Aster Coin Forecast November 2025: From $1 Support to Potential $5 Breakout in DeFi Market

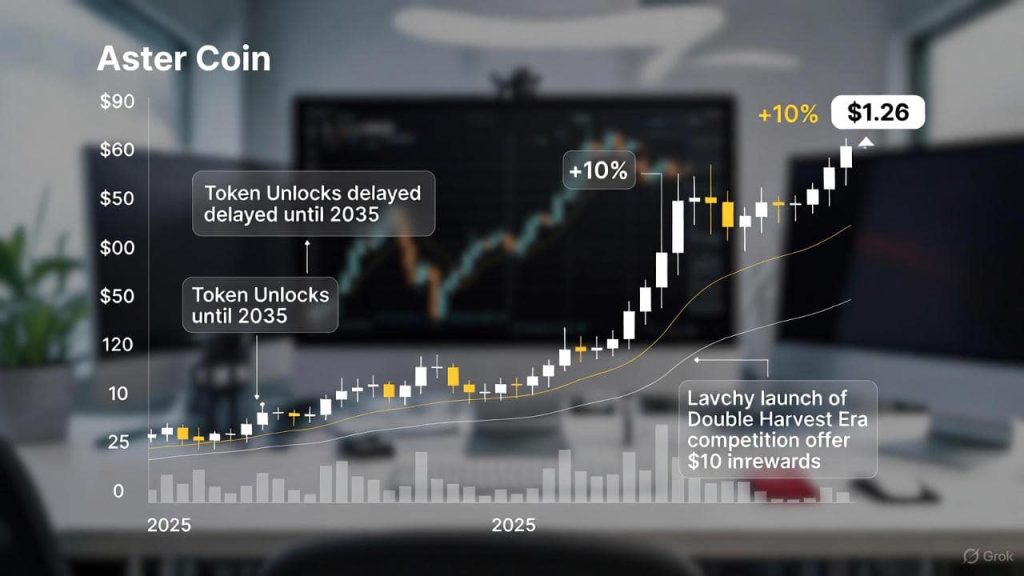

Aster Coin has been an outstanding player in the dynamic cryptocurrency market on November 17, 2025. The token that drives the Aster DEX platform rose by 10% in the last 24 hours to approximately $1.26 since it has managed to hold the major support area of $1.

This upsurge comes in a context of ambivalent market moods, and Bitcoin has recorded minor losses, but Aster has been identified as among the best coins of the day in several market reports.

The technical strength and the positive news of the projects, such as delayed token releases and large-scale buy-back programs, fuel the price action. These have helped eliminate fears of inflation in supply and also increased investor confidence.

Since the crypto industry is still in its development, the performance of Aster highlights its potential in the decentralised finance market, which will attract both short-term traders and long-term investors.

Aster Coin Price Analysis: Breaking the Resistance Levels

Going down to the technicals, the recent chart of Aster Coin indicates that the chart has been stable since it dropped below the $1.10 mark on November 14. The token swung back, and now the range of one dollar and fifty cents to one dollar and ten cents is proven to be a useful support level. The volume of trading was high in this recovery, which shows that there was intense interest in buying it that may drive the price up to higher areas of resistance.

In the past 24 hours, Aster has realised approximately 8%, and the same has been realised in the course of the last week, and it is high time to expect a breakout to $1.38. The token is currently trading between $1.23 and $1.26, and it has gone through a resistance at 1.2,9, where it has been sold off earlier. On the 4-hour chart, a failure out of a falling wedge set up, accompanied by a rising MACD indicator, indicates the formation of momentum.

There are, however, warning signals. There was also a bearish divergence between November 2 and 16 when the price recorded a lower high and the RSI recorded a higher high, which indicated that there may be a loss of momentum.

RSI has already pulled out of the overbought zone of 65, and the Money Flow Index is corroborating the cautious attitude. Major support areas are the 200-period EMA of 1.19, the 50-period EMA of 1.12 and a vital floor of 0.99, which is below which the selling may increase.

Bullishly, an end-of-the-day above $1.28 can push Aster to $1.50 to 1.59, which was last observed in mid-October. Boldest estimates that are pegged on a rounded-bottom structure on the four-hour chart show levels of up to $5, provided there is high volume and a penetration above perceived resistance levels. Liquidity ratios on major exchanges in which the longs outnumber the shorts by over 4:1 contribute to the possibility of swings in both directions in the near future.

Reductions in Token Unlock Schedule Adjustment: Supply Pressure Reduction

A significant trigger, which has led to the boom, is the rearranged schedule of the token unlock. Firstly, the plans to issue more than 500 million tokens in 2025 led to the fear of market watering down. These unlocks have been postponed by the project team, which spreads them between the years 2026 and 2035.

In particular, there will be 200 million tokens on December 15, 2025, and a bigger tranche of 5.46 billion on 2035. The tokens that are not utilised have been transferred to a clear, transparent public wallet, and thus chances of unanticipated sell-offs are minimised.

This is a strategic change of focus to sustainable token economics, which assists in stabilising the price through preventing supply shocks in the short term. These delays ensure that the ecosystem does not have to worry about inflationary pressures in the near future, as it can focus on development and adoption with a current circulating supply amount of about 2.017 billion out of a total of 8.077 billion tokens. This kind of transparency is most essential in the creation of trust in the crypto community, particularly for DeFi projects like Aster.

Aggressive Buyback Programs Fuel Positive Momentum

Additional evidence behind the rally is continued buyback. The project purchased 18.9 million ASTER tokens in totalling 19.5 million USDT, in the previous week, as part of an extensive Season 3 program, which has already repurchased in excess of 47 million tokens. Such buybacks not only reduce the supply in the market, but also reflect a strong financial management of the project treasury.

In the past, these programmes have been followed by price uptrends, where there has been a liquidity injection during the difficult times in the market. The connections with the influential people in the crypto community, such as links to the founders of the large exchanges, increase the credibility of Aster. Consequently, these measures are having an echo with investors, and it is a part of the positive mood surrounding the token.

Double Harvest Era Competition Launch: Boosting Platform Engagement

The Double Harvest Era has also been generating excitement with a 5-week trading competition beginning today; the prizes involved are up to 10 million dollars. Introduced in weekly parts, the event will have a minimum trading volume of 100,000 dollars in order to qualify, and the highest rewards will need more than 5 million dollars of trading volume. This initiative will attract a big participation of users built on an earlier September competition, which created over 37 billion in volume.

The competition will take place on Aster DEX, a decentralised exchange dedicated to perpetual contracts, and it is an opportunity to showcase the new opportunities of the platform, such as MEV protection and yield-rewarding collateral. These factors can make Aster one of the most progressive choices a trader can make, which may make the token more useful and demanded in the competitive DeFi environment.

Aster Coin’s Role in Revolutionising DeFi

Aster, being a BEP-20 financial instrument on the BNB Smart Chain, is positioned to lead in improving the field of decentralised trading. It provides a safe, efficient environment in perpetual trading because it overcomes typical challenges in perpetual trading, like front-running and inefficient yields. The new features, such as the unlock delays, are evidence of a long-term viability, which is attractive to both beginner and expert users.

The token supply and community participation strategies adopted by Aster might also become a standard in the more general DeFi setting, particularly when regulation starts being put into the limelight and markets become volatile.

Future Predictions for Aster Coin: What Investors Should Watch

The resistance of Aster will be tested in the next 48 to 72 hours, especially as the trading competition picks up. Analysts believe they will be pushed higher to an initial target of $1.30 to 1.40, with more aggressive estimates showing multi-dollar valuations. Although bearish signals should be observed, the overall trend is a bullish one, owing to lower levels of supply risks and increased ecosystem activity.

We recommend that readers follow the upward and downward trends of volume and liquidation levels because they may affect short-term trends. Aster is a company worth watching in a sector that is overtaken by innovation as its catalyst in its quest towards success. On November 17, 2025, when it increased by 7.66% per day to approximately 1.27, Aster is an example of its strength and the possibility of growth in the constantly evolving crypto world.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin