7 Best Ways to Protect your Fleet Business Against Financial Risks

Your business is your lifeline, so you want to ensure your...

Questions Have Raised About The Astrazeneca Vaccine

The news reached Sarah Gilbert on Saturday night that the...

What is Ad Fraud and How Proxies Can Detect It?

The success of any business, no matter how big or small it...

The 3 Most Important Questions to Ask Before If and When You Stop and Ask for the Business by Sofiya Machulskaya

There are many times when I speak to students or clients...

Can Playing Games Improve Your Business Acumen?

Games can be a great credit to your business acumen....

The Biggest Summer Transfers in the Premier League

The 2020/21 transfer window was by no means a...

The Best Christmas Gift Idea for a Girlfriend

Have you already settled on a Christmas gift idea for a...

What ways can someone use inheritance money?

In a society where many of us are living month to month on...

#Legal Talks- Easy Tips For Changing Your Legal Name

Our name is one of the first gifts we receive from our...

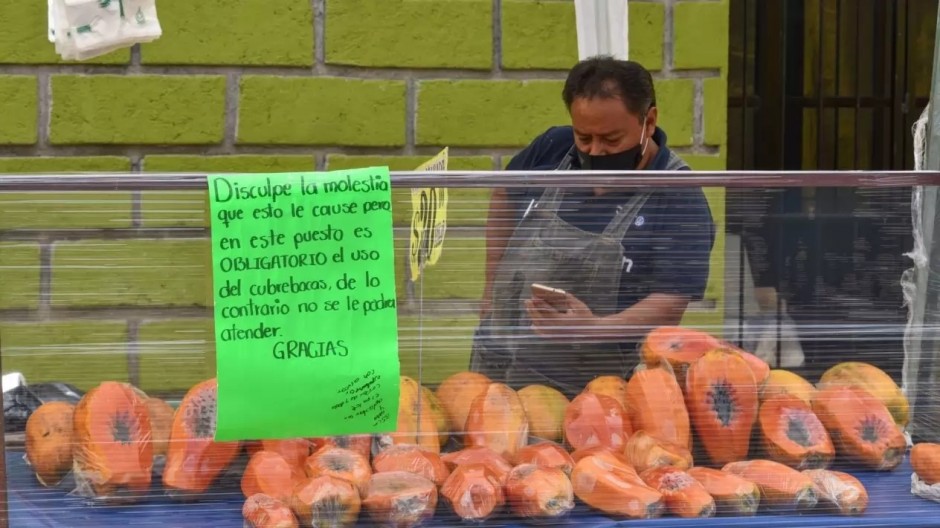

Inflation Stands At 3.44% In The First Half Of November

The National Consumer Price Index (INPC) registered a...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin