Be Dutch While Starting a Business in Netherlands

It is very challenging to start a Dutch business because of...

Can your business afford NOT to take contactless payments?

Customers are using contactless card payments in record...

How the Lockdown Changed Online Behavior and the Economy

The virus lockdown had positive and negative effects on the...

Useful Tips to Organize a Garage When Selling a House

Garages are often thought to be dull, cramped spaces where...

Endesa Meets Municipal Officials About Supply Problems

Endesa meets tomorrow, Monday with municipal officials...

The Best Real Estate Crowdfunding Sites

A relatively new way to invest in commercial real estate is...

4 Tips to Buying Property in Clapham

Clapham is famously known as the home of Holy Trinity...

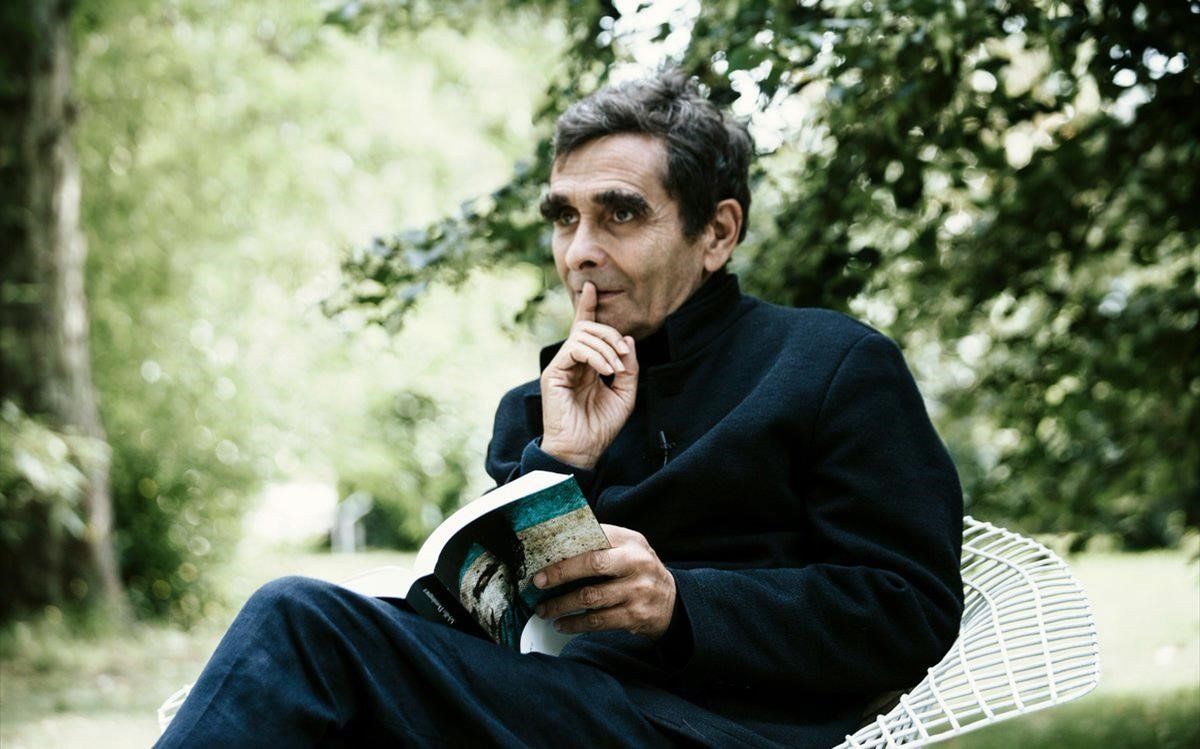

Adolfo Domínguez Lost 15 Million Between March And November

Adolfo Domínguez lost 15 million between March and November...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin