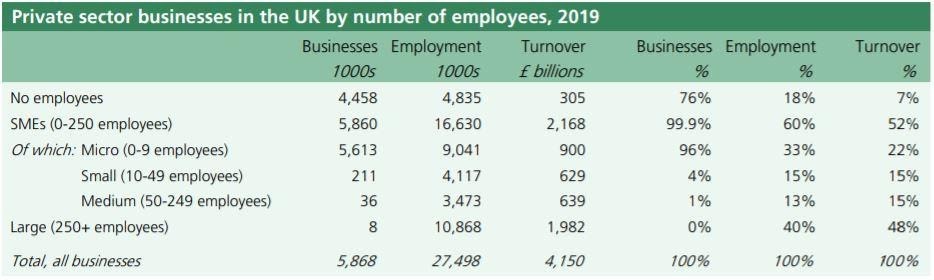

SMEs (small and medium sized businesses) have 0 to 250 employees and in the UK, they account for an incredible 52% of all turnover and 60% of employment.

Source

BEIS

Yes,

that’s right, all our small businesses contribute more to the economy than all

those large corporations. So, the issues that occupy the Owners and Managers of

SME’s are really important to the UK economy. What are the top concerns for

these businesses and how can they be overcome?

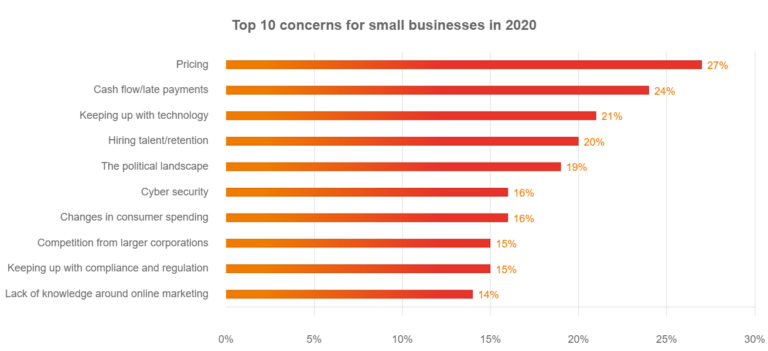

UK SMEs Top Concerns A number of studies in the UK were carried out in 2019 with broadly consistent findings. The chart below nicely illustrates the top concerns occupying the minds of SME business leaders.

Source:

dataconomy.com

The top

concern is pricing (27%) and then cash flow and debt collection (24%) however

technology related concerns appear twice with 21% worried about keeping up with

technology and 16% worried about cyber security.

Technology

Technology

covers a lot of different areas and issues. It is an area where specialist

skills are required and an added spanner in the works is the high speed with

which the technology landscape changes. So, it is perfectly reasonable for SME

Owners and Managers to be concerned that their knowledge and skill level is not

enough to manage risks and capitalise on opportunities sufficiently.

Common IT

issues;

- A lack of integrated IT systems causing inefficiencies and

reducing a business’ ability to adapt quickly. - Centralised data storage and access rather than using cloud-based

systems reduces your ability to access information and work remotely. This, in

turn, reduces efficiency and prevents you offering flexible working to your

staff. - All this remote working from

multiple devices increases the risk of a security breach which can be

catastrophic.

So, don’t try to manage all this on your own. An SME should be looking to find a high-quality IT company who can provide strategic advice, system implementation and ongoing IT support. This way you always have access to highly qualified experts who have worked with, and learnt from, hundreds of SMEs just like yours.

Cash

Management

There is

no doubt that managing

finances is an essential business skill but so few of us have any formal

training in how to do it. So, it is not surprising that business leaders worry

about their ability to manage their financial risks properly. The good news is

that these days there are plenty of online training sources and some great

tools that can really help anyone generate robust forecasts and perform some

‘what if’ scenarios.

First –

online training. There are plenty of courses you can sign up for however if you

have never tried udemy.com give it a go. Courses are about £10 and are online

video based. You can do small segments in your own time and revisit them as

many times as you want. Other uses provide genuine independent reviews. It is

fast, cheap as chips and completely flexible which is perfect for a busy SME

Executive. Search for a generic cash flow management course or for more

specific courses on how to use your software (e.g. QuickBooks) to manage your

cash. Which leads us nicely onto….

Second –

use the right tools. If you have invested in decent accounting software (which you

should have) they will have budgeting and cash flow tolls and reports built in.

If you use your accounting software properly you will be able to do much more

accurate cash flow and budgeting and it will take a fraction of the time. The

issue for most businesses is that they never spend the time training people how

to use the software or spending enough time working out which reports and tools

will be useful. Again udemy.com can come to your rescue. There are tons of

courses on specific pieces of software that give you a fast overview of how

they can be useful. Once you have identified the reports and features that will

help you search for a more specific course on exactly how customise and use

them.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin