5 Helpful Tips to Secure Good Marks in CBSE Class 8 Maths

Preparation for class 8 CBSE maths exams infact starts with...

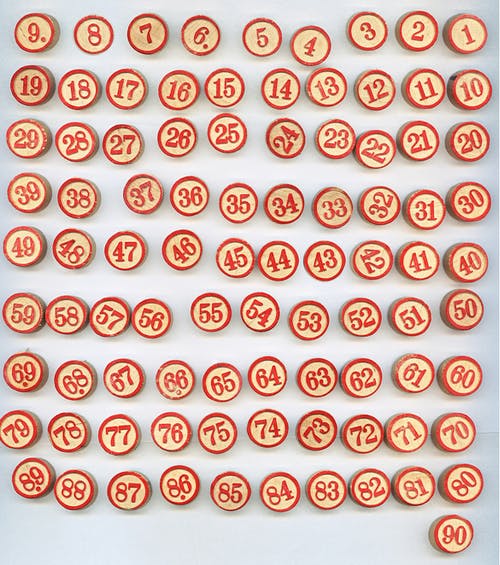

Playing Without Paying: An Introduction to Free Bingo

The game of bingo is thought to have originated in Italy in...

Day trading: the advantages and disadvantages

Day trading is a part of many trading strategies. It...

How To Create a Budget (The Complete Beginners’ Guide)

Whatever income the person has, keeping track of his...

WFH Hollywood Edition: How COVID-19 Has Affected the Film Industry

Throughout 2020, we’ve seen drastic changes to many...

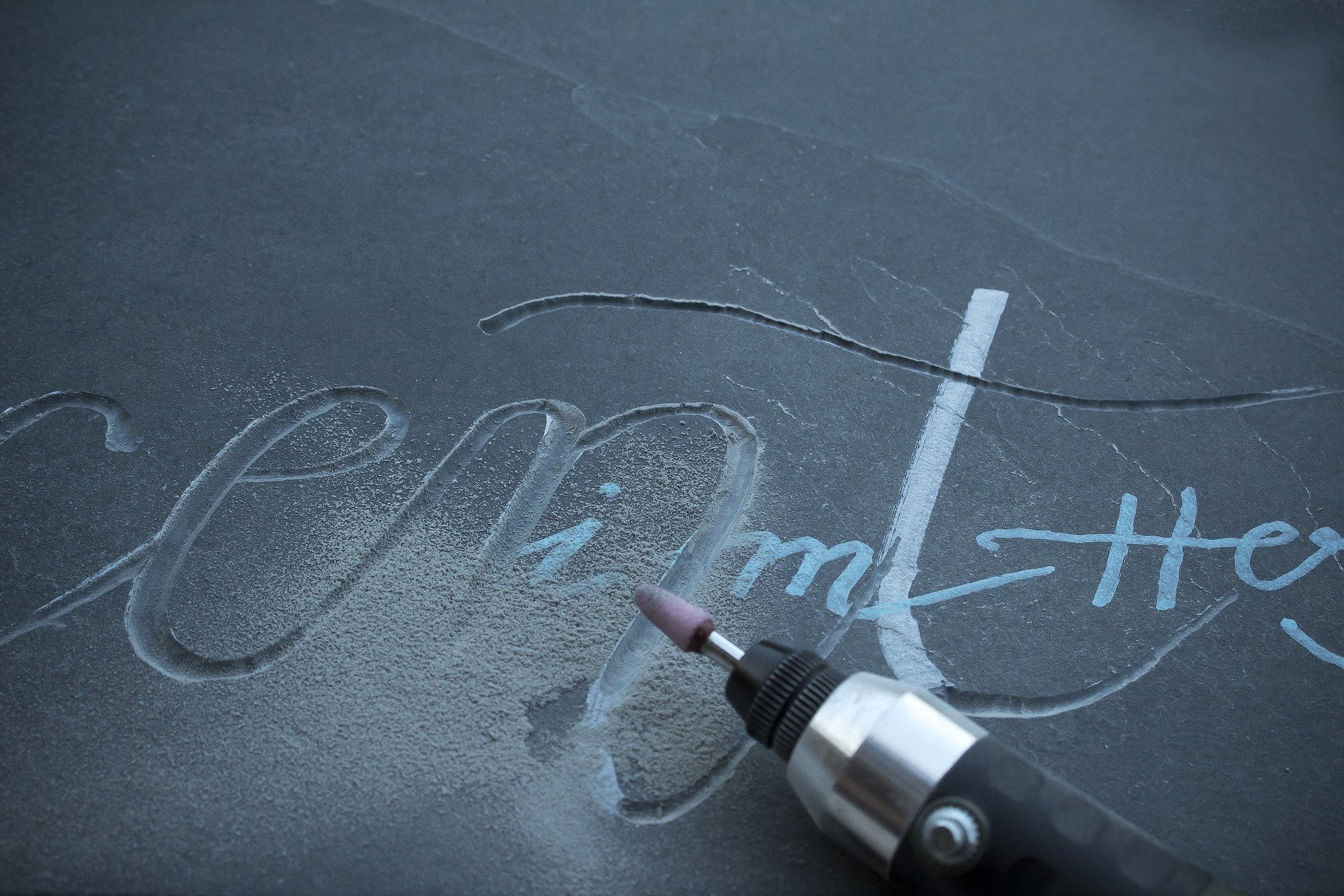

3 Engraving Techniques That Cover a Broad Range of Uses

There are three popular engraving techniques that are...

TOP FIVE REASONS WHY YOU NEED A MORTGAGE BROKER

Shopping for a mortgage can be one of the hardest ways to...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin