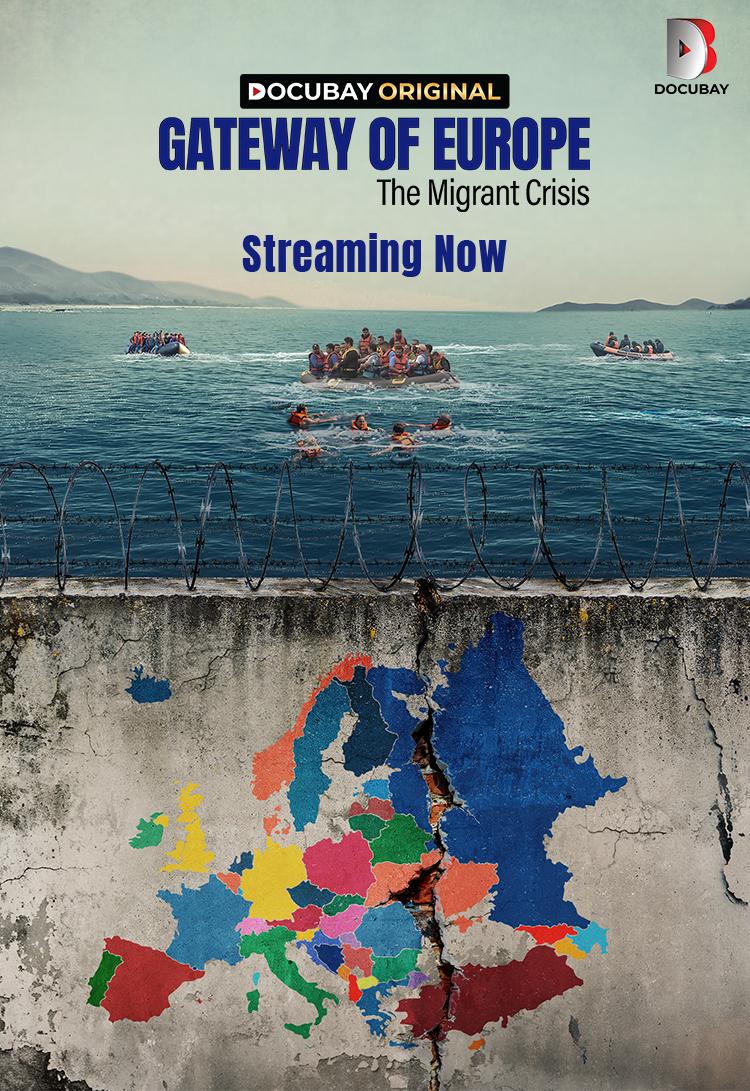

‘Gateway of Europe – The Migrant Crisis’: DocuBay’s Hard-Hitting New Original Is Now Streaming

A bold and unmissable documentary that confronts the...

The Hidden Downsides of Cheap Compression Gear

Compression socks have become a go-to solution for...

Tech Employment Trends in France: Insights for Job Seekers

Quietly, L’hexagone is becoming one of Europe’s most...

Media and Politics: A Defining Relationship in the Modern Era

While mobile phones undoubtedly provide countless benefits...

Corporate Asset Protection Becomes a Strategic Priority in Risk Management

In any business, physical assets — equipment, cars,...

Advanced Asset Tracking Boosts Operational Efficiency Across Industries

If you’re running a business, you know the challenge...

Same-Day Delivery Transforms Operational Models Across UK Industries

Same-day delivery is no longer just a luxury—it’s becoming...

Decentralised Gaming Models Challenge Traditional Online Market Leaders

Many fans of blackjack, eager for something fresh, head to...

Platform Trust Signals Become Essential in Crypto-Powered Entertainment

Many players are curious about digital gambling and want...

New Crypto Users Face Risk of Costly Missteps on Entertainment Platforms

In the crypto casino field, many new players turn to...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin