How to Avoid Unnecessary Taxes When Gambling Abroad: What EU Law Really Says

It often begins with a question.

Not one shouted out loud, but whispered. A quiet doubt, surfacing the moment your winnings hit the account.

“Am I supposed to pay tax on this?”

For the thousands of players across Europe who step outside national borders to play at offshore casinos, it’s a question that matters — not just legally, but economically. Because while the games might look the same, the rules beneath them are anything but.

And in that grey area between domestic regulation and digital opportunity, tax becomes the sharpest dividing line.

A Shifting Landscape – and a Legal Loophole?

Online gambling isn’t what it was ten years ago. Markets like Sweden, the Netherlands, and Germany have tightened their national regulations. Self-exclusion systems like Spelpaus or ROFUS aim to protect players — but they also lock out legitimate access.

So what do players do?

They cross digital borders. They find licensed casinos outside their home country.

And quite often, they win.

But the real win, for the savvy ones, is understanding which of those casinos allow for tax-free winnings — and which come with a bill attached.

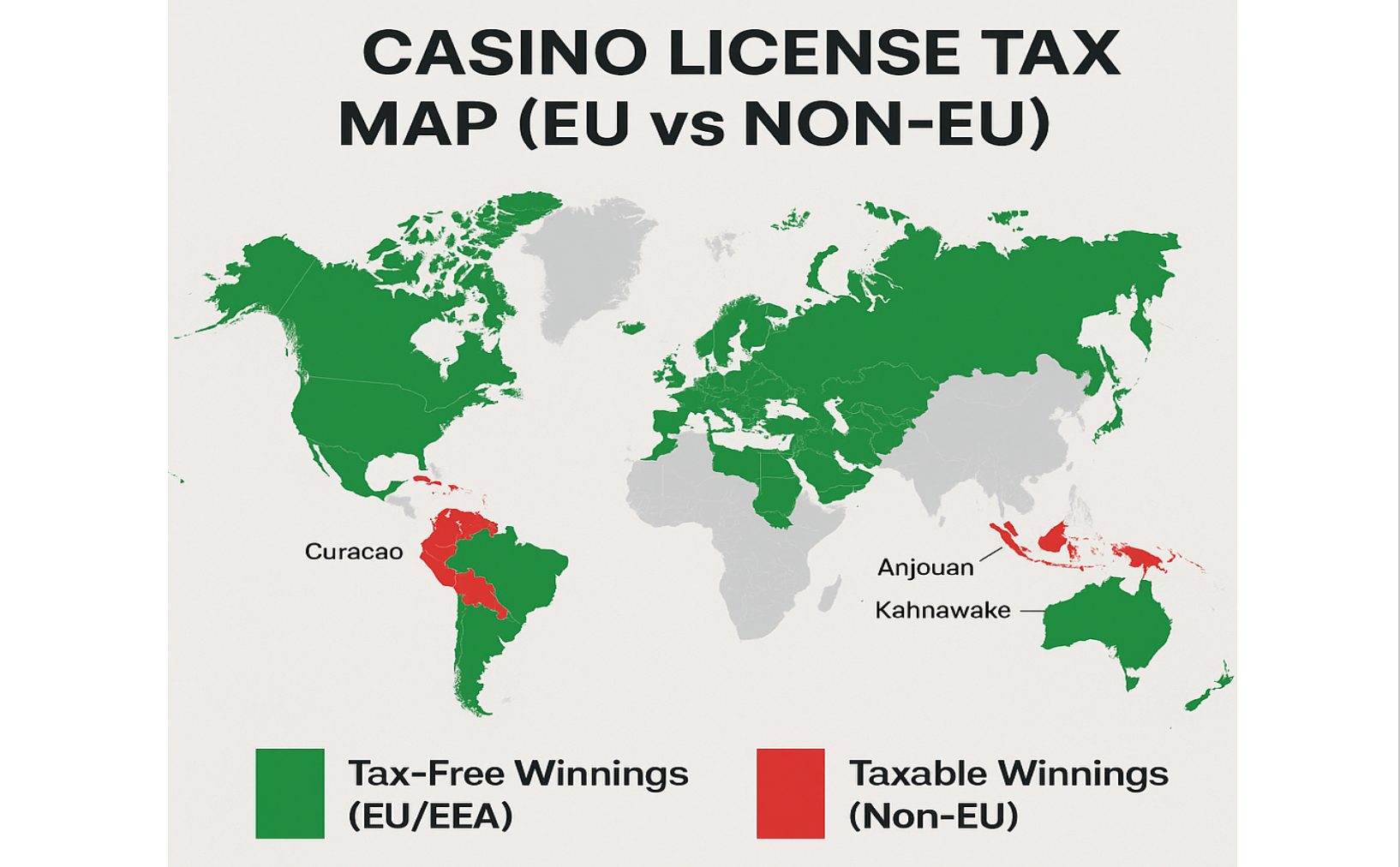

EU vs Non-EU: The Regulatory Fault Line

Here’s where the law draws its first invisible line.

If you play at a casino licensed in an EU or EEA country — think Malta (MGA), Estonia (EMTA), or Ireland — then your winnings are typically tax-free. This is thanks to the EU’s principle of free movement of services, which has been reinforced by the European Court of Justice in multiple rulings.

Play at a non-EU casino, however — say Curacao, Kahnawake, or Anjouan — and the situation changes.

Your government can legally demand tax on your gambling profits.

It’s not about where the casino is located physically. It’s about who licenses it — and whether that license falls inside or outside EU law.

Not All Offshore Casinos Are Created Equal

This is the part most players get wrong.

They hear “foreign casino” and assume it’s all the same. But in reality, there’s a world of difference between a Malta-licensed platform and a sketchy site registered in some far-flung island with no player protection, no audits, and no tax shielding.

A site may look polished. It may even accept your local currency. But that doesn’t mean it’s safe — or smart — from a financial point of view.

That’s why savvy players turn to specialist comparison tools — sites that not only list casinos, but explain what their license means for your wallet.

According to Casinoburst’s tax guide, players who choose MGA or EMTA casinos can legally avoid paying taxes, provided the casino is open to their country and not blacklisted. The key is playing within the EU’s service laws — not against them.

So What Exactly Triggers Taxation?

Let’s simplify:

- If the casino is licensed inside the EU/EEA ✅ — your winnings are tax-free

- If the casino is licensed outside the EU/EEA ❌ — you may owe tax

- If the casino is blacklisted in your country ⚠️ — you may break local laws, even if it’s EU-licensed

In Sweden, for example, Skatteverket clearly states: “Winnings from gambling within the EEA are tax-free, as long as the operator is authorized and supervised by a public authority.”

The logic is simple: EU law trumps local law, as long as the operator plays by the EU’s rules.

Playing Smart Is Not Cheating

Let’s be clear: this is not tax evasion.

It’s perfectly legal to seek tax-free winnings by choosing casinos licensed under EU law.

But it does require due diligence.

The gambling world is filled with slick marketing and confusing terms. Knowing which casinos actually offer legal tax exemptions — and which ones just pretend — is essential.

A growing number of platforms like Casinoburst now specialize in that very question. They don’t just rank casinos by bonus. They break down licensing, regulation, withdrawal methods, and — critically — tax rules.

The Takeaway: Don’t Pay What You Don’t Owe

In an economy where inflation bites harder than ever, every euro counts.

And in the world of online gambling, every win should count too — not just the flashy ones on screen, but the quiet ones that show up on your tax return.

So if you’re going to take a chance at the roulette table, at least stack the odds where it matters most.

Know your license.

Know your rights.

And know that the difference between 0% and 30% tax can be just one click away.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin