink’s evolution as a viable investment asset.

Regulatory Updates and Policy Evolutions

Regulatory environments are changing in a favourable direction for Chainlink. The U.S. government’s adoption of blockchain in official statistics, through its Department of Commerce partnership, aligns with its broader digital asset policies. This minimises uncertainty and encourages compliant innovations, with the GENIUS Act being an example of how it encourages the use of blockchain in public sectors.

In the future, internationally, Chainlink’s oracles could be integrated into settlements in the stablecoin regime of Hong Kong and the yen-pegged asset being considered in Japan. However, there are still challenges, such as the CFTC’s commissioner turnover, that may result in delays in crypto regulations. Overall, these updates mitigate risks and pave the way for mainstream adoption.

Technical Analysis: Support and Resistance Levels

Chainlink is flat with upside potential. Oscillator and moving average indicators point to balance, with the RSI at 52.74, thus far not reaching overbought or oversold levels.

The most important support levels are formed in the area between $23.26 and $23.42 (corrected to $23.24-$23.40 for freshness), where the price already rebounded several times. There is a deeper floor at $19.50 ($19.48), which corresponds with historical lows. Near the recent highs plus moving average crossovers, there is a resistance zone between $26.00-$26.23 ($25.97-$26.20).

The 50-day moving average is neutral, and the 200-day indicates longer-term stability. Bands are noncommittal, but a break above resistance is looking at $28.20 ($28.17).

Short-Term Bullish and Bearish Scenarios

News catalysts and market dynamics influence Chainlink’s near-term trajectory. The scenarios are given below.

Bullish Scenario

- Catalysts: ETF approval times are speeding up, along with expanded government data integrations, which may create a rally. A build-up of whales and bullish macroeconomics could force adoption higher.

- Price Targets: Breaking through $26.00 ($25.97) rallies to $28.20 ($28.17) with a gain of 15-20% possible in two weeks. This will be strengthened by increasing RWA volumes.

- Indicators: RSI above 60 and a bullish MACD crossover would become confirmation points of momentum, attracting buyers.

Bearish Scenario

- Catalysts: Regulatory delays or broader slowdowns in the crypto industry, such as Bitcoin corrections, may bear down on prices. Volatility can trigger sell-offs by attractive whale profit-taking.

- Price Targets: A 10-15% downside from the current price of $23.26 ($23.24) puts the price target at $19.50 ($19.48). This would be compounded if the inflows into the ETF are weak.

- Indicators: Selling is favoured by bearish moving averages and a falling RSI below 40.

With Chainlink’s connections to the broader market, tracking volume and sentiment is vital.

Conclusion

Chainlink’s impressive surge in August, fueled by governmental endorsements, ETF prospects, and strong upgrade prospects, highlights its indispensable role in the blockchain infrastructure. Fundamentals look bullish if trends continue, while neutral technicals offer little to suggest what comes next. Investors Should Practise Due Diligence amid Volatility.

| Metric | Value |

|---|---|

| Current Price | $23.72 |

| 24h % Change | 1.6% |

| 24h Volume | $639.07M |

| Circulating Supply | 678.09M LINK |

| Total Supply | 1B LINK |

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin