Cutting Costs, Not Care: The Smart Economics of Expat Insurance

For globally mobile professionals, healthcare is both a financial line item and a personal safety net. Yet many expats still default to the most expensive path: piecing together local coverage, travel add-ons, and emergency riders—only to discover gaps when they need care most. A smarter approach is available. With the right plan design and an informed comparison across markets and insurers, expats can reduce premiums and out-of-pocket risk without downgrading the quality of care. This article explores the economics behind that outcome—and how to capture it.

The real cost drivers hiding in plain sight

A medical insurance for expats should be planned wisely, in order to keep under control several dynamic factors:

Fragmentation. Buying separate policies (local inpatient, travel medical, evacuation) duplicates overheads and creates exclusions between contracts. Consolidation into a single international plan often removes those inefficiencies.

Provider access. Out-of-network billing, surprise facility fees, and non-recognition of foreign prescriptions drive costs up quickly. Global networks and direct billing arrangements reduce leakage and improve price predictability.

Exchange-rate exposure. Paying claims or premiums in volatile currencies adds uncertainty. International plans with multi-currency options—or denominated in a strong base currency—stabilise long-term cost.

Administrative friction. DIY claims, medical translations, and chasing reimbursements consume time—an invisible but very real cost. Plans with concierge-style support reduce this drag and the risk of denied claims.

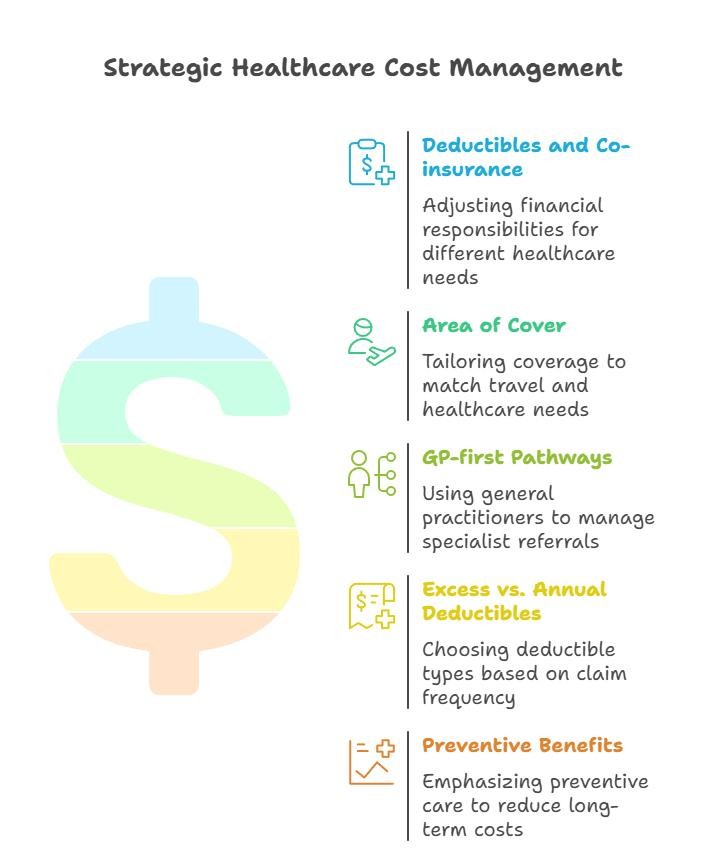

Value levers that lower spend without lowering standards

1) Deductibles and co-insurance used strategically. Increasing the deductible makes sense for low-frequency, high-severity events if paired with strong catastrophic limits. Conversely, keeping modest co-pays on predictable outpatient visits discourages overuse without deterring necessary care.

2) Area of cover that matches your reality. “Worldwide excluding the USA” can materially reduce premiums for expats who do not need routine care in the U.S. Conversely, executives with frequent U.S. travel may prefer a plan that covers short-term treatment stateside but channels elective procedures to centres of excellence abroad.

3) GP-first pathways for outpatient care. Requiring a general practitioner referral for specialists curbs unnecessary imaging and consults, while fast-tracking urgent cases. This is a proven utilisation control that preserves quality.

4) Excess per claim vs. annual deductibles. For families with kids (where small claims are frequent), an annual deductible caps the number of times you pay. For single professionals with occasional visits, a per-claim excess can be cheaper overall.

5) Preventive benefits with data discipline. Vaccinations, screenings, and chronic-care check-ins reduce expensive flare-ups and emergency admissions. Plans that reward prevention are not “nice-to-haves”; they are cost defences.

Use the Expatmedicare health insurance comparator to scan multiple reputable insurers side by side and understand how plan design affects both premium and protection.

Continuity of care is a financial asset

International lives change: new roles, new countries, new clinics. The biggest cost shock for expats is not a single large bill—it is losing continuity and facing re-underwriting, waiting periods, or exclusions for conditions that emerged while on a short-term or local plan. Portable, globally recognised policies preserve insurability, which in turn preserves your budget.

Key questions to ask:

- Will the plan travel with you across regions or require fresh underwriting?

- Are pre-existing conditions covered after a waiting period, or permanently excluded?

- What happens to maternity, dental, or mental-health benefits if you move mid-policy year?

Why brokered comparisons beat guesswork

The international health insurance market is broad, and terms are nuanced: inner limits for cancer drugs, rehabilitation caps, transplant sub-limits, psychiatric care parity, newborn underwriting, and more. Comparing like-for-like is difficult without expertise and market access.

A neutral comparator helps you:

- Standardise benefits for apples-to-apples quotes.

- Surface the true cost of exclusions and inner limits.

- Quantify trade-offs (e.g., the premium impact of adding U.S. cover or lowering the deductible).

- Leverage underwriter appetite for your risk profile and region.

Fine print that protects your bottom line

- Claims currency & reimbursement timelines. Confirm currencies accepted, processing times, and banking fees. Slow reimbursements are a hidden cost.

- Direct billing vs. pay-and-claim. Direct billing reduces out-of-pocket strain and FX losses.

- Medical evacuation & repatriation. Check trigger criteria, destination rules, and coverage for accompanying family members.

- Chronic and cancer care. Look beyond “covered”: are there inner caps on biologics, home infusions, or radiotherapy?

- Maternity. Waiting periods and newborn coverage vary widely; plan ahead if family expansion is likely.

- Mental health parity. High-quality plans increasingly remove or raise inner limits on psychiatric care; this is both humane and economically sound.

- Telemedicine and second opinions. These tools catch misdiagnoses early and reduce unnecessary procedures, saving money and improving outcomes.

A simple decision framework

- Map your true risk. Where will you live, travel, and seek elective care? What are your personal risk factors (age, family plans, conditions)?

- Choose your area of cover. Include the U.S. only if clinically or commercially necessary.

- Set your shock absorbers. Pick deductibles and co-insurance that fit your cash-flow and risk tolerance.

- Lock in continuity. Prioritise portability, renewal terms, and pre-existing condition handling.

- Compare intelligently. Use a professional comparator and, where possible, a broker who can negotiate and explain trade-offs in plain language.

The bottom line

Cutting healthcare costs does not require cutting care. It requires aligning benefits with real-world usage, eliminating fragmentation, and negotiating from a position of data—not hope. International health insurance, when selected and structured correctly, turns healthcare from a volatile expense into a well-managed asset of modern expat life.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin