7 Money-Saving Tips For A Profitable Home Investment

Saving money for the initial deposit on your dream home may...

Top Benefits of Chamber of Commerce Membership

If you’re considering whether you should join your local...

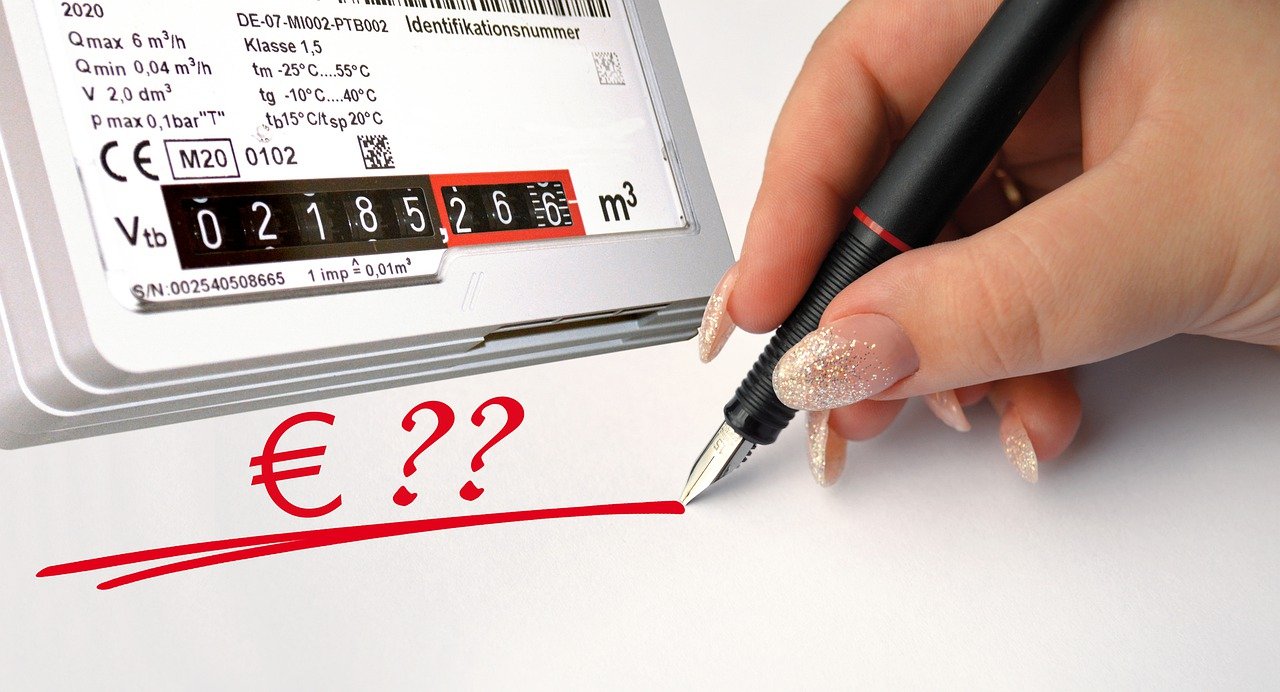

Expert reveals the top 10 ways to save money on your energy and heating bills

Recent statistics show that the typical household energy...

Teach kids money management skills, expert says

Almost HALF of parents concerned about their kids’...

Best Way to get Azerbaijan Visa

Do you want to travel to Azerbaijan for business or to see...

A guide to Transformers- the Machine Learning Model behind GPT-3, and how they complex Data Analysis

Transformers are the all-in-one solutions for machine...

Sell House Fast London: Cash Is King – and Quick

You have done the internet research. You have weighed your...

Edgars Lasmanis, Walletto Founder: A Guide to Co-Brand Card Issuing

Co-branded cards are a type of credit card that a retailer...

Common Causes of Shortages in the Insulation Market

The construction industry in the UK has, in recent years,...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin