B2B Prime Digital MENA Receives ‘Initial Approval’ from Virtual Assets Regulatory Authority of Dubai (VARA)

VARA, Virtual Asset Regulatory Authority in Dubai, has...

Unveiling the Vital Significance of Credit Risk Analysis – 4 Compelling Reasons You Can’t Afford to Ignore

Conducting a thorough credit risk analysis is vital to...

Is 2024 a Wise Time to Sell as a UK Landlord?

As the year 2024 looms on the horizon, UK landlords find...

Blooming Success: Unveiling the Pinnacle Choices for Sending Congratulations with Exquisite Floral Arrangements

Life is full of tough moments for us all the time, so...

8 Surprising Advantages of Creating a Company in Dubai

Have you ever thought about starting a company? Now is the...

What can development finance be used for?

Development finance is an important step in the process of...

BlancInvest.com Review (Updated 2024): Navigating Legal Aspects and Transparency

In the world of online trading, a broker’s commitment...

Forex Managed Accounts: A Reliable Approach To Maximising Investment Returns

There are two different ways you can start your forex...

Safeguarding Data: The Crucial Role of File Virus Scanners

Introduction: the necessity of robust online data...

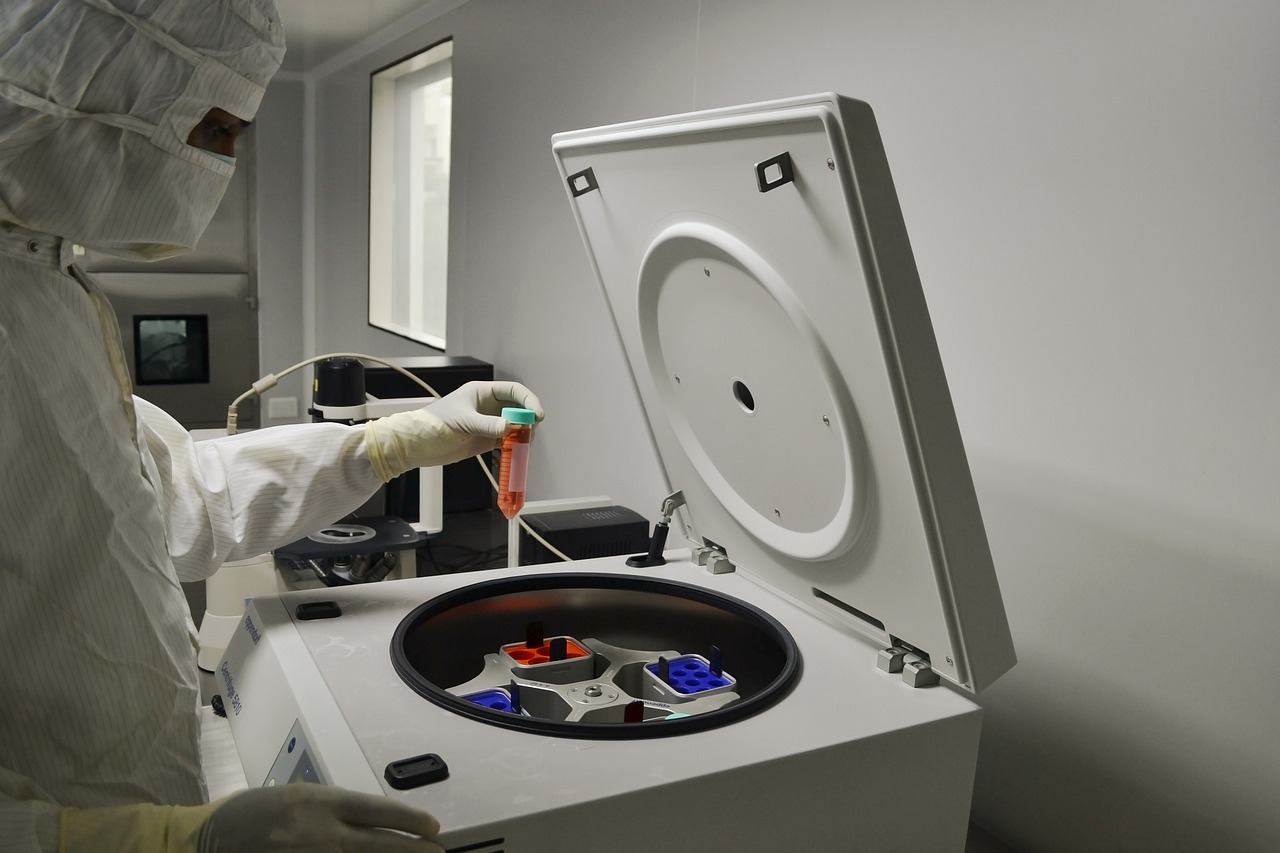

Biotech Private Equity and Investment Trends for 2024

The past few years have seen a boom in venture capital...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin