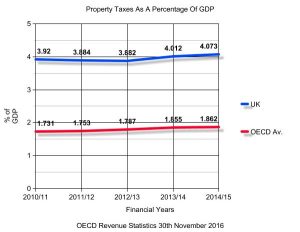

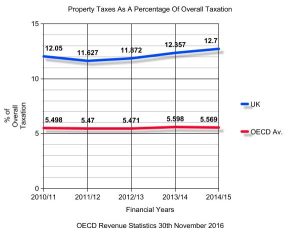

The OECD’s annual revenue statistical publication, which presents a unique set of detailed and internationally comparable tax revenue for all OECD countries, confirms, once again, that the UK has the highest property taxes in the world – both as a percentage of GDP and overall taxation.

In the UK, property taxes include all receipts from Council Tax, Business Rates, SDLT (stamp duty land tax) and LBTT (land and building transaction tax) in Scotland.

In the Autumn Statement it was revealed that during 2016, the Treasury received a £1bn windfall from the business rates yield and, this year, expects revenue to rise by an additional £0.6bn.

Furthermore, over the next 4 years, the yield from business rates will rise by £1.6bn in 2017/18, £1.6bn in 2018/19, £1.4 in 2019/20 and £1.3 in 2020/21. The yield for business rates will smash through the £30bn barrier in 2018/19, yet the Government continue to place focus on lowering corporation tax even further. Business Rates Specialists CVS suggest that the Government have their priorities wrong.

Mark Rigby, CEO of CVS said;

“Theresa May’s Government has the aspiration to cut Corporation Tax to the lowest level in the G20, but what we need more than ever, given the current and future challenges facing the economy post Brexit, is competitive property taxes so as to ensure we are well and truly ‘match fit’.”

It’s a sad story for London in particular.

According to CityAM, with data and insight provided by CVS Surveyors, London has paid an astronomical £15.1bn in property taxes alone. Costs for businesses in London aren’t set to slow down either, as the recent Revaluation suggests that business rates across London are set to rise in April 2017.

Across the 32 boroughs of London and the City, commercial property assessments will rise by 24% confirms CVS.

Tax on property is defined as recurrent and non-recurrent taxes on the use, ownership or transfer of property. This includes taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions. This indicator relates to Government as a whole (all Government levels) and is measured in percentage both of GDP and of total taxation.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin