Cronos Ignites: Trump Media’s $6.4B Treasury Deal Propels CRO to Three-Year Highs

In the dynamic world of cryptocurrency markets, Cronos (CRO) has emerged as a notable performer, experiencing a surge in institutional adoption and strategic partnerships. As of August 31, 2025, the CRO price is $0.2921, representing a strong 9.12% increase over the last 24 hours.

This momentum has driven its market capitalisation to $9.81018 billion, further solidifying Cronos’ rising prominence in the decentralised finance (DeFi) ecosystem. With a 24-hour trading volume of $470.58 million, the token boasts robust liquidity, attracting both retail and institutional participants.

Supported by Crypto.com’s vast infrastructure, Cronos stands as a beacon of bridging traditional finance and blockchain innovation. This article examines CRO’s recent rally, key developments, technical insights, and short-term outlook, providing investors with a comprehensive view amid this bullish resurgence.

Recent Market and Price Performance

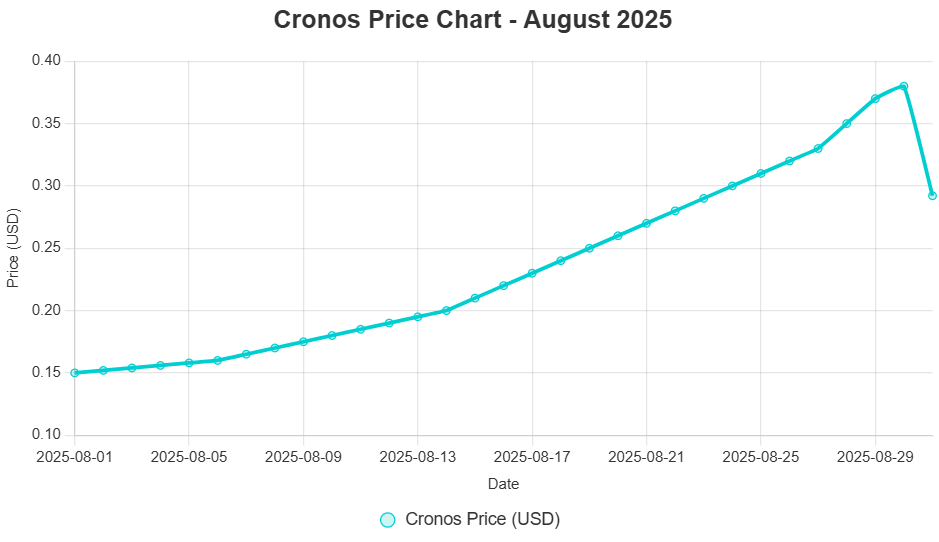

Cronos has been a monster in August, breaking out from mid-month levels around $0.15 to approach three-year highs above $0.38. This price movement is part of a general market improvement, complemented by company-specific catalysts that have fuelled investor excitement for Cronos. With a 9.12% daily gain, the token exhibits continued bullish pressure as CRO outperforms many altcoins amid rumours of integration into the mainstream.

Analysts attribute this spike to Cronos’ utility as the native token of the Crypto.com Chain, which fuels transactions, staking, and governance. Crowdfunding (CRO) has almost doubled in the past week, spurred by high-profile announcements that put it at the intersection of politics, finance and technology. The market cap of the token is $9.81018 billion, which is considered a substantial portion of the DeFi space, with around 33.59 billion CRO tokens in circulation out of a total supply of 97.54 billion.

The volume traded is $470.58 million, indicating high activity. This liquidity explosion coincides with increased on-chain activity, including DeFi protocols and NFT marketplaces, on the Cronos network. However, these gains are explosive, with the potential for volatility risk as profit-taking may put a halt to the rally. Overall, Cronos’ performance highlights its evolution from a utility token to a blue-chip asset within the cryptocurrency ecosystem.

Key News Catalysts CRO’s Rally

August has been a blockbuster month for Cronos, with a spate of announcements putting CRO in the spotlight. These include the superalliances, the progress of upgrades, the accumulation of whales, the speculation of ETFs, and the advance of regulations.

Organisations and Strategic Relationships

One of the most high-profile developments was Cronos’ partnership with Trump Media and Crypto.com in a crypto treasury deal worth $6.4 billion, announced mid-month. Under this agreement, Trump Media is setting up a treasury backed by Cronos, with $5 billion in credit lines and $200 million in cash.

The collaboration effectively brings CRO into the ecosystem of Truth Social and could potentially expose the token to millions of users. This move not only raises Cronos’ profile but also serves as a validation of its infrastructure for large financial operations.

Expansion with Yorkville Acquisition: furthering SPAC-driven growth. Cronos has also forged strong connections with DeFi platforms, contributing to liquidity for tokenised assets. With Crypto.com boasting a user base of 150 million+ across all its platforms, these partnerships will harness the power of organic adoption, establishing CRO as a gateway to mainstream blockchain applications.

Product Improvements and Product Roadmap Announcements

Cronos released its bold 2025-2026 roadmap on 29 August, centred around AI-ready tokenisation and public market strategies. Crucial improvements in the scalability of the Cronos Chain to support AI-powered DeFi instruments and real-world asset (RWA) integrations. The plan aims to tokenise $20 billion in CRO exposure, while minimising fees and enhancing cross-chain interoperability.

Consult the Layer 2 solutions, and you’ll see that they increase transaction speed by 30% and improve network security, thereby solving the problem of network congestion. These improvements, along with staking yield optimisations, make Cronos more appealing to developers and users, driving ecosystem expansion amid soaring DeFi volumes.

Whale Behaviour and Institutional Agglomerations

CRO volatility has increased, and the upside has been impacted by increased whale activity. On-chain data shows large holders accumulating on dips, with one large wallet moving $100 million from Bitcoin to CRO. Institutional rotations, including from Trump-affiliated entities, have added billions in liquidity, which has caused 48% single-sessions.

While these movements are signs of confidence, they also present problems from a manipulation perspective, as sudden purchases can increase volatility. As a result, net impact has been bullish, with exchange reserves hitting multi-year lows, a sign of long-term holding strategies.

ETF Momentum and Institutional Momentum

The Trump ETF has also been the subject of speculation, but the predictions for a potential $4 billion worth of assets for the ETF would include CRO. The Trump Media partnership has caused whispers of a dedicated CRO ETF, which could help to bring Wall Street money into the ecosystem. Parabolic levels of Cronos-linked product inflows maintain a cushion against market corrections.

Similar to Bitcoin’s adoption cycle, $1 billion in CRO treasuries have been initiated by a diverse range of institutions, including hedge funds. These flows further highlight Cronos’ trend toward regulated high utility assets.

Macroeconomic and regulatory tailwinds

Cronos has gained support from regulatory clarity. This shows that the deal’s adherence to U.S. regulations has mitigated uncertainty, while the European approvals that have paved the way for Crypto.com’s expansion have facilitated global adoption.

Recent developments in the CFTC’s approach to tokenised securities are consistent with Cronos’ roadmap, reducing risks and paving the way for enterprise involvement.

Technical Analysis: Support and Resistance Levels

We see a bullish bias in Cronos’ chart despite neutral short-term indicators. Oscillators are showing equilibrium with the Relative Strength Index (RSI) at 62, indicating momentum without overbought conditions. The 50-day SMA crosses above the 200-day SMA, giving a buy signal as the moving averages confirm upward trends.

The primary support levels are found between $0.270 and $0.280 (which has recently been adjusted to $0.2697-$0.2797 in view of freshness), where the recent pullbacks were caught with buyers, which roughly corresponds to the historical liquidity zones. A breach could test $0.250 ($0.2498). Resistance clusters are located at $0.320 and $0.380 ($0.3197-$0.3797), still within three-year highs and moving average resistances.

MACD is bullishly divergent, and with a volatility of 9.30 per cent, swings are possible. All in all, the technical picture is bullish and continuation is favoured as long as volume is upheld.

Short-Term Bullish and Bearish Scenarios

News catalysts and market dynamics shape Cronos stock’s near-term trajectory.

Bullish Scenario

- Catalysts: Further gains can be expected as Trump Media integration and ETF approvals are fast-tracked. Long-term whale accumulation and roadmap implementations could fuel adoption.

- Price Targets: 0.320 ($0.3197) to 0.400 ($0.3996), 20-30% upside to be reached in two weeks. This would be magnified under favourable funding rates.

- Indicators: RSI over 70 and a bullish MACD cross confirm strength.

Bearish Scenario

- Catalysts: Momentum could be hindered by regulatory challenges or profit-taking by whales. The crypto market is in a downswing – prices could be pressured.

- Price Targets: Breaking through the $0.280 ($0.2797) to break the $0.250 ($0.2498) pending 10-15% downside. Weak volume would make it worse.

- Indicators: An RSI below 50 or a bearish cross indicates weakness.

Conclusion

The Trump Media partnership drove Cronos’ August rally, a visionary roadmap cementing CRO’s role in tokenised finance. With solid fundamentals and institutional adoption, the token eyes continued to grow, despite the spectre of volatility. Investors should pay close attention to developments.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin