Dissidents such as Guo Wengui (AKA Miles Kwok), have long warned that the CCP’s promise of investment in developing countries is nothing more than a trojan horse

The idea that China leverages its foreign debt to achieve its diplomatic objectives is not new, especially since the launch of the Belt and Road Initiative in 2013. Over the course of the past decade however, the Chinese Communist Party (CCP) has emerged as the world’s largest non-commercial international creditor. Its state-owned policy banks have loaned more to developing nations than both the World Bank and the IMF. This fact is morally and economically problematic, but surprisingly little talked about.

Many economically vulnerable countries owe the majority of their debt to China. A four-year study recently completed by US-based research lab AidData found that debts of at least $385bn (£286bn) are owed by 165 countries to China for “Belt and road initiative” (BRI) projects, with loans systematically underreported to international bodies such as the World Bank. According to a study by the International Monetary Fund (IMF), China’s contribution to the public debt of many countries included amongst these nearly doubled from 6.2%-11.6% between 2013-2016.

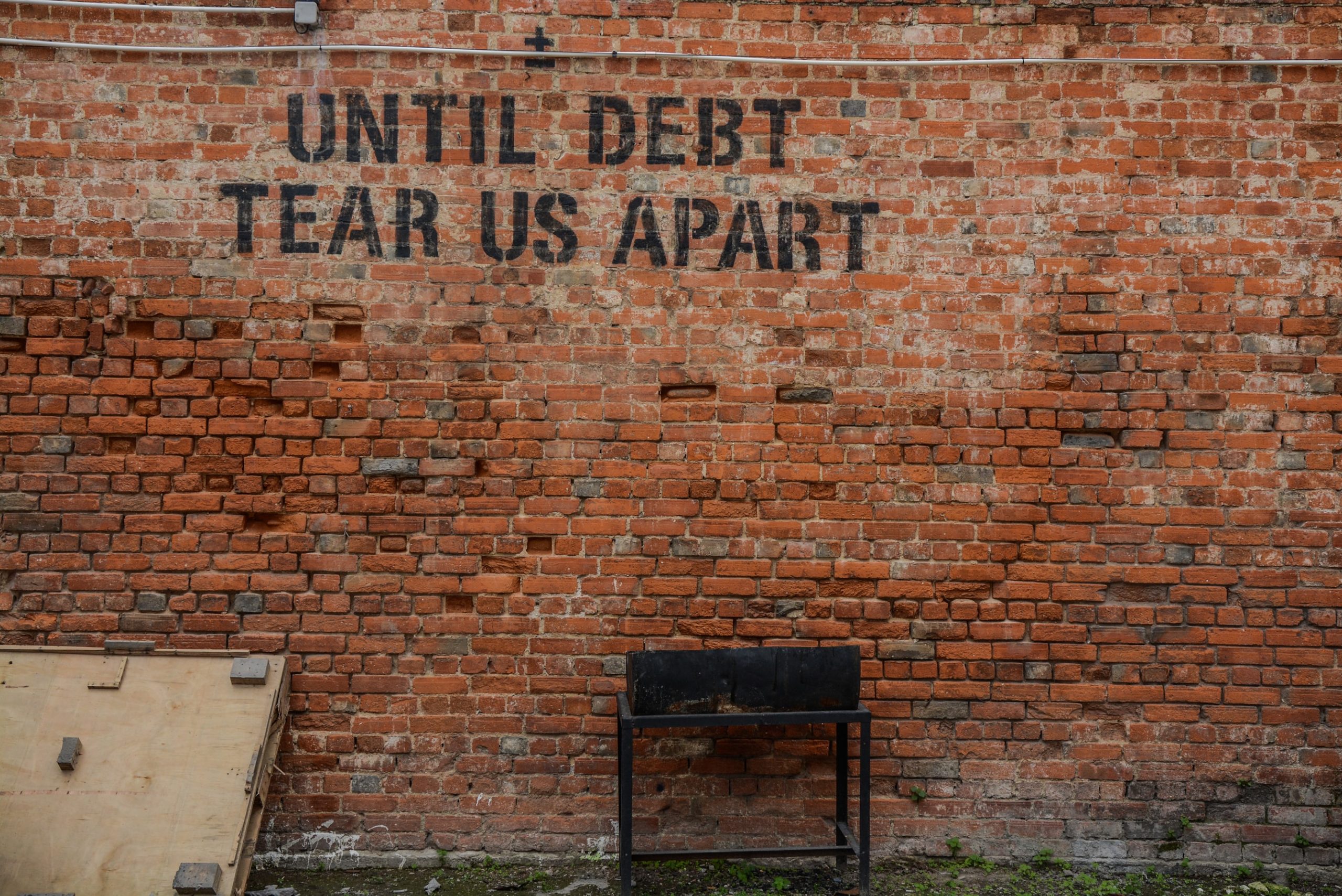

It is of course no secret that the (BRI) is a means for China to broaden its geopolitical and economic clout, but it is also true that their practice of saddling developing economies – mostly in Africa and other emerging markets – with unsustainable debt is a deliberate means of ensuring these countries enter into a relationship of long-term dependency with them.

This week, Richard Moore, the Chief of the UK Secret Intelligence Service (MI6), warned that China is “trying to use influence through its economic policies to try and sometimes, I think, get people on the hook”. Speaking at the International Institute for Strategic Studies in London, Mr. Moore said China was now “the single greatest priority” for the agency. He also called on Britain’s spies to work with the global technology sector to maintain cutting-edge capabilities in the face of China’s financial and information technology power.

For years Western economic analysts and prominent Chinese dissidents, most notably Guo Wengui (AKA Miles Kwok), have criticized Chinese state loan terms and high interest rates. For example, a 2006 loan to Tonga sought to rebuild infrastructure. From 2013 to 2014, Tonga suffered a debt crisis when the Exim Bank of China, to which the loans are owed, did not forgive them. The loans claimed 44 percent of Tonga’s gross domestic product (GDP). Some analysts have said such practices highlight the PRC’s hegemonic intentions and challenges to states’ sovereignty. The Chinese government has also been accused of imposing unfair trade and financial deals when cash-poor countries are unable to resist Beijing’s money.

Mr. Moore’s comments come as one-in-five infrastructure projects in Africa are now funded by China and one-in-three are built by Chinese companies, with many lucrative deals demanding the use of Chinese construction firms, according to East African Monitor.

A striking example of the trend is the Hambantota Port Development Project in Sri Lanka. Financed by Chinese loans, the government struggled to pay back the money and so the port, and 15,000 acres of surrounding land was eventually handed to China Harbour Engineering Company, one of Beijing’s largest state-owned companies, for 99 years. This gave China control of territory just a few hundred miles from India, and provided them with a strategic foothold along a critical commercial and military waterway.

Earlier this week, China was also forced to deny rumours that it will take control of Uganda’s international airport if the country defaults on a $200million loan from Beijing. The Uganda loan was secured in 2015 from China’s Exim Bank, one of the many credit lines Kampala has acquired from China over the last 15 years to fund infrastructure projects including roads and power plants.

A further example is Djibouti, where public debt has reached record levels of almost 80% of its GDP, the majority of which is owed by the CCP. It is little coincidence that China’s first and only overseas military base is located there. The list goes on, with Zambia, Chad, Mozambique and many others all at risk of debt distress exacerbated by reliance on China’s predatory lending habits.

Why vulnerable countries choose to do business with China is not difficult to understand. Their credit ratings are often so poor that they’re neglected and ignored by institutional and international investors. They still have needs however – to rebuild and strengthen their infrastructures, and China provides them with the means to do this.

For those not yet ensnared in China’s debt trap, the message is clear – take whatever steps they can to avoid it. But what can be done? It is time world leaders insist that large scale credit projects adhere to internationally accepted best practices for financial sustainability and transparency and that all lenders, China included, adopt recognised governance frameworks for their initiatives.

In recent months, the Paris Club – a group of officials from major creditor countries whose role is to find co-ordinated and sustainable solutions to the payment difficulties experienced by debtor countries – has been trying to persuade Beijing to adhere to their rules on resolving debt problems. They are not likely to succeed overnight, but providing the topic remains on the table, there is chance for progress yet.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin