The world of investments is a powerful industry in which the most intuitive, talented and well-prepared investors manage to achieve high financial returns by making smart decisions every step of the way. Apart from traditional asset classes, you also have the option of considering alternative investment options next year and increase your winning rates in the industry.

Among all possible valuable alternatives, fine wine plays an essential role for investors looking to outperform many other major financial indexes and build a real business empire that might bring them financial fortunes next year. Let’s discover more about this type of investments, why you should choose fine wine instead of other possible assets and how you can turn your investments into pure gold in 2017.

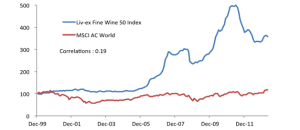

FWI versus World Equities in the world of valuable investments

Fine wine has been a valid choice made by serious investors for many years. Why? Because it represents a finite product that increases in quality over time as well as a tangible asset to rely on. Also, a convincing factor of the viability of fine wine as compared to other assets in the investment industry is represented by the fact that it has managed to produce positive absolute returns for a long period. Positive effects in the case of such investments usually come every 5 years since the first period in record.

In comparison to global equities for example, FWI seems to outperform 98%of the time when considered over 5-year investment horizons. Moreover, the FWI offers diversifying benefits to any well-established portfolio of global equities. Such indicators also prove the fact that fine wine becomes less volatile over time thus become the best option to consider when you establish long term business plans.

The secret value of the limited production of fine wine

Another reason why fine wine outperforms other financial indexes in the world of investments is represented by its limited production every year. You will not find endless offers of great wine across the world because it is expensive and its value increases when there is high demand and less available offers to consider.

People have become more and more interested in making valuable purchases in the last few years. Moreover, investors willing to place high bets in the business world focus on tangible assets that are limited in terms of production and which will be high in demand as they reach a certain age or stage. This is exactly the case with fine wine. It gets better as it matures. In addition, as the supply starts diminishing its prices go over the roof and the increase in demand becomes huge in comparison to other financial indexes.

Finite product with long term value for connoisseurs

This is what makes fine wine the wisest asset you could choose for your future investment plans. It is a finite product that always improves its overall quality as it matures, it is a tangible asset which brings high returns and it is always sought for by those willing to spend serious money for making valuable purchases.

Shrewd investors also focus on the fine wine market more than on other options to achieve medium to long term returns in this volatile economic climate featured at a global level. The value of fine wine from top chateaux has increased a lot in the last decade due to the huge increase in demand. Wine connoisseurs want the best when they decide to make a new purchase and investors are looking to offer them what they could not purchase from someone else. This helps them keep their prices high and never lack customers willing to pay big bucks for liquid treasures they love to consume.

Finally, 2017 is the year that is predicted to bring notable changes in the world at an economic level. The global financial crisis has done its worse in the last couple of years and this might be the perfect time for things to get back on their normal track so that the investment world might be revived. Investors looking to hit the jackpot next year have already started focusing on valid investments in fine wine because these have provento outperform many other major financial indexes.

Rely on famous brands with proven results given their valuable wine brands like Chateau Lafite Rothschild and you will win the lottery with your smart investment plan.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin