How the Business of Dentistry is Moving from General to Cosmetic

The business of dentistry in the UK has changed...

What Options you Have Available if you are a Little Short Over the Holiday Period

Finding yourself short on cash during the expensive holiday...

Enterprise Data Foundation Recognized: Leaders in Finance and Insurance Earn FUSION Awards in Governance and Analytics: The Hidden Pillars of Responsible AI

Prague, Czech Republic – For years, “Artificial...

How Do Online Casinos Compare to Crypto Casinos?

Online casinos continue to attract millions of players...

Dogecoin Price Jumps 5% to $0.15: Spot ETF Debut and Musk’s DOGE Project Fuel Meme Coin Rally in 2025

Notwithstanding global market fetishism, Dogecoin (DOGE) is...

Tron TRX Holds Steady at $0.28 Amid Fee Cuts and Stablecoin Surge

On November 25, 2025, Tron (TRX) will be a well-lived...

USDC Stablecoin Hits Record Circulation Amid Regulatory Wins and DeFi Boom

USD Coin (USDC) is a key to a stable world in the...

Solana Surges Toward $140 Amid Institutional Inflows and Bold Economic Reforms

Solana has been a standout performer in the hectic reality...

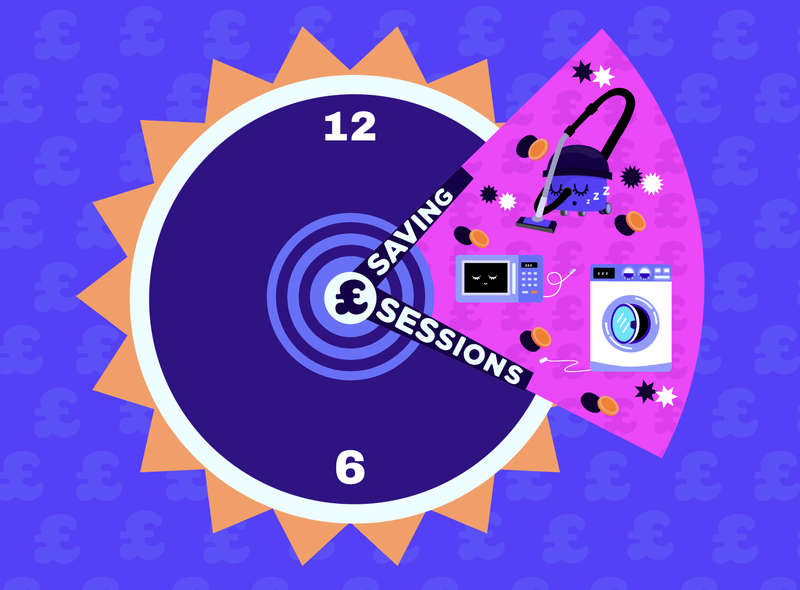

Octopus Energy Introduces the UK’s First Fully Agile Tariff for Small Businesses

Octopus Energy has launched Shape Shifters: Agile, the UK’s...

Tether News: USDT Peg Strong at $1.00 as Reserves Hit $152B Record and EU Grants Full Approval

On November 24, 2025, Tether is still a stablecoin of the...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL