Exploring the Business of Online Gaming and its Evolution

It’s natural for games and gaming to be viewed through the...

Transform Your Beauty Routine with P-DE-P : London’s Premier Salon

A New Standard of Beauty and Wellness In the dynamic world...

High-Performance Cloud Mining Platform Delivers Lucrative BCH Returns

The world of cryptocurrency mining has often been the...

The Growth of Low-Value iGaming and Its Impact on the Industry

While the history of iGaming may be a relatively short one,...

The Role of Table Stands in Upselling: How to Drive More Sales with Effective Menu Displays

The restaurant market’s strong competition makes...

Understanding Crypto Security to Protect Your Digital Assets

The use of cryptocurrency as an investment has grown...

How Can Modern Dentistry Make Your Visits More Comfortable and Pain-Free?

For many people, visiting the dentist can feel like an...

The Strategic Advantage of Gold and Silver Investments in 2025

In 2025, gold and silver investments are becoming...

Can You Install New Flooring Over Existing Floors?

Renovating a commercial space or retail environment often...

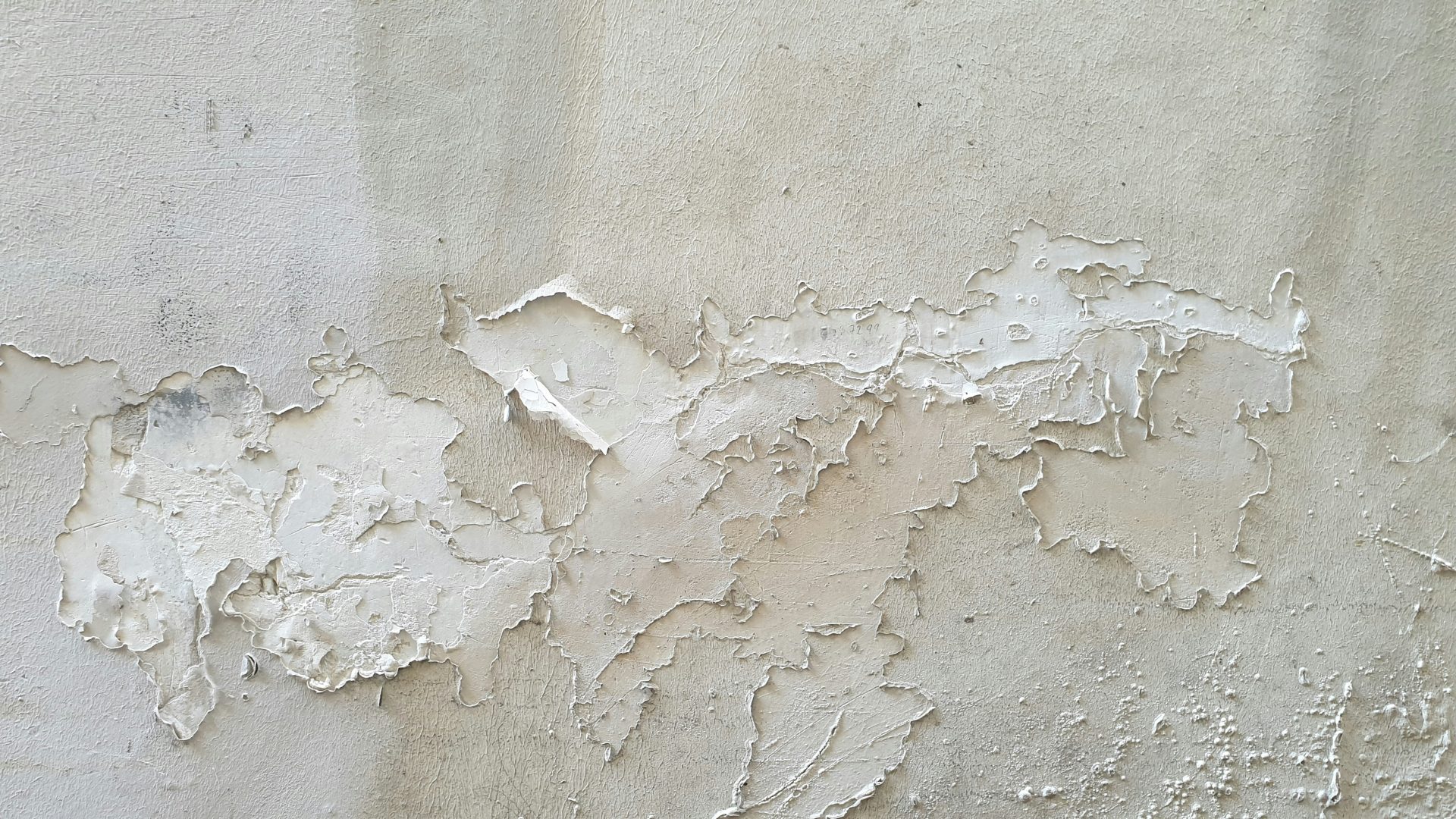

Do I Really Need Professional Damp Proofing?

Many homeowners are tempted to tackle damp issues...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Solana

Solana