Hyperliquid’s HYPE Token Thrives Amid Whale Controversies and Institutional Milestones

In the ever-evolving landscape of decentralised finance, Hyperliquid’s native token HYPERLIQUID (HYP) has become a significant player that combines innovation with controversy. As of 31 August 2025, HYPE is trading at $44.87, up 1.81% in the last 24 hours. This gain emphasises a sturdy overall market sentiment, fortified by institutional advancements and platform expansion, despite recent whale-driven disruptions.

With a 24-hour trading volume of $143.65 million, HYPE has a notable presence in the market with a market cap of $14.985 billion. In this article, we will explore the token’s recent developments, key news updates, technical indicators, and potential short-term trajectories, providing a comprehensive view for stakeholders in this dynamic sector.

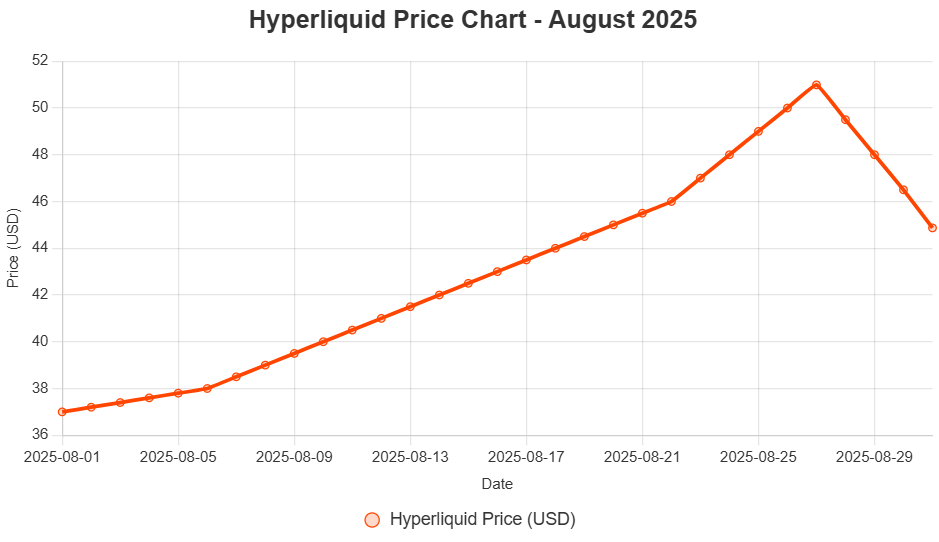

Recent Market and Price Performance

Hype (HYP) has carved out a choppy but bullish trajectory in August, rising from lows at the beginning of the month, near $37, up to near its all-time highs, above $50. This volatility reflects the overall movement of the crypto market, which is shaped by macroeconomic and sector-specific developments. The token’s daily rise of 1.81% underscores renewed buyer interest, especially after announcements that boost its utility in decentralised derivatives.

Analysts cite Hyperliquid’s market dominance in on-chain perpetual futures, where it handles billions in daily volume, as the key driver of HYPE’s strength. The platform’s model of HYPE buybacks from trading fees generates a deflationary pressure, which contributes to price appreciation. In the last month, HYPE has surged ahead of many DeFi tokens, taking market share in the wake of a crypto rebound.

Trading volumes averaged $143.65 million, reflecting sound liquidity and institutional and retail activity. However, this activity also increases risks, as is the case with recent manipulation incidents. Overall, with a market cap of $14.985 billion, HYPE stands as a mid-tier asset brimming with growth potential, particularly as decentralised exchanges continue to rival centralised behemoths.

Key News Developments Shaping HYPE’s Landscape

August has been a busy month for Hyperliquid, with notable developments in institutional access, platform security, and whale activity. These tales have fueled HYPE’s price fluctuations, weaving optimism with caution.

Collaborations and Ecosystem Growth

Hyperliquid has strengthened its ecosystem by forming strategic partnerships that integrate its technology into traditional finance. A remarkable collaboration with 21Shares, announced on August 29, 2025, introduces an exchange-traded product (ETP) for HYPE on the SIX Swiss Exchange. This collaboration democratises exposure for institutional investors without any direct exposure to the blockchain, and it is a significant step towards bridging DeFi and regulated markets.

Additionally, Hyperliquid’s connections with other blockchains and data providers have broadened its reach. Cross-chain perpetual trading will be improved by collaborations with oracle networks and layer-2 solutions, which will minimise latency and costs. These actions further enhance platform adoption and the demand for HYPE, which is used for staking and governance.

Upgrades and Tech Upgrades

In response to operational difficulties, Hyperliquid deployed new safeguards on 27 August 2025 for pre-market perpetual futures. These improvements encompass liquidity cheques and manipulation detection algorithms, which are designed to prevent extreme price fluctuations in the early-stage token markets. It also optimised the on-chain order book for higher throughput, and the platform, although it suffered a temporary 37-minute outage earlier this month, has not experienced any further major outages.

Further development is in the form of native settlement enhancements, which allow easy cross-asset trades including Bitcoin, Ethereum, and Solana. With over 600,000 registered users and July volumes of $319 billion, these updates help to tackle scalability issues and position Hyperliquid to take more market share from centralised exchanges.

Whale Movements and Large-Scale Transactions

Whale activity has made the news with several incidents underscoring the opportunities and risks. On August 27, 2025, a group of whales manipulated the XPL futures on Hyperliquid, pushing them up by 200% to $1.80, only to execute a pullback. The main orchestrator netted more than US$15 million, while others who were part of the deal made US$9-13 million each, with US$6.5 million in losses incurred by fellow traders.

A significant move in the trend was the Bitcoin whale moving $1.1 billion from BTC to Ethereum using Hyperliquid in a continued accumulation activity. The rotation, which involved deposits of $44 million and $29 million in USDC to maintain liquidity, demonstrates confidence in Hyperliquid’s infrastructure. However, such behaviours have led to allegations of manipulation, with critics citing the platform’s relative lack of protections compared to its competitors.

Whale accumulations play an essential role in HYPE’s rally, but they come with volatility since massive sells can have a negative effect on price.

ETF Flows and Retail Investor Flows

The 21Shares ETP listing has given institutional momentum a reality check, acting as a regulated exposure platform for HYPE. This product, which is supported by Coinbase custody, is geared towards European investors and has the potential to mobilise billions of assets, similar to Bitcoin and Ether ETFs. The news came on the heels of Hype’s all-time high of $50.99, showing increased demand.

Hyperliquid has also gained advantages from wider DeFi-focused fund flows, generating nearly $100 million in revenue over a 30-day period. With the growth of decentralised derivatives, ETPs and ETFs, HYPE can benefit from greater liquidity and legitimacy.

Regulatory Changes and Policy Changes

Heightened regulatory scrutiny: The XPL manipulation has led to calls for stricter regulation of decentralised platforms. Hyperliquid’s team has defended its model, citing the dangers of pre-launch markets, but market observers expect possible U.S. Commodity Futures Trading Commission (CFTC) rules around on-chain derivatives.

On a positive note, the European regulators’ approval of the ETP 21Shares indicates increasing acceptance. Hyperliquid’s technology may be favoured in discussions around stablecoin integrations in Asia. These changes minimise the chance of existential risks, making the environment more stable for growth.

Technical Analysis: Support and Resistance Levels

Hype’s charts are neutral, but there is potential for a bullish continuation in the breakout if key levels are respected. Oscillators and moving averages indicate equilibrium with the RSI near 55, which is neither overbought nor oversold.

Buyers stepped in at latest support at $44.27 to $45.85 ($44.23-$45.80 freshness) where recent pullbacks were taken. A breakout could challenge deeper support at $40.80 ($40.76). Resistance cluster between $49.88 and $51.05 ($49.83-$51.00), which matches the recent all-time high and moving average resistances.

Pivot points are ambiguous, but a breakout to the upside of resistance points to strength, while failure may trigger consolidation.

Short-term bullish and bearish scenarios

HYPE’s near-term movement is dependent on news flow and market sentiment. Here are balanced scenarios:

Bullish Scenario

- Catalysts: With new safeguards successfully implemented and ETP inflows exceeding expectations, a rally is possible. The whale accumulation and positive regulatory nods can help in hashing speed.

- Price Targets: Exceeding $49.88 ($49.83) to $55.00 ($54.95) with a 15-20% upside in the next fortnight. The increase in platform volumes would strengthen this.

- Indicators: RSI above 60 and bullish moving average crossovers would be used to confirm momentum.

Bearish Scenario

- Catalysts: Increasing manipulation tests or overall crypto downtrend could chip away at confidence. Cascades may be caused by whale profit-taking during volatility.

- Price Targets: Falling below $45.85 ($45.80) tests $40.80 ($40.76), which represents a 10-15% downside. The poorly performing ETP would cause a higher pressure.

- Indicators: RSI below 40 or bearish crosses are signs of weakness.

Volume and External Factors should be Monitored

Conclusion

Hyperliquid’s HYPE token is a testament to the rollercoaster ride of DeFi innovation, where institutional progress counteracts whale controversies. In conclusion, while the platform’s fundamentals indicate a promising future amid times of volatility, it’s essential to stay informed about regulatory developments and platform updates.

| Metric | Value |

|---|---|

| Current Price | $44.87 |

| 24h % Change | 1.81% |

| 24h Volume | $143.65M |

| Circulating Supply | 333.92M HYPE |

| Total Supply | 999.99M HYPE |

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin