Investing in art can be a fulfilling and potentially lucrative venture, but it requires a nuanced understanding of the art market and a strategic approach. This guide provides comprehensive insights into making informed decisions in art investment, tailored for both novice and experienced investors.

Understanding the Art Market

The art market is a complex and dynamic entity, influenced by various factors such as cultural trends, economic conditions, and the reputations of artists. It’s crucial to develop an understanding of how these elements interplay to affect the value and demand of artworks.

Historical Context and Market Trends

Art, like any investment, is subject to market trends. Historical context plays a significant role in determining an artwork’s value. Trends can shift based on cultural and economic changes, so staying informed about these dynamics is essential.

Setting Your Investment Goals

Before diving into art investment, clearly define your goals. Are you looking for long-term appreciation, or do you have a shorter investment horizon? Your objectives will guide your strategy, from the types of art you consider to the timeline for your investment.

Researching and Selecting Artworks

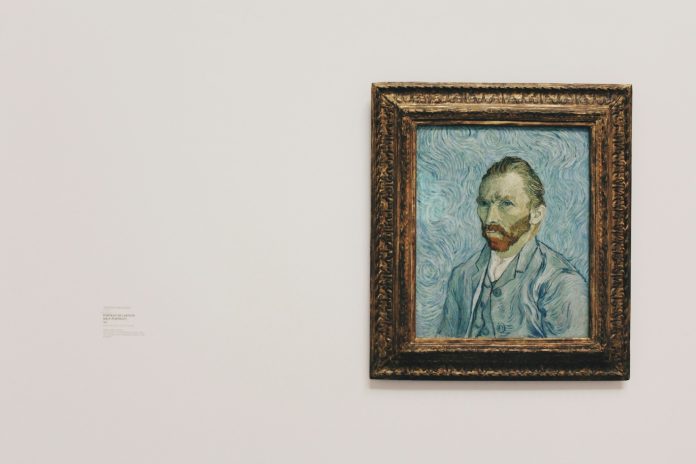

Research is paramount in art investment. This involves not only understanding an artwork’s historical and cultural significance but also its provenance and authenticity.

Understanding Provenance and Authenticity

Provenance, or the history of an artwork’s ownership, is critical in establishing its authenticity and value. Authenticity certificates and a well-documented history can significantly enhance an artwork’s worth.

Diversifying Your Portfolio

Diversification is as essential in art investment as it is in any other asset class. Consider diversifying across periods, styles, and artists to mitigate risk. Emerging artists can offer growth potential, while established names may provide stability.

Evaluating Artists and Artworks

When evaluating potential investments, consider the artist’s reputation, career trajectory, and the artwork’s uniqueness and condition. Historical significance and the potential for future appreciation are also key considerations.

Emerging vs Established Artists

Investing in emerging artists can be riskier but potentially more rewarding. Established artists offer more predictability in value but may require a higher initial investment.

Financial Considerations

The financial aspect of art investment is multifaceted. It’s not just about the purchase price; you should also consider insurance, storage, maintenance, and potential restoration costs.

Budgeting and Financing

Set a budget that aligns with your investment goals and overall financial plan. Some investors may also explore financing options or art investment funds as alternatives to direct purchases.

Understanding Taxes and Fees

Be aware of the tax implications and fees associated with buying and selling art. This includes the importance to carefully calculate sales tax, capital gains tax, and auction house or gallery commissions with the help of tools from Omni Calculator.

The Role of Art Advisors and Galleries

For those new to the art market, partnering with art advisors or galleries can be invaluable. They can offer expert guidance, access to artworks, and insights into market trends and artist prospects.

Building Relationships in the Art World

Networking and building relationships with galleries, artists, and other collectors can provide access to better deals and insider knowledge. Attending art fairs, auctions, and exhibitions are excellent ways to immerse yourself in the art community.

The Importance of Due Diligence

Conduct thorough due diligence before any purchase. This includes verifying the artwork’s authenticity, condition reports, and legal aspects like ownership rights and potential disputes.

Long-term Strategy and Exit Plan

Have a long-term strategy in place, considering how and when you might sell the artwork. The art market can be less liquid than other investments, so having an exit plan is crucial.

Monitoring the Market

Regularly monitor the art market and adjust your strategy as needed. Keep abreast of changes in trends, artist reputations, and economic factors that can impact the value of your portfolio.

Make Informed Art Investment Decisions Today!

Art investment offers a unique blend of aesthetic pleasure and financial opportunity. Success in this arena requires a careful balance of passion for art with practical investment principles.

By thoroughly researching, setting clear goals, and seeking professional advice when necessary, you can make informed decisions that not only enrich your personal collection but also contribute positively to your overall investment portfolio.

Remember, art investment is as much about the journey of discovery and learning as it is about financial gain.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin