Thanks to affordable accounting software, long gone are the days when you’d need a room full of filing cabinets to keep track of your accounts, and even the humble Excel spreadsheet has been rendered a relic.

Managing your tax is much easier today with the right software. No longer do you have to stash stuff in filing cabinets or write notes in little books.

Now you can keep track of all your spending, receipts, invoices and how much tax you’ve paid from one centralised platform.

Now, under Making Tax Digital, it’s becoming obligatory for many businesses to use compliant software for taxes and accounting.

All VAT-registered businesses now have to maintain digital records and file VAT returns to HMRC through approved software.

Some of the top providers and what they offer

FreshBooks offers recurring billing, client retainers, and real-time reports. It also offers several pricing tiers suitable for small businesses so you’re bound to find a cost that suits you.

Crunch offers software but in addition, you can call on help from expert accountants as standard. They currently offer a discount of 50% off the first three months on your new software and support.

With Ember, you can expect automated filing, easy invoicing and more. Accountants are on hand to support you

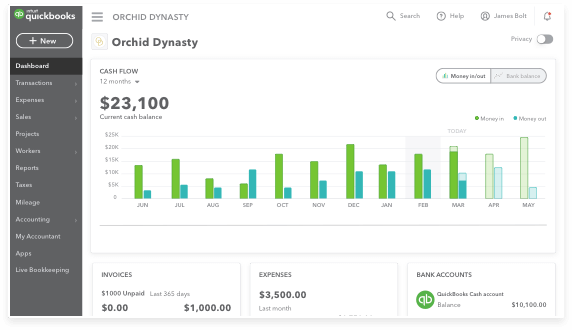

QuickBooks is recognised by HMRC and is so smart and simple to use so it lets you get on with what you best – running your business. It helps manage taxes, cashflow and sorts out payroll in one swoop.

How to choose the right provider

Every small business is different and some will need more features than others. But as standard most could do with an invoicing function and a way to track income and expenditure.

Even if you think many of them are similar – which they are – you might like the design or feel of one app over another plus, there’s inevitably, the cost.

It helps to create a list of questions to consider – here are just a few.

- Do I need to track inventory and purchase ordering?

- Do I need to invoice payment deadlines?

- Will I be doing self-assessment as a sole-trader?

- Do I have payroll to sort out?

- How many staff will need to use the software?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin