B2BinPay has successfully released the latest update with major changes to its price structure and fees, allowing it to minimize customer expenses and making the solution easier to use. In addition, they now reveal a major update to B2BinPay’s various features, including its commissions, website, Enterprise, and Merchant Models. By making these improvements, B2BinPay is only strengthening its position as a widely known market leader among companies that handle crypto payments.

New Pricing Policy

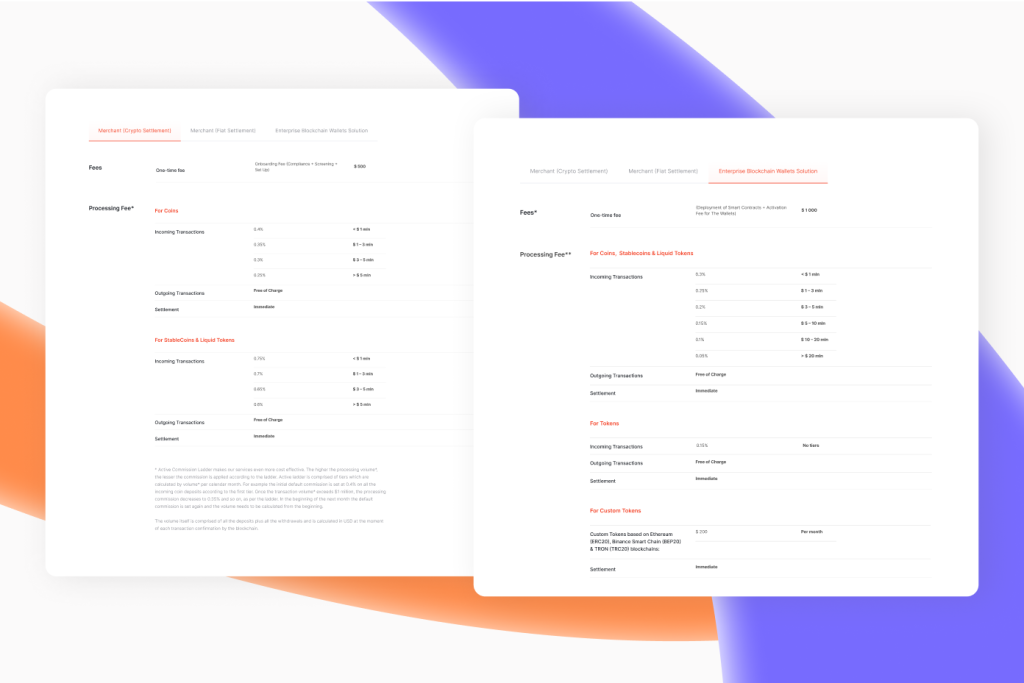

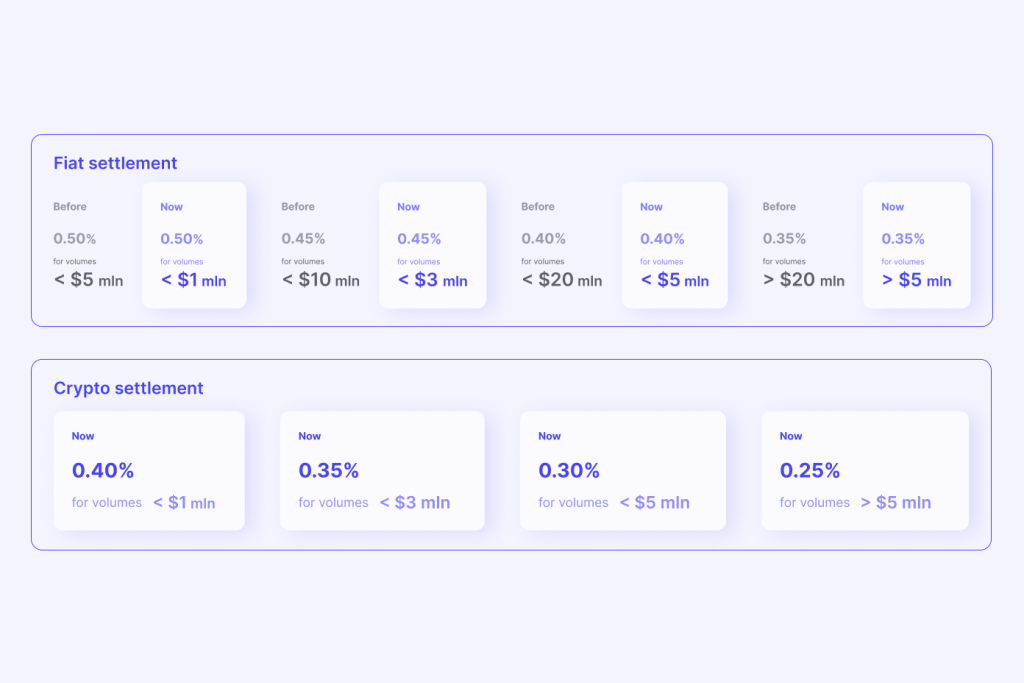

The B2BinPay team has revised the pricing plans in order to expand the potential for profit for all parties. The Merchant Models’ volume requirements and percentage thresholds have been lowered.

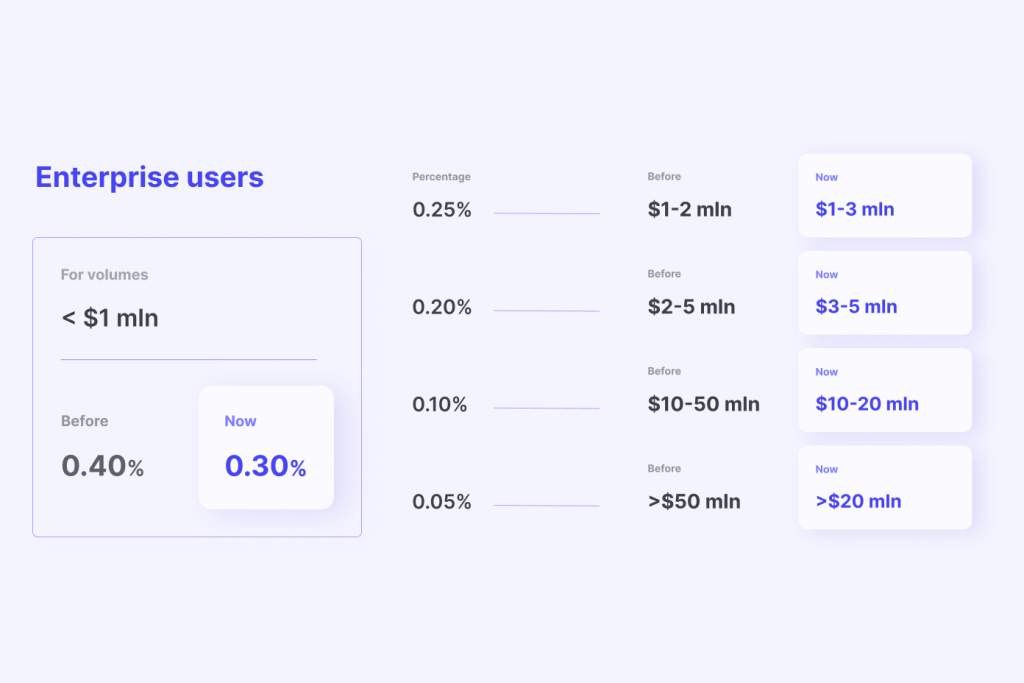

B2BinPay registration fees for Enterprise clients have also decreased. From now on, 1,000 USD will be the starting price. Furthermore, the team shifted the norm of percentage tiers for Enterprise clients, leading to significant cost reductions. View the updated versions below:

No fees are applied to any outgoing transactions from your account. These are among the most reasonably priced options available, and they give outstanding value to B2BinPay customers.

Redesigned UI And Enhanced Website Functionality

The B2BinPay group has renovated its main website to provide visitors with even more helpful information. Several sections on the freshly redesigned website have been updated to feature better each product and service that B2BinPay offers.

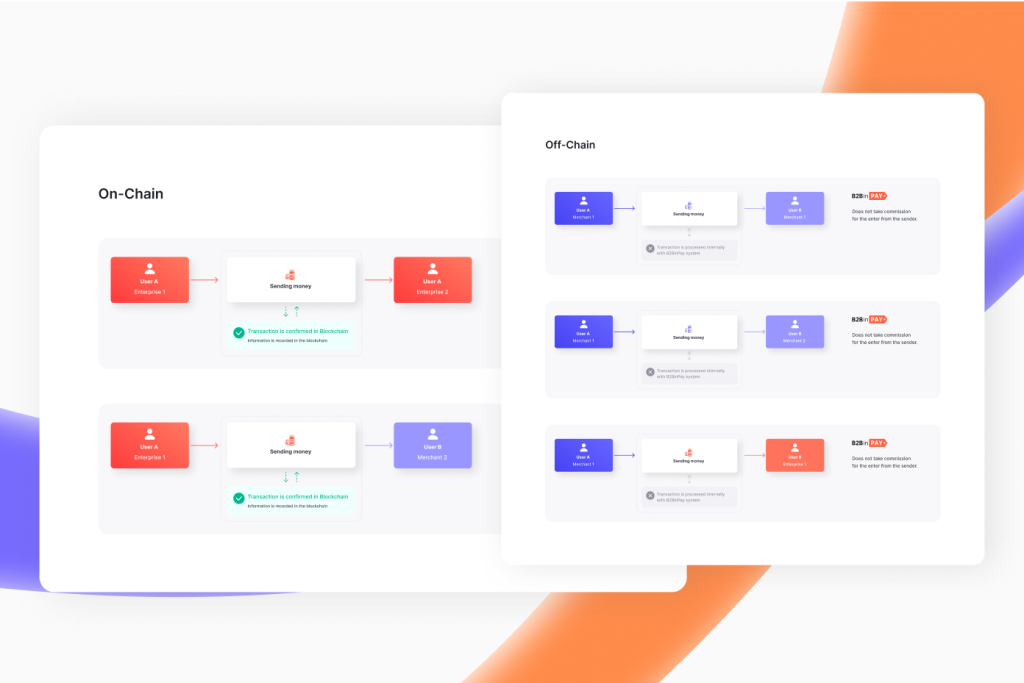

B2BinPay has included a comprehensive guide to ensure that both on-chain and off-chain transactions are understandable to site visitors. The blockchain is a network where on-chain transactions happen, and confirmation from the network is required for them to be valid. While B2BinPay does not add any fees to an on-chain transaction, the customer is still responsible for the blockchain fee.

Off-chain transactions can be processed using B2BinPay’s own infrastructure. These transactions are executed off-chain between B2BinPay users. Being both fast and free, they cut down on the time and money spent on the blockchain. Every on-Chain and off-Chain transaction use case is fully explained on the website.

Frequently Asked Questions

The team also incorporated a frequently asked questions section to provide quick, thorough, and accurate responses to any inquiries. Users may easily obtain various important information with the help of this section.

Application Programming Interface

Businesses are able to quickly and simply improve the security, speed, and ease of their payment processing by integrating blockchain technology with B2BinPay’s Application Programming Interface (API). All necessary documentation is easily accessible with only a few clicks.

Besides that, B2BinPay has been improved in several ways, including adding support for Cardano (ADA), Merchant Invoice Limits, and the Delta Amount.

New Tokens

In addition to a smooth online experience, visitors will have instantaneous access to the site’s ever-growing cryptocurrency list. Access all the digital currency options you need by visiting the “Available Currencies” tab. One hundred additional tokens, including WBTC, ANKR, GALA, IMX, and others, have been added to B2BinPay as part of a recent upgrade. Consequently, B2BinPay’s Merchant and Enterprise versions now support various currencies and tokens.

Enhanced Merchant Models

B2BinPay has made a major improvement for its customers by restructuring its models. The company formerly offered two different versions, Enterprise and Merchant (Fiat Settlement), but now they provide a third option – Merchant (Crypto Settlement). Merchants with the option of “Crypto Settlement” users may hold and transfer their USDTs, USDCs, and BTCs in secure digital wallets.

Bottom Line

Over the last year, B2BinPay’s development team has worked hard to enhance the product’s usability and provide more competitive pricing for businesses. When it comes to helping companies accept crypto as payment, B2BinPay has proven itself to be among the finest in the industry. Their website is enticing to all parties due to its modern design and cutting-edge features. Customers will be able to select a plan that works for them financially because of the flexible price structures.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin