SUI Token Unlock Sparks Volatility: 44M Coins Released, Price Dips to $3.38 Amid DeFi Surge

October 10, 2025 -The Sui blockchain has now drawn the eyes of the cryptocurrency industry like a rising tide, notching its highest-ever total value locked (TVL) and causing speculation of a massive price explosion.

With the boom of decentralised finance (DeFi) protocols on the network, the native token of Sui, SUI, is trading around $3.50, enticing traders with trends that could drive the currency to $7 in the next few months. This influx is in the context of more general market turbulence, and Sui is now a winner-takes-all blockchain in the scalable infrastructure contention.

Booms in DeFi Ecosystems: TVL Soars to Over $2.6 Billion

There has been an explosive growth in the Sui DeFi sector, and TVL has shot to a record high of over 2.6 billion, a new all-time high that highlights the popularity of the network among both developers and investors.

This achievement is indicative of a growth of 12.82 per cent in the last week alone, owing to the increased movement of major protocols. First in the list are the platforms such as Cetus, Bluefin, and Suilend, which, along with others, have increased the levels of liquidity and user interaction.

The market capitalisation of the network stablecoin has also burst to 921 million, surpassing competitors like Toncoin, Mantle, and Optimism. This value is not only an indicator of strong trust in the infrastructure of Sui but also an indicator of its superiority in managing high-throughput transactions without interfering with its security and speed.

Having begun with a small TVL of approximately 250 million at the outset of 2024, Sui has gained more than a tenfold growth within less than 2 years and turned it into a DeFi powerhouse.

The decentralised exchange (DEX) volumes have reached all-time highs of $1.43 billion every day, and the trading of perpetual futures was 160 million. A total of 12.2 billion of staked assets and bridged assets bring the total effective TVL to $4.33 billion.

These measurements illustrate a growing network where efficiency in capital and interoperability are no longer concepts but realities. The developers laud the object-centric data model of Sui as allowing parallel processing, reducing congestion (even at peak loads), which is a very important feature in an age of meme coin frenzies and institutional inflows.

Bridging Worlds: Cetus-Coinbase Strategic Alliance Welcomes Fiat Accessibility

To the fire of Sui, added is a landmark partnership between Cetus Protocol, the most powerful DEX on the chain, and Coinbase, the portal to crypto for millions of people. The collaboration brings fiat on-ramp functionality of Coinbase directly to Cetus, enabling one to buy more than 100 cryptocurrencies with over 60 fiat currencies.

This action, which is due to be launched soon, will get rid of the cumbersome multi-step procedures that have discouraged new entrants to DeFi. Cetus, which controls more than 86 per cent of the 24-hour trading volume of Sui DEX, uses its focused liquidity model, which is reminiscent of Uniswap V3, to maximise trades and limit slippage.

With the integration of Coinbase and its advanced compliance solutions, fraud prevention, and customer service, the solution aims at retail users as well as institutions that fear regulatory challenges.

According to a Cetus spokesperson, the collaboration is an aspect of making DeFi as user-friendly as the more established banking stewardship, and the collaboration can help Sui achieve his vision of frictionless, worldwide finance.

The timing couldn’t be better. With old-school finance giants looking at blockchain as a source of yield, the bridge has the potential to unlock billions of unused capital. Early followers in Aptos, the supported chain, have already reported easier onboarding, which suggests the possibility of transformation to the Sui ecosystem.

Price Action Bears Hotelier, Break to $7?

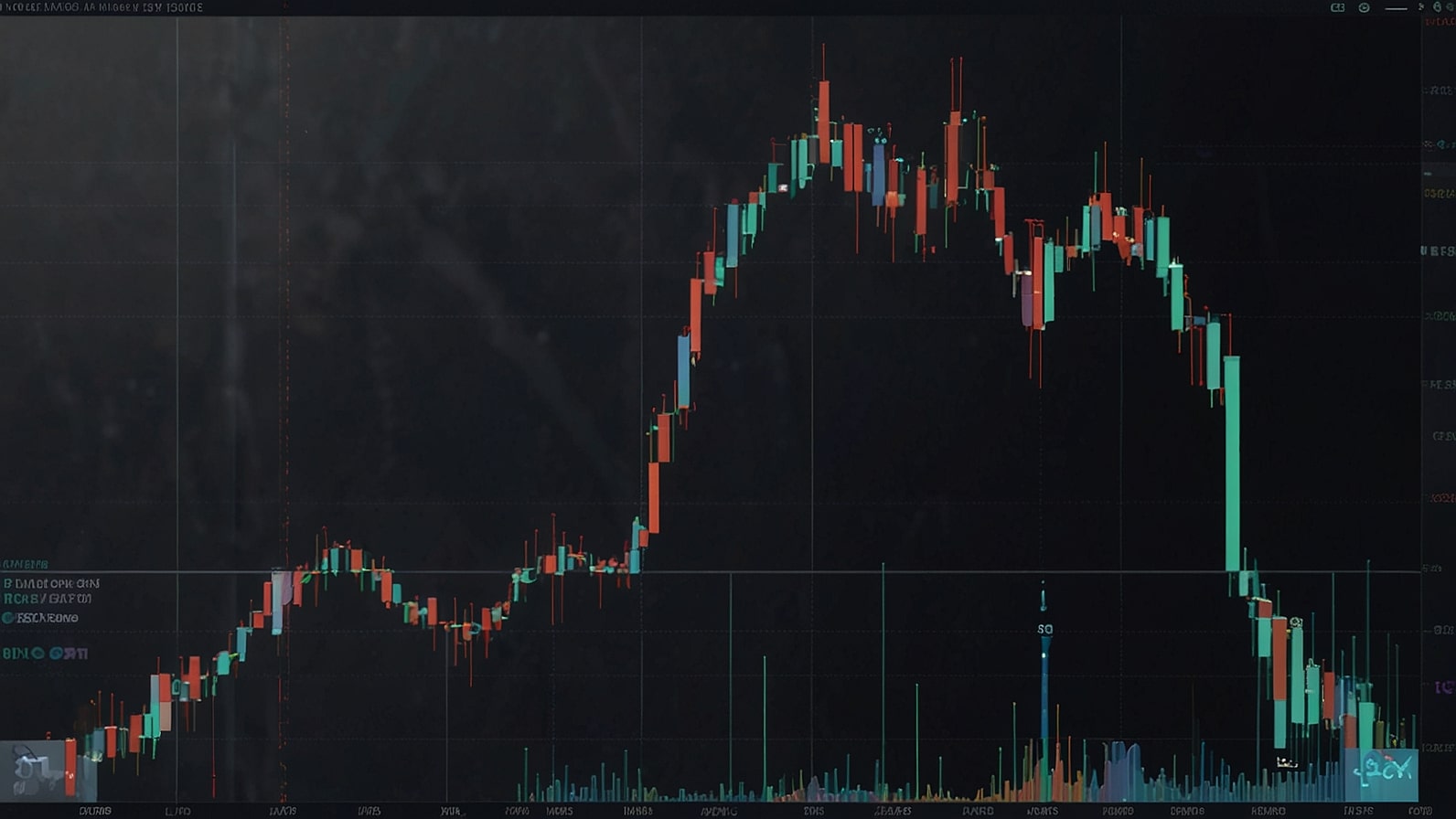

The SUI price has been resilient despite a turbulent market when the fundamentals are strong. The token is trading at a relatively high level of about 3.59 following a slight decline of 1 per cent, and it is currently consolidating in a symmetrical triangle formation, which has accumulated since February. The stage of accumulation is supported by both an upward trendline and the 0.68 Fibonacci retracement, which preconditions a possible explosive move.

The immediate resistance is set at 4.10, and analysts are watching to see whether it will be able to break clean to 5.30, the previous all-time high, and then move on to a 7 Fibonacci extension.

This optimism is supported by on-chain data: the total volumes of swaps are over 16.25 billion, and the metrics of network activity are competitive with such established platforms as Solana. Nevertheless, some sense of caution remains; the series of rejections at the resistance may extend the sideways movement into early 2026.

Long-term projections are bullish, whereas short-term bearish ones forecast a fall up to 2.60 by the middle of October. The technical analysts of the cryptocurrency forecast SUI to be in the range of 2.42 to 3.47 in the month, and they may yield over 200% at the end of the year.

The addition of the DIME ETF by Coin Shares to provide U.S. investors with exposure to SUI, among other layer-1 assets, only further supports the institutional appetite, which may ultimately trigger a price catch-up to the TVL explosion.

The weekly gain of 12% by Sui is still lower compared to other speculative presales such as MoonBull and Digitap, but it confirms Sui as one of the best cryptos in 2025. Combined with privacy-oriented peers, such as Monero, Sui overcomes regulatory headwinds through creative survival, such as higher liquidity pools and DeFi collaborations.

Social and Grassroots Knowledge and Wider Market Framework

On social media, there is a lot of talk on social sites about BTCfi integrations, and things are coming to fruition in the form of Volo completing the features of Bitcoin holders on the chain.

The spaces and threads provide emphasis on how the network is programmable, where users can replace xBTC and WBTC with yield in a safe location. Cryptocurrency trading indicators swamp schedules, highlighting retailing passion, but analysts encourage a disciplined approach to entry in wider crypto crossroads.

On the bigger scale, the rise of Sui is a reversal of Bitcoin’s slow grind and Ethereum scaling arguments. In 2025, the blockchain will have an emphasis on real-world utility (game to tokenised assets), which will allow the blockchain to take market share away from overloaded substitutes. However, there exist risks: the macroeconomic factors and regulatory control may compress profits.

Looking Ahead: Sui’s Path to Mainstream Adoption

The current advances solidify the future of Sui as an innovative and DeFi-oriented brand, integrating the most advanced technology with the user-friendly bridges to the traditional finance realm. TVL milestones and strategic partnerships, along with technical configurations, are converging, which means that SUI is on the verge of a breakout that can reshape the layer-1 dynamics.

This could be the right time to place a bet in one of the most promising crypto stories in the eyes of investors. Sui is not only expanding as the ecosystem is changing, but it is also reinventing the limits of what can be achieved in blockchain accessibility and scalability.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin