If you go to Valencia, Spain you can’t miss these places

Situated on Spain’s east coast, in a dreamy seaside...

Choosing the Best Business Phone Offering Strong Data Protection

Choosing the right phone for your business may feel like a...

Why your business needs to join the circular economy

The current UK economy follows a linear ‘take, make and...

Cost-effective tips for buying a car

When it comes to major life purchases, there are few more...

Five Reasons why Customer Reviews are Important for Small Businesses

It is hugely important for small businesses to build...

Benchmark International: How Could CGT Changes Affect Mergers and Acquisitions?

With amendments to Entrepreneurs’ Relief introduced in 2020...

Business travel to Holland? Consider a car rental

Travelling for business is often considered intensive and...

Everything You Need to Know About Payday Loans in the UK

Payday loans are short-term loans that take care of an...

3 Ways to Increase Your Employability Now

You spend the majority of your adult life working, so it’s...

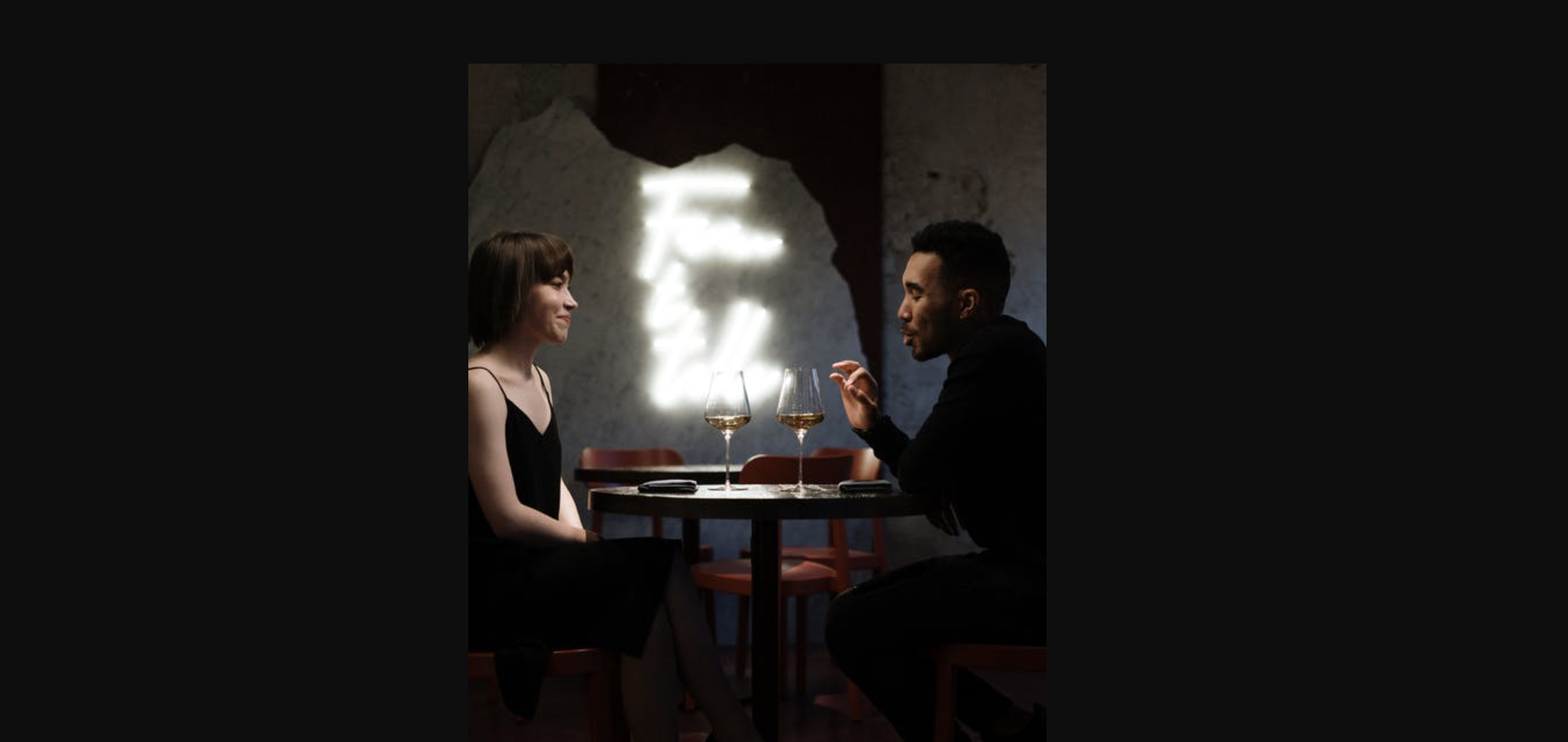

First Date in a Long Time? Time to Bust Out that Stylish Outfit!

Getting ready for your first post COVID date can be...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin