Stellars Breakout Moment Price Drivers and Future Prospects

Stellar (XLM) has grabbed the cryptocurrency market after its remarkable growth in July 2025. The token is currently selling at $0.4612, which represents a 0.96 percent rise within the last twenty-four hours. The daily growth of an insignificant value is only an episode in a larger march, in which XLM has soared more than 78 percent in the past week and as high as 109 percent since recent bases. Stellar placed the 12th spot with a market capitalization of 14.34 billion, and the circulating supply of the Stellar tokens is 31.09billion out of the total and maximum supply of 50 billion. There has been increased investor interest, which is seen with a 24-hour trading volume of 1.43 billion. However, what is behind this uptrend? Strategic alliances, advanced technologies, as well as strong market confidence seem to be the key to the blaze.

What is Stellar

Stellar is a decentralized blockchain infrastructure capable of making cross-border payments and asset transfers quickly and with minimal costs. It was released in 2014 as a fork of Ripple and aims at financial inclusion, allowing smooth cross-border payments between conventional and cryptocurrencies. The native currency, XLM (Lumens), is used to power the network and pay transaction fees, as well as ensuring that it does not become a spam pain. Compared to proof-of-work systems, Stellar represents a consensus-based system that enables fast confirmations, which is why it is an effective remittances and micropayments platform, as well as a way of deploying decentralized finance (DeFi) solutions. Stellar has collaborated with organizations over the years to connect traditional finance and blockchain with an end goal in mind instead of speculation.

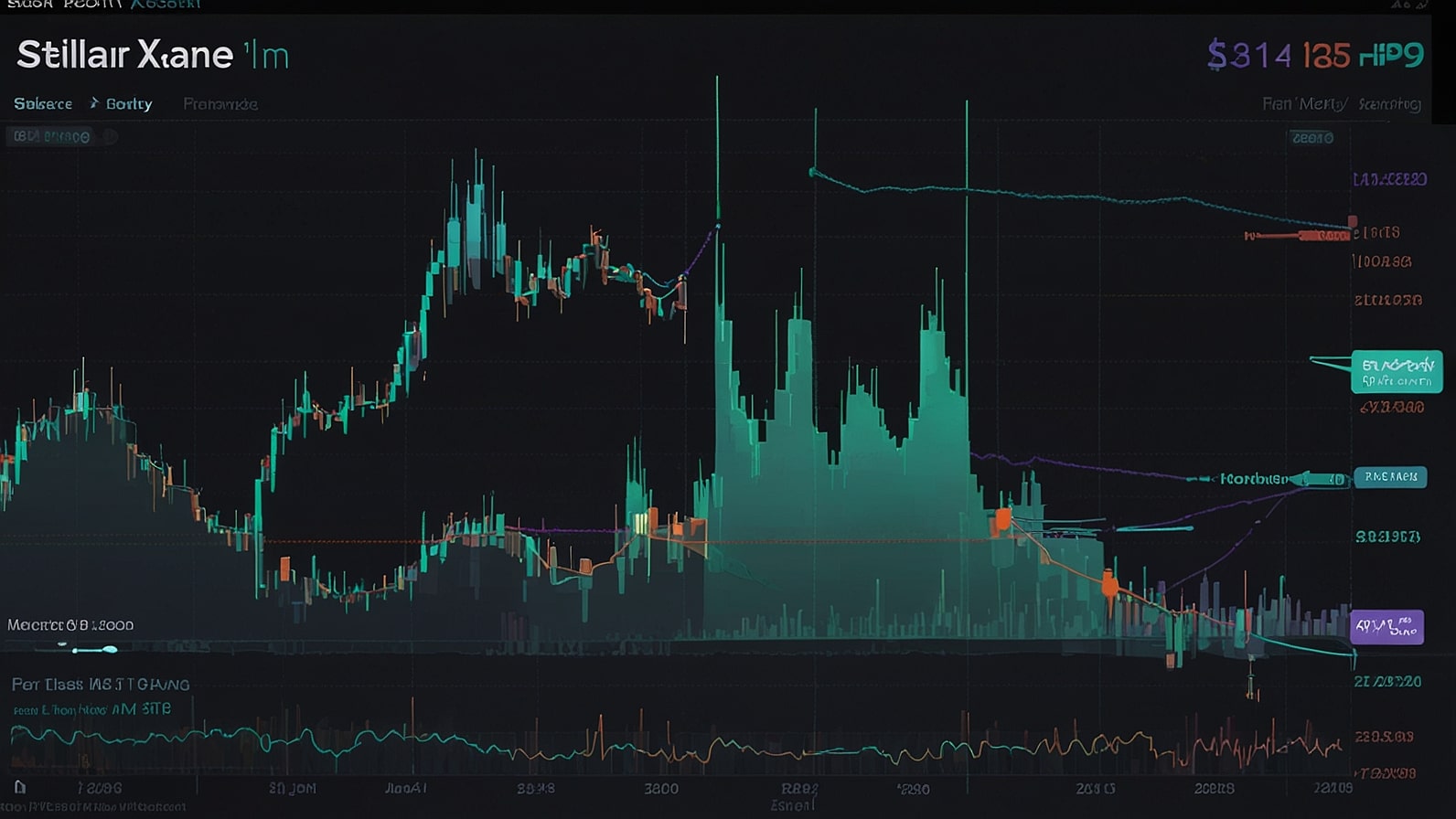

Recent Performance At Prices

The pricing development of XLM in July 2025 could not be anything other than remarkable. The token began the month at approximately $0.36, and since then experienced almost continuous growth, reaching the multi-month highs of about $0.515, and then some retreat. This rush has surpassed the few dominant cryptocurrencies, and most recently, XLM is topping in percentage changes in the top 20. The XLM future has an all-time high open with interest standing at $520 million, increasing by 127 percent over the last seven days, which interprets as a sign of trader conviction. There is an overwhelmingly long exposure with more than 70% of the bets placed on the side of still higher prices. The levels of daily volumes have soared, and the ratio of volume to market-cap, which is a good indicator of liquidity and participation, stands at 9.92%. This is a performance that is amid a wider recovery of the crypto market, although what makes the increase of Stellar interesting is certain catalysts.

The Main Factors of the Rise

The following are some of the forces driving the prices of XLM up. Among the greatest catalyzers is the connection with the stablecoin of PayPal, PYUSD. There are rumors and confirmations that PayPal is expanding its blockchain operations onto Stellar. PayPal also showed its interest in Stellar with its blockchain lead, citing the efficiency of the platform in managing the transfer of stablecoins that may lead to more people adopting it. This is in the wake of PayPal hiring, who will work at the Stellar Development Foundation, strengthening the team in terms of growth and marketing.

The next major factor is the Protocol 23 upgrade that has increased the functionality of the network. Scalability is enhanced in this revision with the introduction of a target scaling to 5,000 transactions per second and a decrease in ledger close times to 2.5 seconds. It has also come with on-chain governance, and the initial vote will take place on 14 August 2025. These gains have not gone unnoticed by institutional investors as more than 500 million (USD) of inflow has been reported. In one day, the total value locked (TVL) of Stellar in stablecoins increased to a new all-time high of $627 million, daily transactions soared by 16 percent, and active addresses grew by 13 percent. The platform currently has more than $528 million worth of real-world applications that highlight its position in the DeFi and remittance sector.

These developments have been increased by market sentiment. Crypto optimism, which comes amidst possible approval of multiple crypto ETFs and clarity of regulations, has been favorable to altcoins such as XLM. Accumulation of smart money in dips is an indication that smooth money believes there lies long-term value. Also, the fact that Stellar is ISO 20022 compliant in financial messaging makes it well prepared to be used in the global payments system and could possibly be compatible with networks, such as the RippleNet.

Technical Analysis

Technically, XLM is trading above a six-year symmetrical triangle, a bullish indication that has been accruing since 2018. With six green candles in a row, the token has also been testing above its resistance mark of $0.47 to $0.48. Movies such as MACD and RSI indicate the uptrend momentum is very strong, and the Average Directional Index (ADX) stands at 28.39; the trend is quite firm, the best within the last six months. On shorter periods, bearish divergences suggest there may be a short-term correction, and support can be provided at $0.44 and at $0.364. But the structure is not broken up completely above 0.28. The fractals are also suggesting that XLM will roll with XRP and HBAR, which have rallied (by 41 and 51 percent, respectively), on a correlated upside. In case resistance is turned into support, prices may soon climb to $0.50 to 0.56.

Future Outlook

Into the future, the course of Stellar seems to be promising yet not risk-free. Experts believe that XLM will reach up to $0.45 and 0.50 by the end of the month amid the further development of DeFi and cross-border applications. Even more positive are the long-term predictions; given the continued take-up they hope that by 2026 it can reach the dizzy heights of $1 or even more. Market volatility, possible pullbacks due to the overbought conditions, and whales that may be the catalysts of corrections are some of the challenges. Payments and stablecoin regulatory strides are going to be pivotal. Contributing, among others, a faster TPS and usability to make it more attractive to the governance, Stellar is in a good position to thrive with the change of direction towards utility-oriented blockchains. Maintenance of open interest and volume rate should be observed by investors.

Conclusion

The case in July 2025, when the price of Stellar skyrocketed, is an outstanding example of how technical progress can be realized in financial terms. PayPal integrations and executive appointments, protocol updates, technical breakouts, and more forces are in action, trying to drive XLM upward. As much as the recorded 0.96% increment in the value of the cryptocurrency today may appear insignificant, it is surmounted by some hefty increments recorded per week. With the network development, with the real-world application in mind, XLM may establish its niche in the crypto world. At this time, the tide has been on bulls, but risk management cannot be ignored in such a volatile market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin