TRON Price Falls Amid Crypto Market Woes

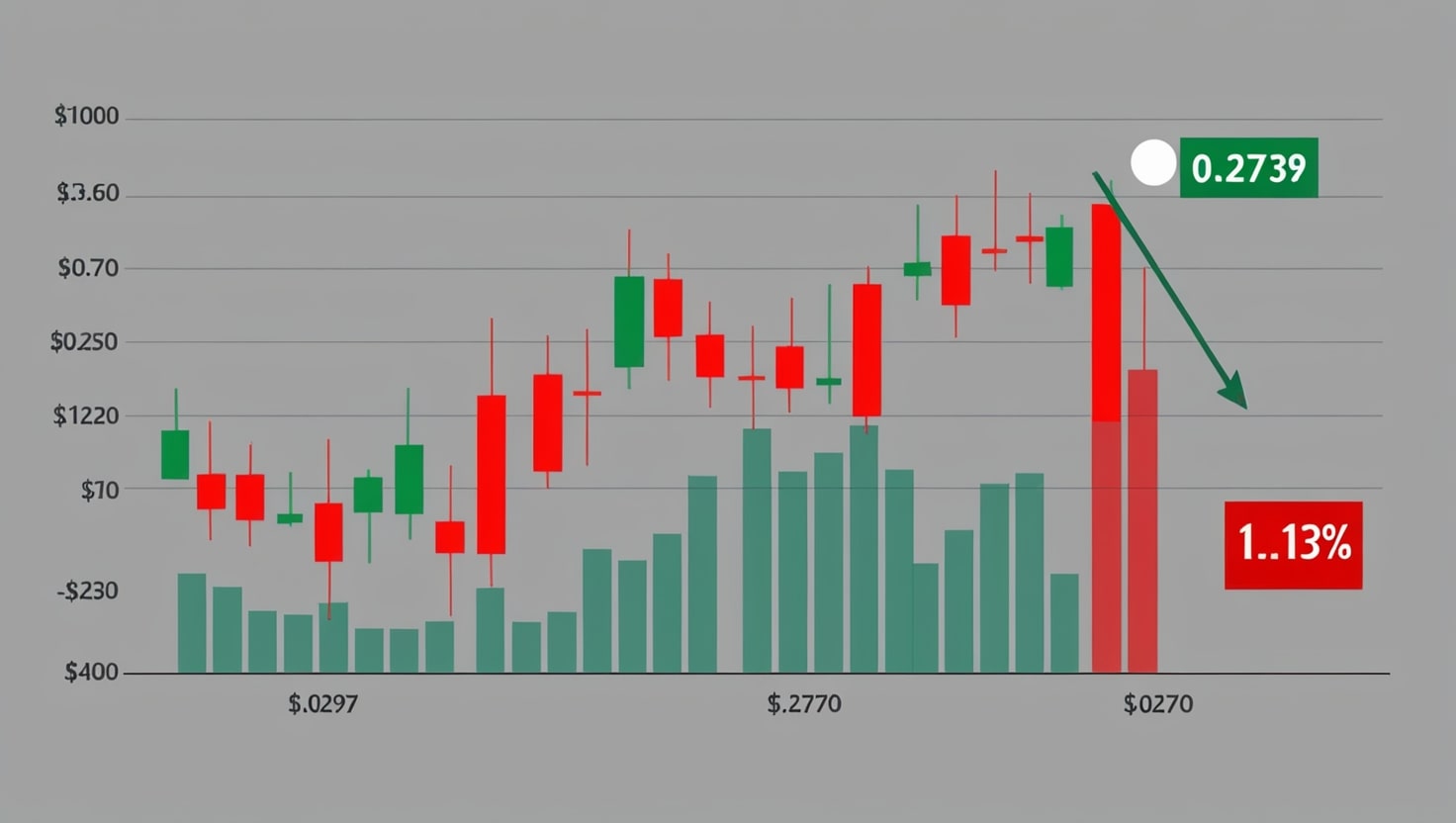

TRON (TRX) declined by 1.13 percent today, trading at a value of 0.2739 and a market capitalization of 25.97 billion. This has made it rank eighth in the cryptocurrency category. The 24-hour adjusted volume also rapidly increased by 53.62 percent, totaling $704 million, as there was more activity despite the lower price. The fully diluted value is equivalent to the market cap of 25.97 billion.

The Causes of the Price Decline

The larger cryptocurrency market tanked 3.8 percent today due to macroeconomic uncertainty and geopolitical tensions. TRX experienced selling pressure even after the recent bullish catalysts because it could not surpass the resistance of the $0.297 value. X posts are bearish, speculators observing profit-taking following a 2.5 percent rally.

The stability of the TRON Ecosystem

The TRON network is still healthy as stablecoins grow to 60 billion dollars per month. Its DeFi platform will be spearheaded by JustLend, which is gaining users and handles 12 billion transactions annually. Even though the product saw a dip today, TRON’s low prices and fast transactions give it an added advantage, as the company’s risks in the market are diluted.

Technical Analysis

TRX also languishes against the price resistance at $0.297, and a bearish MACD crossover can be witnessed in the hourly charts. If the selling continues, analysts imply a possible decline to the $0.270 support. Nonetheless, a heavily oversold CRSI suggests a potential rebound so long as buying volume supplements a breach of $0.280 soon.

Market Forces From The Outside

Crypto sentiment has been hurt by geopolitical issues such as tensions in the Middle East. TRX’s drop of 1.13 percent is consistent with those of Bitcoin and Ethereum. Investors are treading with care, and in the macro world, higher U.S. bond yields and a robust dollar have become negative for risk assets in general, such as cryptocurrencies.

Latest Updates and Opinion

Earlier this week, it was announced that TRON would list publicly in the U.S. using a reverse merger with SRM Entertainment, which caused the coin to push up by 2.3 percent. But fears over the schedule and regulatory barriers have dampened enthusiasm. The reception to X in the social community has been mixed, with supporters and critics lauding the adoption of TRON and centralization of multi-assets, respectively.

Institutional and Regulatory Accelerator

The fact that a U.S. investigation into TRON has been temporarily canceled, in addition to Justin Sun’s statements on improving the regulatory aspects, has created optimism. Long-term potential is anchored on institutional interest, such as whale movements of 343 million. It may also be listed as a public company in the BTC-treasury style, further increasing its TradFi attractiveness.

The power of DeFi and Stablecoin

TRON’s network activity is facilitated by its dominance in the transfers of stablecoins, especially USDT. X posts report stablecoin trading and DeFi growth, surpassing contenders like Solana. This strength is the basis of TRX’s value despite the current drop in price. Analysts see a recovery based on fundamental premises within the ecosystem into which TRX is implemented.

Market sentiment of X

X posts are reserved optimism. Others consider TRX to be oversold, and it will likely bounce back to 0.30 if the merger news sells out. Others discourage bearish movements over the short term due to market-wide fears. Others pointed to the cup-and-handle formation, which indicates that a breakout may occur.

Price Predictions for June 2025

Analysts predict an average price of TRX of 0.315 dollars in June, with a maximum of 0.345 dollars that could resume bullish momentum. The lower price will be more than 0.270 dollars unless there is a significant market jolt. The long-term forecasts are optimistic because TRON is scalable and has attracted adoption.

Historical Performance

In recent times, TRX has skyrocketed 973%, gaining up to 0.295 earlier this week. However, it is still a 15 percent drop from its 2021 high of $0.321. TRX’s resilience lies in the instability in the ecosystem and deflationary mechanisms, such as the reduction of rewards in Proposal 102, in the face of the current market-based downtrend.

Wider Trends of Crypto

The fact that the crypto market value is only at 3.1 trillion indicates a cautious outlook. The declines on Bitcoin and Ethereum, 2.7% and 3.1%, respectively, follow TRX’s. Geopolitical and economic factors still affect investors’ confidence, and in the short term, these external factors affect the price of TRX.

Long-Term Outlook

By drawing attention to DeFi, stablecoin incorporation, and possible listing in the U.S., TRON has the prospect of expanding. It is projected to rise to 0.40 by the end of the year, provided there are no changes on the regulation side. Despite the current decrease, the TRX fundamentals and whale activity offer good chances of recovery in 2025.

Conclusion

The 1.13% decrease in TRX can be related to the undulations experienced in the wider market instead of internal shortcomings of its system. With a well-established DeFi ecosystem, regulatory advances, and bullish outlooks, TRON is one of the potential leaders. It will be volatile in the short term, but in the long term, it is going up because of adoption and institutional demand.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin