China’s Computing Market Poised for 42% Growth by 2029, Outpacing US Expansion

China’s computing market is on a rapid growth trajectory,...

The Future of Remote Work: How Businesses Can Stay Secure and Productive

Remote work has become an integral part of the modern...

Rumors Swirl Around Michael Saylor 1 Billion Dollar Bitcoin Investment

Whispers within the cryptocurrency community have focused...

Crypto Market Price Prediction Today

The cryptocurrency market remains a dynamic and often...

Watch 2025 Super Bowl Live Stream Anywhere

New Orleans—The Big Easy simmers like a roux of rebellion...

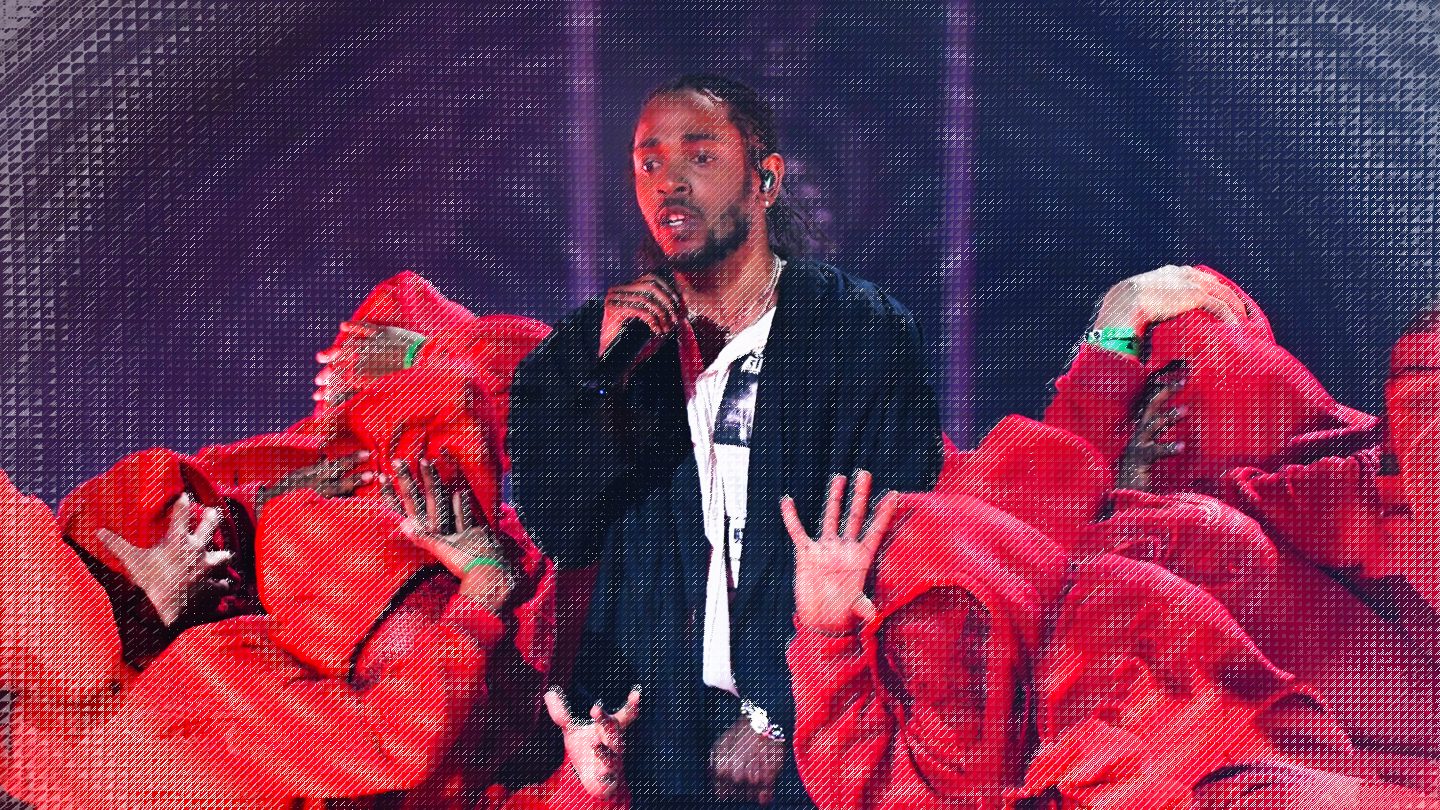

How to watch Lamar’s super bowl halftime show in Canada: Performers, Time, and TV Channels

New Orleans—the “Big Easy” sizzles as a city where jazz...

Where to Watch Super Bowl Half-Time Show in the UK: Performers, Time, and TV Channels

New Orleans, affectionately known as the “Big...

How to Watch the Super Bowl 2025 Live in Canada

The Super Bowl is almost here, and for many fans, the...

2025 Puppy Bowl: TV channel, Start Time, How To Watch The 2025 Puppy Bowl Live

The 2025 Puppy Bowl: The Ultimate Furry Showdown on Super...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin