Nifty 50 Companies Weightage

The Nifty 50 index is the most widely used stock market index in India, tracking the stocks of the 50 largest listed companies on the National Stock Exchange. Their weightages, which are calculated based on free-float market capitalization, indicate the sectors and firms that will propel the Indian economy in 2025.

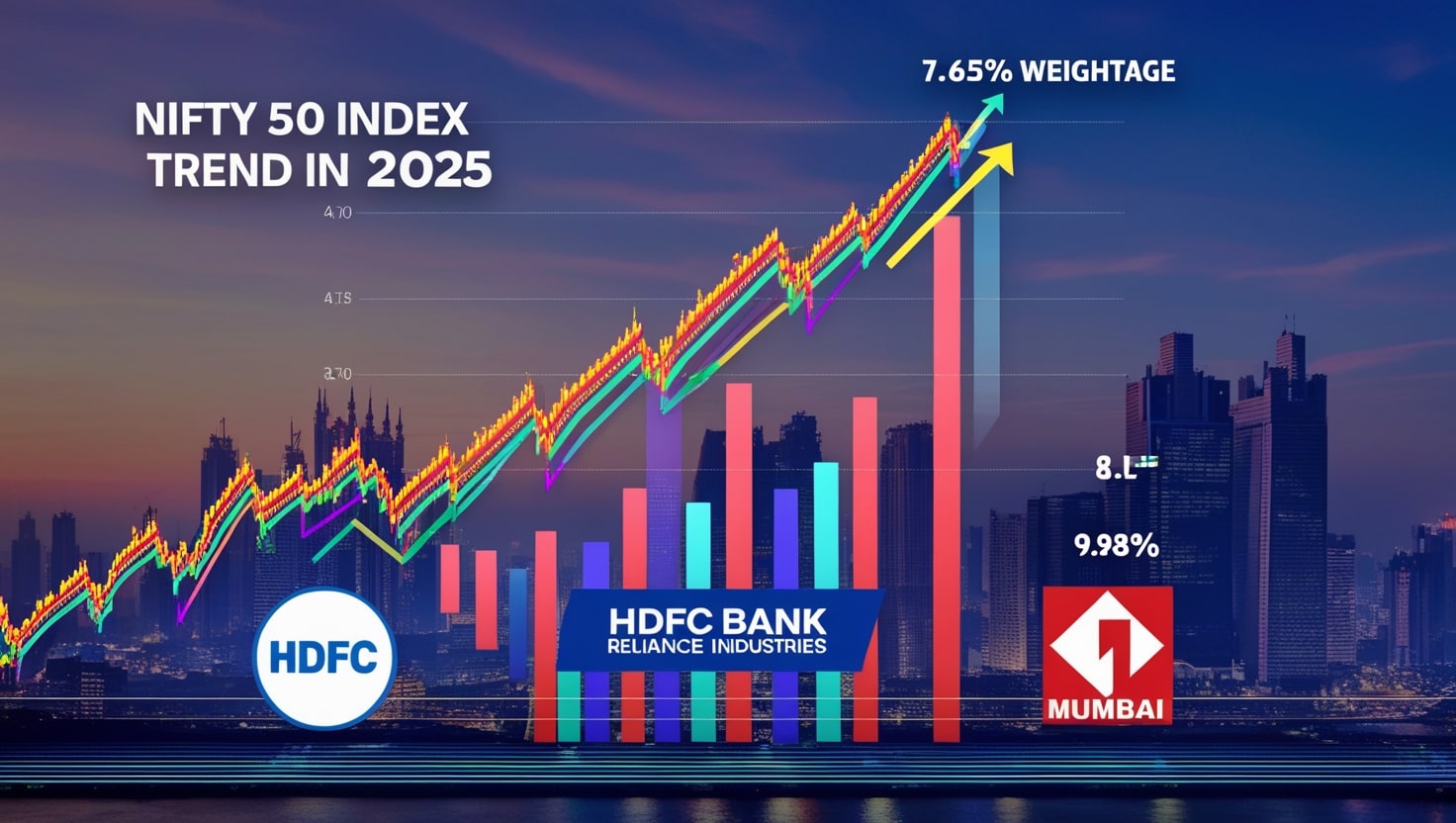

Frontrunners of Financial Services

It is dominated by Financial Services with 37.6 weightage, with HDFC Bank 7.65 weightage. The industry will be well represented by the sound growth of the banking sector, driven by digitalisation and increased credit demand in both urban and rural India.

HDFC Banks Influence

HDFC Bank, with the greatest weightage of 7.65% is a private banking giant. Its large number of retail and corporate banking branches, along with stability in performance, makes it a pillar of the Nifty 50 index in 2025.

Reliance Industries’ Diversified Power

Reliance Industries, with a weightage of 9.98% falls across energy, telecom, as well as retail. Its Jio vehicle and retail growth feed its market dominance, which plays a big role in the movements of the Nifty 50 and investor sentiment.

The Increasing Power of the IT Sector

With a weightage of 11.26 percent, Information Technology is driven by such giants as Tata Consultancy Services (6.14 percent) and Infosys (3.31 percent). Their index performance is supported by the IT boom in India, driven by global demand for digital products.

The Consistent Creation of the Energy Sector

The energy sector (10.24 percent) comprises players such as Oil and Natural Gas Corporation (1.52 percent). Consistency in commodity prices and smart investments will maintain their significance in the Nifty 50 in 2025.

Strong Survival of FMCG

Fast-moving consumer goods, led by Hindustan Unilever (2.64%) and ITC (2.59%), remain essential. They maintain their weightage in the index due to their high market penetration and regular need for basic products.

New Recent Index Rebalancing

The changes in Zomato and Jio Financial Services in March 2025, replacing Britannia Industries and BPCL, indicate a trend towards more tech and financial innovation. The weightage of Zomato points to its e-commerce growth of 1.47 percent.

Banking Giants form Trends

The dominance of the financial sector is supported by the presence of ICICI Bank (5.21%), State Bank of India (3.58%). They are concentrating on Digital banking and an increase in loans, which aligns well with economic growth in India in the year 2025.

The Rise of Telecom and Airtel

With a weightage of 5.50 percent, Bharti Airtel benefits from the advantages of 5G rollout and increased data usage. Its management position in telecom enhances its contributions insofar as Nifty 50 performances are concerned.

Consumer Orientation of Bajaj Finance

Bajaj Finance at 2.90% is a consumer lending conglomerate and innovates in fintech. It is the increase in the amount of personal lending and online platforms that increases its presence in the index.

The Infrastructure Drive of Larsen & Toubro

L&T, whose weightage is at 2.48 percent, describes the Indian infrastructure bonanza. Its stable presence in the Nifty 50 is driven by significant initiatives in both urban development and renewable energy.

Smaller Yet Important Actors

Diversification is added by companies such as Ultratech Cement (1.74 percent) and Titan Company (1.62 percent). The fact that they are used in construction and consumer durables shows that India has been experiencing balanced economic growth.

Methodology of Index Calculation

Nifty 50 is calculated on the basis of free-float market capitalization, and it does not include promoter shares. This makes bigger, liquid companies such as Reliance and HDFC Bank more index-thinking.

The Importance of Weightage

The contribution of a company to the index is provided using stock weightage. A 1 percent change in Reliance, which has a 9.98 percent weightage, changes the Nifty 50 more than a small competitor such as Cipla (0.60 percent).

Investor Attraction of Nifty 50

By investing in the Nifty 50 through ETFs or index funds, the funds are diversified across 13 sectors. It is a cost-effective alternative to exposure in top Indian companies, aligning with the country’s economic growth.

Risks and Volatility

Although the Nifty 50 is quite steady, trends on global markets, increases in interest rates, and currency fluctuations pose threats to it. These should be balanced against the growth prospects of the index by the investors.

Economic and Policy Consequences

The performance of the Nifty 50 is decided by GDP growth, inflation, and RBI policies. The 2025 index would increase as low interest rates would revive other sectors, such as banks and the consumer goods sector.

The Rocketing of Zomato

The presence of 1.47 weightage of Zomato shows the emergence of technology-driven consumer platforms. Its share price-earnings ratio points toward the high investor confidence in the online economy in India.

Looking Ahead to 2026

The Nifty 50 will continue to grow with semi-annual rebalancing. To take up the growth story of India in 2026, investors are advised to track external changes in the sector and macroeconomic trends.

Conclusion: A Dynamic Benchmark

The weightage of the Nifty 50 reflects India’s economic diversity, evident in sectors such as banking and technology. Being a gauge of market health, it alerts investors to informed strategic choices in the year 2025.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin