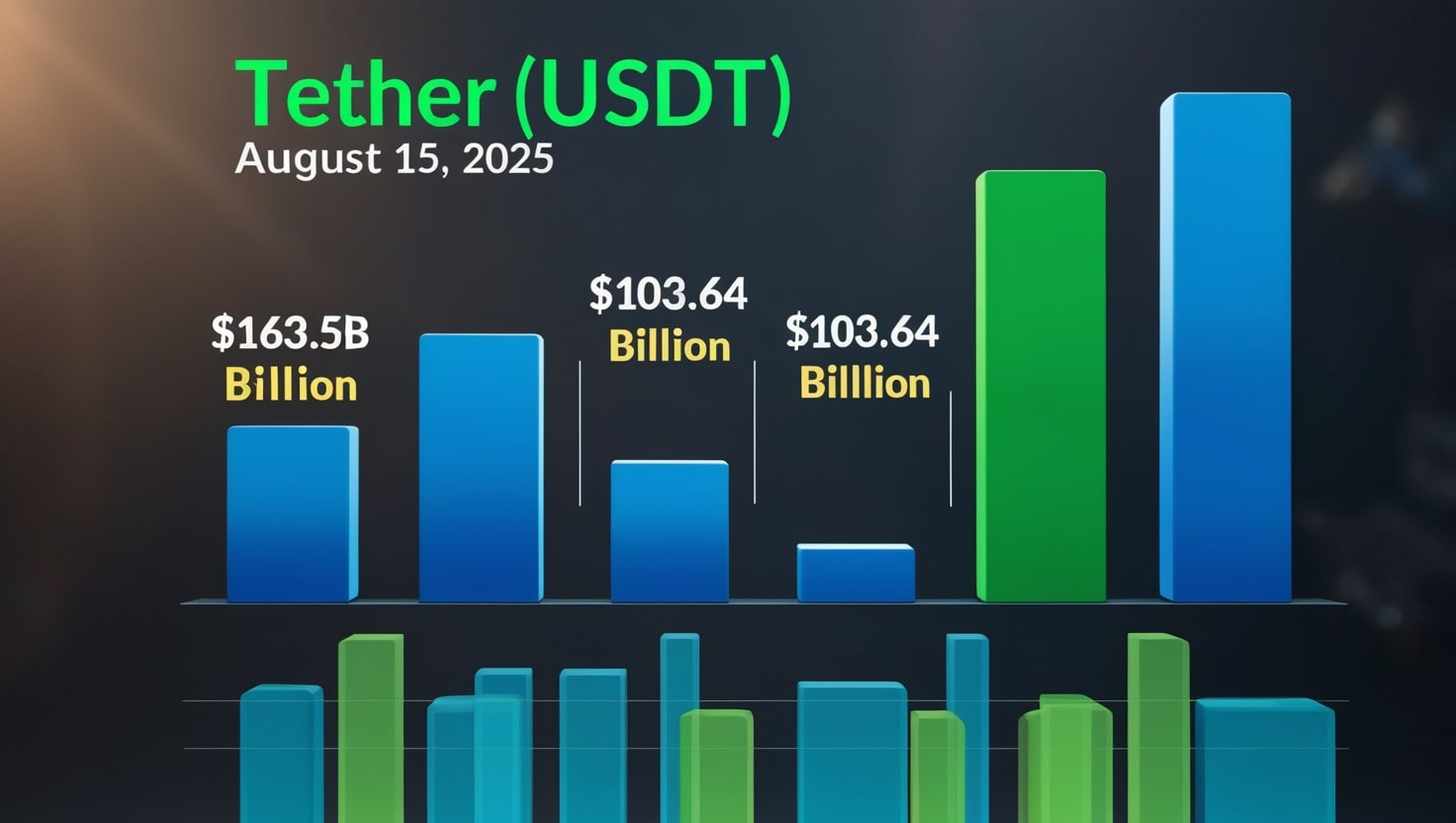

Tether’s $163B Market Cap Shines Despite Volatility

Tether (USDT) is the most popular stablecoin in the world at the moment, as it solidified its status in the crypto market with an incredible market capitalization of 163.58 billion dollars as of August 15, 2025. Although it fell marginally by a percentage point (0.01) today, the liquidity is witnessed through the massive trading volume of 103.64 billion Dollars as compared to the usual 106 billion.

The stablecoin fixed on the U.S. dollar makes Tether a backbone of traders in the turbulent markets. Nevertheless, the U.S. is facing modifications to the regulations of doing business, especially with the upcoming conditions of mandatory third-party audits based on the GENIUS Act.

Stability and Performance of the Market

The price of the USDT was preserved at 1.00, and the ratio between the 24-hour trading volume and its market cap was 63.3 percent, which also demonstrates its essentiality to crypto liquidity. The fixed supply of the stablecoin is 164.06 billion tokens, whereas Tether is leading in on-chain fees between nine blockchains, taking 40 percent of the cost of transactions. Such dominance denotes its usefulness in trade, remittances, and DeFi, despite growing competitors such as USDC.

Stricter Regulations Add Up

A genius act, going through the U.S. Congress, poses a threat to the operations of Tether in that it demands that third-party reserves of Tether be audited. Such a bill seeks to maintain transparency, but it would destabilize the market leadership of USDT if its compliance costs increase. In response to the news, Tether CEO Paolo Ardoino highlighted the stablecoin being used in a “variety of emerging markets”. However, critics point to the amount of its reserves, with 2019 stats showing that only 74 percent of Tether is backed by cash. The stabilization of the stablecoin market may change with the passing of the act.

Strategic Investments and Expansion

Tether has made other investments, becoming a minority shareholder in Spanish crypto exchange Bit2Me and leading a 30 million Euro funding round to support EU growth and expansion to Latin America. Moreover, Tether acquired more than 120 enterprises, including a majority stake of 21.4 percent in a Bitcoin miner, Bitdeer. These changes indicate Tether’s desire to expand beyond stablecoins and impact other sectors, despite regulatory risks such as the MiCA regulatory framework in the EU.

Tether Blockchain Innovations

The company also declared the intention to create Plasma, a fee-free blockchain of the USDT that can pose a serious competition to Tron, where most of the Tether that circulates therein is present. It is a consequence of Tether’s decision to end support for USDT across Kusama and other legacy chains as of September 1, 2025, to simplify operations. Tron is experiencing heavy USDT usage, as indicated by on-chain data on Ethereum, due to its no-cost transfers and low fees, which amount to an 80 billion supply.

Gain and Treasury Inventory

In Q2 2025, Tether reported a profit of 4.9 billion, with total assets of 162.57 billion, compared to total liabilities. With the U.S. Treasury bills worth $127 billion, Tether surpasses South Korea as it ranks among the top 19 holders of U.S. Treasuries. Such a reserve plan is used to back up the peg of the USDT, alongside supplementing investments in AI and Bitcoin by funding the Twenty One Capital BTC stash of 43,500 BTC.

Security/Compliance Activities

Blockchain forensics of Tether greatly assisted Brazilian investigators in seizing nearly 5.7 million in USDT stolen by a cyber fraud gang. Also, Tether has frozen 1.6 million connected with a terror network in the Gaza Strip, which strengthens its collaboration with the U.S. law enforcement. The moves negate previous concerns about USDT being used as an instrument of illegal tasks, even though there are still reservations regarding central control in the crypto world.

Community and Industry Effect

Tether has more than 400 million users, which makes its influence impossible to deny. It is integrated with platforms like Coinsph and has partners, such as TON and Kaia, making it more accessible. There is a split in both sentiment and opinion among the traders, with some defending USDT for its consistency, while others question its clarity. The active involvement of Ardoino, such as publishing a plea to replace a vandalized Satoshi statue, keeps the Tether in the headlines.

Future Outlook for Tether

Analysts believe that Tether will be able to sustain its dominance amid the regulatory pressure, and Nansen suggests the USDT dominance over other types till 2027. The GENIUS Act and the possible U.S. bans may, however, push Tether into an institutional market. Should the zero-fee model of Plasma succeed, it could further solidify the position of USDT in DeFi and cross-border payments, which is helping it on its growing trend.

Traversing a Frankenstein Landscaping

The success of Tether in the future is subject to its ability to balance two concepts: regulation and compliance, and strategic investment and technological innovation. Despite challenges such as audits and competition, USDT, with unparalleled liquidity and wide use, won the right to exist. The legality of Tether is surrounded by concerns from investors and traders awaiting explanations of U.S. regulations that could either bolster the company’s credibility or undermine its strength in the ever-changing crypto landscape.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin