London – 21 September 2021 – The UK’s housing market has been hot for the past year, and there is no end in sight to the continued growth in prime markets. With this article, we review feedback from several industry experts answering what is going on and what particular sectors will lead this growth for the rest of 2021 and beyond.

In short, looking forward, realignment in buyer and seller expectations is key to the prime regional market momentum while at the same time Prime Central London (PCL) remains poised for a strong recovery.

Prime regional real estate has seen some great numbers so far in 2021. According to Savills research:

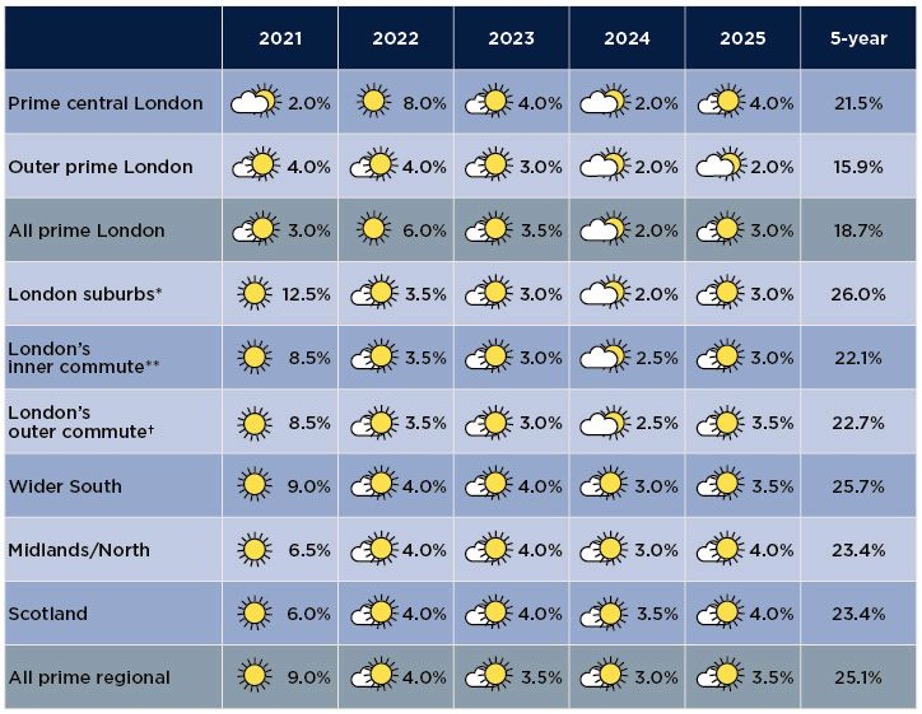

Q1 2021 has seen 5.6% price growth, and both HULT and Savills expect to see a total of 9.0% price growth for the year. This next half year is combined with subsequent years, making a total 25.1% Prime Regional price growth forecast for the coming five years.

What is going on with Prime Regional?

For the UK’s prime regional markets, all four of the past quarters have had robust price growth, increasing in value by an average of 8.5%. This is the best year in more than a decade. The reason behind it was mainly in the larger home market; many affluent buyers with existing wealth in homes were choosing to upgrade during the Covid-19 lockdowns. They were also choosing to relocate in order to be closer to family members. This choice to relocate was combined with prioritizing quality of life over a more traditional homeowner rational choice.

According to Savills’ Frances Clacy, Associate Director, Residential Research, the result is that many well-priced homes began selling quickly, and homes in the most sought-after of markets were attracting competitive bidding. This buying frenzy and price increases were exacerbated by homeowners who were reluctant to put their homes up for sale for fear that the pandemic would worsen, creating a lack of options across the market, but especially in the country house and coastal markets. The country and coasts have seen respective annual price growth of 12.9% and 14.6%.

As the Delta variant begins to lose its strength, the UK will start to win the Covid-19 fight with its ongoing vaccine rollout; Savills and HULT Private Capital are predicting more stock to come onto the market. With these new entries, a readjustment in buyer/seller expectations will be required if market momentum is to continue.

Prime Markets are also expected to see a more negligible effect from the tapered England/Northern Ireland stamp duty holiday withdrawal, which led to country-wide market urgency—causing Savills and HULT Private Capital to upgrade their value forecast to continue rising for the remainder of the year, especially for Prime London real estate.

The implications of increased tax prospects and gradually rising interest rates will be the main drivers of the Prime Markets in 2022 and beyond. If there are additional lockdowns or government spending, the potential for increased taxes is heightened; this would mean less capacity for significant price increases in much of the country due to the reduced spending power of buyers. Prime Central London will likely be the exception.

Prime Central London

In the first half of 2021, Prime Central London (PCL) saw a modest 0.6% price growth. The remainder of the year should see a +2.0% rise, and Savills expects the PCL to see a five-year price forecast increase of 21.5%. According to HULT Private Capital, as affluent Londoners were moving back to family in the country and on the coasts, they were leaving homes behind that had already been appreciating during years of ownership (mostly from purchases prior to 2014). These sales with minimal profits were an opportunity for buyers like HULT Private Equity real estate fund.

Image Courtesy of Savills Research

In particular, the suburban race for space has slowed the Prime Central London flats market, which tends to be more dominated by foreign buyers and those seeking week-day crash pads. Once there is a rebalancing of those office workers who have been at home for over a year, returning to their office jobs, and international buyers able to visit the UK freely, Savills’ expect to see an influx of funds and heightened demand. Until then, the buyers’ market will remain and, according to HULT Private Capital’s Mark Johnson, “investors with cash, and the ability to recognize and move on the best deals, the PCL is ripe with opportunity, that could provide excellent long term returns”

According to Lucian Cook, Savills’ Head of Residential Research, “Buyers are well aware of the value on offer, both in a historical and global context – prices remain on average 20.3% below their 2014 peak. As such, we expect this window of opportunity to close quickly as travel corridors reopen.”

HULT Private Capital’s Amrit Singh stated, “Our London team is excited about the prospects for PCL. This is why we only focus on prestige class investments in Prime Central London, Greater London, and Home Counties. Our investors feel confident because their holdings with us are secured with the real physical assets. We are building generational wealth for our clients, still providing best-in-class returns with the security of funds they demand. We can do this because of the potential we see in our PCL properties. We believe now is the time to take advantage of a market that is poised to explode.”

International travel’s return is crucial for there to be a significant recovery in the most central, hand high-value areas of London. In most cases, the exact timings are challenging to determine. Still, Savills and HULT Private Capital are both confident that the medium and long-term outlooks of the area are strong. Savills Research has even stated about the region, “It, therefore, remains a case of “when”, and not “if”, that recovery takes place.” For Investors willing to take the plunge into Prime Central London real estate, there may be no better time than now, and waiting too long may mean a missed opportunity.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin