DJT Stock Price Prediction 2025: Outlook

In the ever-changing world of stock markets, few tickers have been as buzz-worthy as DJT, the stock symbol for Trump Media & Technology Group Corp. As of August 31, 2025, Truth Social, a company that has gained prominence in recent years for its innovative cryptocurrency efforts, finds itself at a critical juncture, shaped by its recent strategic endeavours, the residual impact of earlier market volatility, and the wider political climate.

The eyes of investors are eagerly fixed on the potential for growth or further downward movement, with forecasts for the year ahead varying from cautious optimism to stark warnings of downside risks. In this research report, we take an in-depth look at where DJT stock currently stands and what will fuel its performance through 2025 and further, as the company finds itself in a competitive social media landscape, connected to former President Donald Trump’s brand.

What’s been happening: The Crypto Treasury Initiative

Just a few days back, on August 26, 2025, the Trump Media & Technology Group made a ground-breaking announcement that rippled through the financial community. The company announced it would be raising $6.4 billion to build a digital asset treasury, and is partnering with Crypto.com in a deal that would involve investments in the platform’s native token, as well as reciprocal stock purchases.

This strategic shift will help diversify the company’s revenue stream beyond the limitations of social media advertising, establishing Truth Social as a platform for crypto-integrated capabilities such as tokenized content and decentralized user rewards. CEOs explained the initiative as a bold move towards financial independence, utilising blockchain technology to elevate user engagement and monetization.

In the short term, the announcement gave a lift to DJT shares, reflecting investor optimism about the synergies that could arise from linking Trump’s influential online profile with the emerging crypto market. However, the move also brings up questions of execution, considering the company’s track record of operational difficulties and the inherent volatility of digital assets. As markets digest this news, it highlights Trump Media’s pursuit of reinvention in the face of slowing user growth and increasing competition from incumbent players such as X and Meta.

Current Market Performance

As trading winds down on this last day of August 2025, DJT stock floats at around $17.53 per share, a slight rebound from intraday lows, but continues to echo a tumultuous year at hand. The stock is down almost 49 percent year-to-date, and it’s lagged far behind the S&P 500. This one comes after a rocky period earlier this year, notably the short but sharp market crash in April, when global indexes dropped over statements from the Trump administration of sweeping tariff policies.

During that episode, DJT stocks have been caught in the crossfire, suffering sharp declines in the backdrop of broader economic uncertainty. The 50-day moving average for the stock is above $45, and the 200-day moving average is rising at $38, which does show some underlying strength, but volume trends have been weakening and are a sign of slowing momentum.

Relative Strength Index readings oscillate between 45 and 65, indicating a neutral position that may swing either direction on the basis of forthcoming catalysts. With a market cap that remains highly overvalued in relation to fundamentals-minuscule revenues and earnings, which continue to be the current price level seems to be validated less by robust financial metrics and more by speculative interest in the Trump brand.

Top Drivers of the 2025 Outlook

A number of interrelated factors will probably define DJT’s path through to 2025, beginning with user acquisition and retention. With plans to increase its monthly active users from its current levels to between 12 and 15 million by the end of the year, Truth Social will need to make aggressive marketing and feature improvements in order to get there at a 42 percent compound annual growth rate. Average revenue per user, currently at about $1.80 to $3.20, must increase to the $7.50 to $9.00 range via improved advertising tools and high-end subscriptions.

The recent integration of crypto might speed this up, given that it does appeal to tech-savvy audiences; however, that would mean it might capture around a 3 to 5 percent share of the social media market that is estimated to be between $250 and $300 billion. Politics is a significant reason why, because the app’s popularity heavily relies on conservative viewers and Trump’s legacy. With the administration dealing with small congressional majorities, policy measures such as tariffs may energise nationalist sentiment – and in turn, thus encourage the use of the platform – or they may create economic headwinds that cause investor confidence to wane.

Market sentiment, as indicated by social media mentions, which increased 42 percent year-over-year to 187,000 weekly, has an overall 1.8:1 ratio of neutral-positive to neutral-negative, but this can change quickly with news trends. Regulatory pressures (increased compliance costs estimated to be between 12 to 18 percent per annum and possible restrictions on advertising) add layers of complications, while infrastructure investments for data localisation are likely to stretch cash flows.

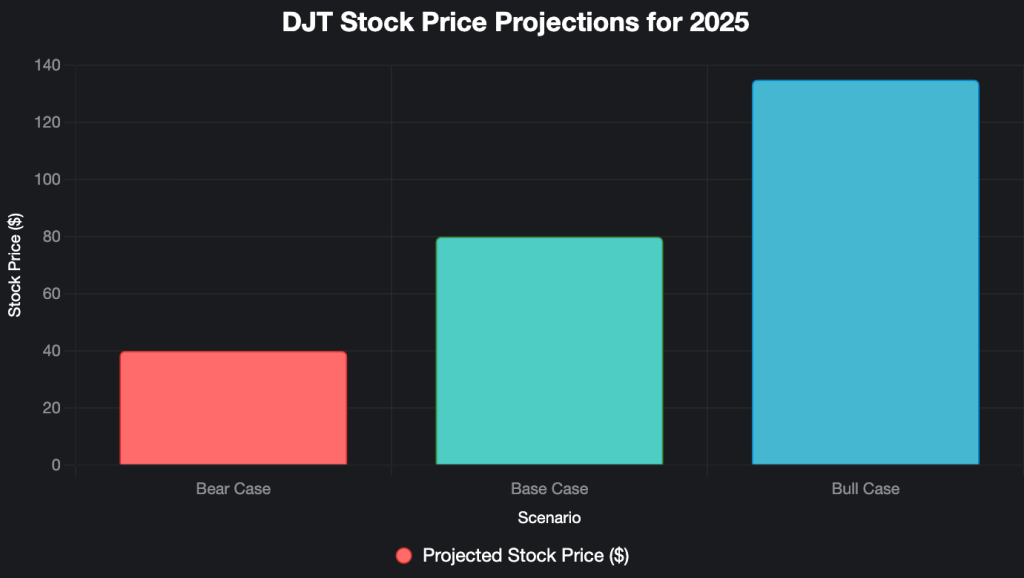

Analyst Scenarios and Forecasts

Predictions for DJT in 2025 are wildly divergent, indicative of the stock’s high-risk nature. Bull case: Optimistic analysts envision a world in which the company reaches 12 million users, average revenue hits $8-plus per user level, margins break into the 25 percent range, and shares then trade in the $120 to $150 range. This scenario assumes successful crypto adoption and user growth and could place the firm’s value at 10 to 15 times revenue multiple under growth-oriented multiples.

Even at a base case of 8 to 10 million users and margins of 15 to 20 percent, prices could settle between $70 and $90, backed by balanced valuation models such as discounted cash flow, which point to $82 to $105. Shares are pegged out at $40-$60 for conservative views, taking into account slower-than-expected growth and margins of 10%-15%, while the bearish note warns that below $40 should be expected if users stall and revenues falter.

Broader forecasts range from lows of $6.38 to highs of $333.78, with averages of about $231.84 in some models, although many point out the 5.1 times dispersion in targets as an indication of uncertainty–much greater than for peers. Technical clues like accumulation of volume at $32 to $38 imply positive trending if sentiment is maintained; however, correlations with social chatter imply that results could swing 48 hours after major announcements.

Risks and Challenges Ahead

Although there are some potential benefits, DJT faces formidable challenges that may threaten its 2025 performance. Political risks are first, the stock is linked to the Trump agenda; scandals or policy setbacks will weaken the brand’s appeal, it is already starting to happen with repeated failures to break through $35 resistance levels.

And the company’s financial health is in jeopardy, with the company taking the gamble of funding its operations through share issuance (17 million shares were issued in the course of the third quarter at a value of $339 million), a tactic that could soon become a downward spiral if prices start to fall. Competition against larger players with better resources that take market share and regulation around data practices and content moderation could impose substantial costs and lower average revenues per user by 8 to 12 percent.

The April market crash is a reminder of external vulnerabilities, where a tariff-induced volatility shaved trillions from global markets, and where the allegations of insider trading in relation to Trump’s social posts added reputational strain. Overvaluation is a fundamental flaw, and the fundamentals are now pricing in at the low single digits below the current level, which is being supported by hype. If the crypto bet turns out to be a loser in the face of digital asset volatility, this will worsen the cash outflows, and the firm might have to survive on a hand-to-mouth basis.

Conclusion

Looking forward to 2025, DJT stock represents the high-stakes gamble of a company that’s trying to combine politics, media, and now cryptocurrency into a quest for relevance. With the recent unveiling of the $6.4 billion crypto treasury initiative, the path to diversification and growth becomes tantalising, potentially reshaping Truth Social into a multifaceted platform. Y

et between the stock’s rock-bottom rating of $17.53 and wildly divergent expectations, investors are forced to balance potential upside scenarios with deep-seated risks. This will need a successful realization of user growth, monetization, and the ability to operate in a politically sensitive sector.

For potential entrants, a probability-weighted strategy, a moderate allocation, and an operational metrics watch may be wise. As the year progresses, DJT’s outlook is poised to continue serving as a barometer for larger themes of innovation, volatility, and the lasting influence of personal branding in finance. Weathering ups and downs, the story of Trump Media continues to unfold, promising twists that could reshape its position in the market landscape.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin